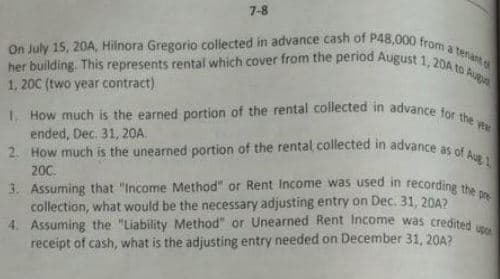

her building. This represents rental which cover from the period August 1, 20A to Augn 2. How much is the unearned portion of the rental collected in advance as of Aug 1. How much is the earned portion of the rental collected in advance for the yew On July 15, 20A, Hilnora Gregorio colected in advance cash of P48,000 from a tenat 1, 20C (two year contract) ended, Dec. 31, 20A. pre 3. Assuming that "Income Method" or Rent Income was used in recording the collection, what would be the necessary adjusting entry on Dec. 31, 20A? 20C.

her building. This represents rental which cover from the period August 1, 20A to Augn 2. How much is the unearned portion of the rental collected in advance as of Aug 1. How much is the earned portion of the rental collected in advance for the yew On July 15, 20A, Hilnora Gregorio colected in advance cash of P48,000 from a tenat 1, 20C (two year contract) ended, Dec. 31, 20A. pre 3. Assuming that "Income Method" or Rent Income was used in recording the collection, what would be the necessary adjusting entry on Dec. 31, 20A? 20C.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 5SEQ: The balance in the unearned rent account for Jones Co. as of December 31 is $1 ,20(). If Jones Co....

Related questions

Question

Transcribed Image Text:2. How much is the unearned portion of the rental collected in advance as of Aug 1

I. How much is the earned portion of the rental collected in advance for the ye

her building. This represents rental which cover from the period August 1, 20A to Augn

3. Assuming that "Income Method" or Rent Income was used in recording the pre

On July 15, 20A, Hilnora Gregorio collected in advance cash of P48,000 from a tenat

7-8

1, 20C (two year contract)

ended, Dec. 31, 20A.

200.

collection, what would be the necessary adjusting entry on Dec. 31, 20A?

4. Assuming the "Liability Method" or Unearned Rent Income was credited

receipt of cash, what is the adjusting entry needed on December 31, 20A?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning