3.2 Direction: Praclice what you On October 1. 2021, Adam Realty Co. collected the amount of P60,000 representing advanced rental from a tenant who occupies a space of the building. The advanced rental wili cover the period Oct 1, 2021 to October 1, 2022. The accounting period ends on December 31, 2021. Assuming the income method is used: 1. What is the journal entry to record the advance collection? 2. How much is the unearned portion of the amount received in advance as of December 31, 2021? 3 What is the adiustingg entry to record on December 31, 2103?

3.2 Direction: Praclice what you On October 1. 2021, Adam Realty Co. collected the amount of P60,000 representing advanced rental from a tenant who occupies a space of the building. The advanced rental wili cover the period Oct 1, 2021 to October 1, 2022. The accounting period ends on December 31, 2021. Assuming the income method is used: 1. What is the journal entry to record the advance collection? 2. How much is the unearned portion of the amount received in advance as of December 31, 2021? 3 What is the adiustingg entry to record on December 31, 2103?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 69E: Unearned Revenue Jennifers Landscaping Services signed a $400-per-month contract on November 1,...

Related questions

Question

Help me answering this, thanks.

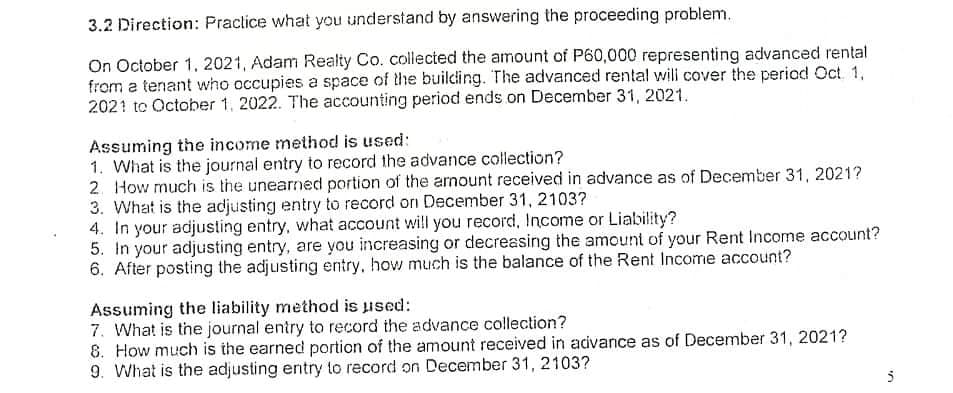

Transcribed Image Text:3.2 Direction: Praclice what you understand by answering the proceeding problem.

On October 1, 2021, Adam Realty Co. collected the amount of P60,000 representing advanced rental

from a tenant who occupies a space of the building. The advanced rental willi cover the period Oct 1,

2021 to October 1, 2022. The accounting period ends on December 31, 2021.

Assuming the income method is used:

1. What is the journal entry to record the advance collection?

2. How much is the unearned portion of the amount received in advance as of December 31, 2021?

3. What is the adjusting entry to record on December 31, 2103?

4. In your adjusting entry, what account will you record, Income or Liability?

5. In your adjusting entry, are you increasing or decreasing the amount of your Rent Income account?

6. After posting the adjusting entry, how much is the balance of the Rent Income account?

Assuming the liability method is used:

7. What is the journal entry to record the advance collection?

8. How much is the earned portion of the amount received in adivance as of December 31, 2021?

9. What is the adjusting entry to record on December 31, 2103?

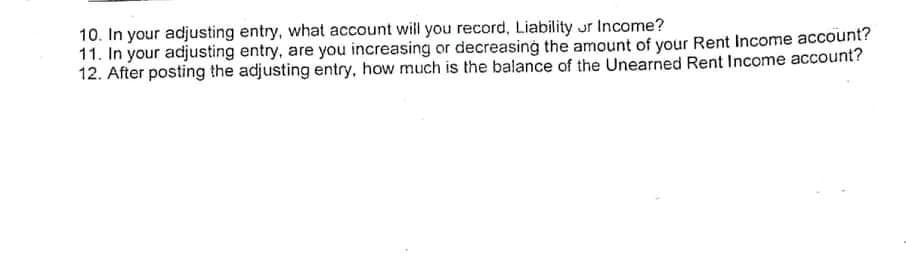

Transcribed Image Text:10. In your adjusting entry, what account will you record, Liability ur Income?

11. In your adjusting entry, are you increasing or decreasing the amount of your Rent Income account?

12. After posting the adjusting entry, how much is the balance of the Unearned Rent Income account?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning