Q: For Pan Elixir u use the formula D/r-g = 2.5 / 0.06 = 41.66 however I used D*(1+g) / ( r-g) = (2.5…

A: Data given: Dividend (at t=0 ) = $2.5 Constant growth rate= 3% You need to calculate price of…

Q: Bond's face value. Term years. Coupon payment = $240 current interest rates 5% = 2 = a) Present…

A: Timing and quantum of cash flows emanating from a bond are known. We have to find the present value…

Q: After you graduate, you want to start saving for a down payment on a house which you plan to buy 5…

A: This is a time value of money (TVM) concept based question. We need to use the standard TVM…

Q: Stillwater Drinks is trying to determine when to harvest the water from the fountain of youth that…

A: NPV is Net Present Value which shows if a project will generate positive cash flows in future if…

Q: You complete a test of autocorrelation on daily data for a thinly traded stock and the Durbin Watson…

A: Historical performance of the stock had been quantified using the Durbin Watson statistic and the…

Q: You are allocating your wealth between two shares, Tinkle.com and Circumbendibus Wheels. Tinkle.com…

A: The formula to find out the minimum risk portfolio between stock a and stock b is Wa =…

Q: a random variable has the following probability distribution 20% chance of realizing a value of 500…

A: Coefficient of variation measures the level of dispersion of data from expected return. It is…

Q: The credit card with the transactions described in the popup below uses the average daily balance…

A: Given, Monthly interest rate is 1.5%Previous balance is $2645.51

Q: Match the terms to the definition:

A: Common Stock: It is a financial security issued by the company to raise capital. The holders of…

Q: You manage a pension fund that will provide retired workers with lifetime annuities. You determine…

A:

Q: You are planning to prepare your child to have a withdrawal of P 20,000 each on his 18th, 19th, 20th…

A: The PV of an asset is used to find the value that the asset holds today based on an assumed discount…

Q: A sneaker outlet has made the following wholesale purchases of new running shoes: 12 pairs at…

A: FIFO method says first in first out. The inventory purchases at first will be sold at first. So…

Q: DO NOT COPY ANOTHER ANSWER THAT'S ALREADY GIVEN. Use MACRS to compute the depreciation schedule…

A: MACRS depreciation The depreciation method allows companies to recover capitalized costs within a…

Q: If the bank paid me 9.98% interest per year and if my actual return (the increase in my purchasing…

A: Nominal rate of return = 9.98% Real rate of return = 5.25% Inflation Rate= ((1+ Nominal Rate)/(1+…

Q: Jane is converting an RRSP balance of $250,000 into a RRIF Jane wants to receive $1,361 at the…

A: You are attempting a time value of money based problem and have got stuck. Most of the values you…

Q: The cost of using an existing asset: Small Appliances Ltd is considering starting a new line of…

A: Cost of taking on the new line of business = EAC / (1+r) ^t Equivalent Annual cost of New Machine…

Q: The credit card with the transactions described on the right uses the average daily balance method…

A: A credit card billing statement has to be prepared. For that we need the average daily balance,…

Q: Suppose that on January 1 you have a balance of $5600 on a credit card whose APR is 17%, which you…

A: Part 1 Balance $ 5,600.00 APR 17% Time Period (Year) 1 Part 2 Loan $…

Q: Country Day's scholarship fund receives a gift of $ 135000. The money is invested in stocks, bonds,…

A: Lets;s consider Stocks = S Bonds = B CDs = C So, Total Investment , S + B + C = 135,000…

Q: 13) Jane needs $30,000 to buy another new car in eight years. How much should she deposit at the end…

A: Periodic payments are made at regular intervals, with the same amount paid for each period. The…

Q: Projects with different lives: Your company is deciding whether to purchase a high-quality printer…

A:

Q: Using an external rate of 12%, find the internal rate of return (IRR) for the following cash flow.…

A: Given, The external rate is 12%

Q: A man made a year-end payment of P100, 000 to an account earning 7% annually for 10 years. How…

A: Here, Annual Payment = P100,000 Interest rate =7% Total no. of payments = 10 years Total no. of…

Q: On October 7, 2022 (Friday), you purchased $100,000 of the following T-bill: Maturity Bid Asked Chg…

A: T-bills are securities that do not pay a coupon. They are usually sold at a discount and at maturity…

Q: he following loan is a simple interest amortized loan with monthly payments. $7000, 7%, 4 years (a)…

A: Loans ar paid by the equal and fixed monthly payments and these payments carry the payment for…

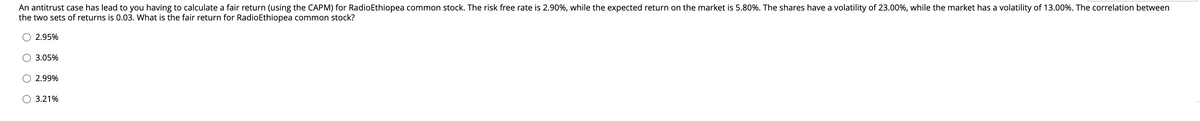

Q: An antitrust case has lead to you having to calculate a fair return (using the CAPM) for…

A: Fair Return = Risk Free Return + Beta ( Market return - Risk Free Return) Beta = Correlation between…

Q: How much market value of each of the zeros will be necessary to fund the plan if you desire an…

A: Information Provided: Annuity amount = $1.4 million per year Interest rate = 8%

Q: Assume that you purchase a property for $2,000,000 and it generates $25,000 per month of rental…

A: Rate of return refer to the value of investment that is to be earned in a specified period of time…

Q: Lab Create the amortization table that includes: Loan Balance, Payment , Interest, Principal, New…

A: Present value of annuity Annuity is a series of equal payment at equal interval over a specified…

Q: A stock has had returns of 16.72 percent, 12.20 percent, 5.90 percent, 26.86 percent, and −13.49…

A: r1 = 0.1672 r2 = 0.1220 r3 = 0.0590 r4 = 0.2686 r5 = - 0.1349 Number of returns (n) = 5

Q: An investor purchases a 30-year U.S. municipal bond for $840. The bond’s coupon rate is 10 percent…

A: We know all the cash flows associated with the bond along with the timing. We need to find the…

Q: A crucial role of financial managers is in making financial decisions and exercising control over…

A: Key aspects of financial decision making are i) Investment, ii) Dividend, iii) Working capital…

Q: Year Earnings and FCF Forecast ($ million) 1 Sales 2 Growth vs. Prior Year 3 Cost of Goods Sold 4…

A: Calculation of stock and change in value of stock.

Q: Statements When the Fed increases the money supply, short-term interest rates tend to decline. When…

A: Interest rates are a powerful tool to manage an economy. When economy is going through a certain…

Q: ric's Financial is a local bank. This local bank usually quotes residential mortgage interest rates…

A: When we borrow from banks we are quoted an interest rate at which interest will be charged on the…

Q: Sales are expected to grow by 14% next year. Assuming no change in operations from this year to next…

A: Spontaneous liabilities = Accounts payables + accruals Current Spontaneous liabilities =$2000+$1400…

Q: You complete a test of autocorrelation on daily data for a thinly traded stock and the Durbin Watson…

A: Statistically derived characteristics of a stock are known. Several actions have been suggested for…

Q: What is the bond's yield to maturity, with annual compounding?

A: Information Provided: Coupon rate = 3% (semi-annual payments) Period = 18 months or 1.5 years Price…

Q: The AAA Inc is considering a new project with revenue of $578,000 in perpetuity. The operating costs…

A: A project is being subjected to leverage. We have to find the value of the levered project.

Q: Assume that as of today, the annualized interest rate for a seven-year bond is 10 percent, while the…

A: We have annualized yield for a 7 year bond and a 3 year bond. We have to find the annualized…

Q: 4. You are saving up for a cruise after graduation. The cruise will cost $1,500. How much must your…

A: Information Provided: Cruise cost (Future value) = $1500 Period = 19 months Interest rate = 2%…

Q: Amy considers two investment opportunities (Stock A and Stock B) with the same price per unit in the…

A: The expected utility hypothesis provides the basis for calculating a portfolio's expected utility.…

Q: I got this example to calculate the value of a zero-coupon bond. It is solved. However, my question…

A: Solution:- Zero coupon bond is a bond which is issued at a price less than the par value of bond and…

Q: eBook A company's 5-year bonds are yielding 9% per year. Treasury bonds with the same maturity are…

A: Data given: Yield of 5 year corporate bond=9% Yield of 5 year treasury bond=4.2% Risk free…

Q: Mamadou is leasing a car originally valued at $42,130. The lease is being financed with an interest…

A: Given, The amount financed is $42,130 Interest rate is 7.87% Monthly payment is $466

Q: A firm has an issue of $1,000 par value bonds with a 12 percent stated interest rate outstanding.…

A: Par Value = $1000 Maturity Value (Mv) = Par Value Maturity Value (Mv) = $1000 Coupon rate = 12%…

Q: Our textbook claims that one of the key services banks provide is maturity intermediation: what…

A: The banks act as intermediaries between the people with the money and those that need money.…

Q: Toni Torres wants to save $1,300 in the next two years to use as a down payment on a new car. If her…

A: Information Provided: Future value = $1300 Interest rate = 9% Period = 2 years

Q: 10. Kristine has $5,000 in an account today that pays 3% interest rate. Two years from now she…

A: Note: Hi! Thank you for the question, As per the Honor code, we are allowed to answer one question…

Q: According to the Brookings Institution, approximately 76% of working adults in the United States…

A: 2020 Honda Fit LX Price = $17,945 Interest Rate = 1.9% Time Period = 5 years Down Payment = $1,500…

Please help answer this question.

Step by step

Solved in 2 steps

- An antitrust case has lead to you having to calculate a fair return (using the CAPM) for RadioEthiopea common stock. The market has a volatility of 18.00%, while the shares have a volatility of 33.00%. The correlation between the two sets of returns is -0.10. The risk free rate is 1.90%, while the expected return on the market is 4.30%. What is the fair return for RadioEthiopea common stock? 1.11% 1.77% 1.46% 1.66%An antitrust case has lead to you having to calculate a fair return (using the CAPM) for RadioEthiopea common stock. The risk free rate is 3.20%, while the expected return on the market is 4.70%. The shares have a volatility of 21.00%, while the market has a volatility of 13.00%. The correlation between the two sets of returns is 0.44. What is the fair return for RadioEthiopea common stock?You are using the CAPM to calculate a fair return for Stardust common stock. The shares have a volatility of 36.00%, while the market has a volatility of 19.00%. The correlation between the two sets of returns is 0.30. The risk free rate is 1.00%, while the expected return on the market is 3.90%. What is the fair return for Stardust common stock?

- Suppose that, after conducting an analysis of past stock prices, you come up with the following observations. Which would appear to contradict the weak form of the efficient market hypothesis? Explain.a. The average rate of return is significantly greater than zero.b. The correlation between the return during a given week and the return during the following week is zero.c. One could have made superior returns by buying stock after a 10% rise in price and selling after a 10% fall.d. One could have made higher-than-average capital gains by holding stocks with low dividend yields.Monkey corporation want to buy stocks in the Goose company, Monkey financlal manager says that the stock fair price is 50 dollars if the treasury bill rate is 0.08 and the covariance between the stock and the market is 0.0034 and the standard deviation of the market is 0.055 the market return is 0.15what is the what is the requirec rate of return ?Suppose that, after conducting an analysis of past stock prices, you come up with the following observations. Which would appear to contradict the weak form of the efficient market hypothesis? A. The average rate of return is significantly greater than zero. B. The correlation between the return during a given week and the return during the following week is zero. C. One could have made superior returns by buying stock after a 10% rise in price and selling after a 10% fall. D. One could have made higher-than-average capital gains by holding stocks with low dividend yields.

- In a recent closely contested lawsuit, Apex sued Bpex for patent infringement. The jury came back today with its decision. The rate of return on Apex was rA = 3.9%. The rate of return on Bpex was only rB = 3.5%. The market today responded to very encouraging news about the unemployment rate, and rM = 3.6%. The historical relationship between returns on these stocks and the market portfolio has been estimated from index model regressions as: Apex: rA = 0.3% + 1.1rM Bpex: rB = −0.1% + 0.7rM a. What is the predicted returns for Apex & Bpex? (Do not round intermediate calculations. Round your answers to 1 decimal place.) b. Which company do you think won the lawsuit? Apex BpexAn analyst has modeled the stock of a company using a FamaFrench three-factor model and has estimated that ai 5 0, bi 5 0.7,ci 5 1.2, and di 5 0.7. Suppose that the daily risk-free rate isapproximately equal to zero, the market return is 11%, the returnon the SMB portfolio is 3.2%, and the return on the HML portfoliois 4.8% on a particular day. The stock had an actual return of 16.9%on that day. What is the stock’s predicted return for that day?(14.9%) What is the stock’s unexplained return for the day? (2%)A stock analyst at PJ Brokers estimates that the beta of stock ZLX is close to two (2.0). Therefore, ZLX will have an expected return that is: A) about equal to the risk-free rate B) about equal to the market expected return C) expected to exceed the market expected return

- a) In order to test the weak form of the efficient-market hypothesis, researchers have used the following methods excepta.estimation of the serial correlation (autocorrelation) for securities and markets.b.measurement of the profitability of trading rules used by technical analysts.c.measurement of how rapidly security prices adjust to different news items.d.All of the options are methods used for testing weak-form market efficiency. b) A firm has $100 million in current liabilities, $200 million in long-term debt, $300 million in stockholders' equity, and total assets of $600 million. Calculate the firm's ratio of long-term debt to long-term debt plus equity.a.40 percentb.20 percentc.50 percentd.17 percentYou are examining three different shares. Share A has expected return -0.30%, beta -0.49, and volatility 29.00%. Share B has expected return 9.80%, beta 1.09, and volatility 24.00%. Finally, share C has expected return 8.60%, beta 0.88, and volatility 13.00%. The risk free rate is 2.70%, while the market price of risk is 7.00%. According to the CAPM, which share is undervalued?Monkey corporation want to buy stocks in the Goose company, Monkey financial manager says that the stock fair price is 50 dollars if the treasury bill rate is 0.1 and the covariance between the stock and the market is 0.0033 and the standard deviation of the market is 0.06 ,the market return is 0.15what is the what is the required rate of return ? Answer