Statements When the Fed increases the money supply, short-term interest rates tend to decline. When the economy is weakening, the Fed is likely to increase short-term interest rates. During the credit crisis of 2008, investors around the world were fearful about the collapse of real estate markets, shaky stock markets, and illiquidity of several securities in the United States and several other nations. The demand for US Treasury bonds increased, which led to a rise in their price and a decline in their yields. When the economy is weakening, the Fed is likely to decrease short-term interest rates. True O False O O O

Statements When the Fed increases the money supply, short-term interest rates tend to decline. When the economy is weakening, the Fed is likely to increase short-term interest rates. During the credit crisis of 2008, investors around the world were fearful about the collapse of real estate markets, shaky stock markets, and illiquidity of several securities in the United States and several other nations. The demand for US Treasury bonds increased, which led to a rise in their price and a decline in their yields. When the economy is weakening, the Fed is likely to decrease short-term interest rates. True O False O O O

Chapter4: Exchange Rate Determination

Section: Chapter Questions

Problem 13QA

Related questions

Question

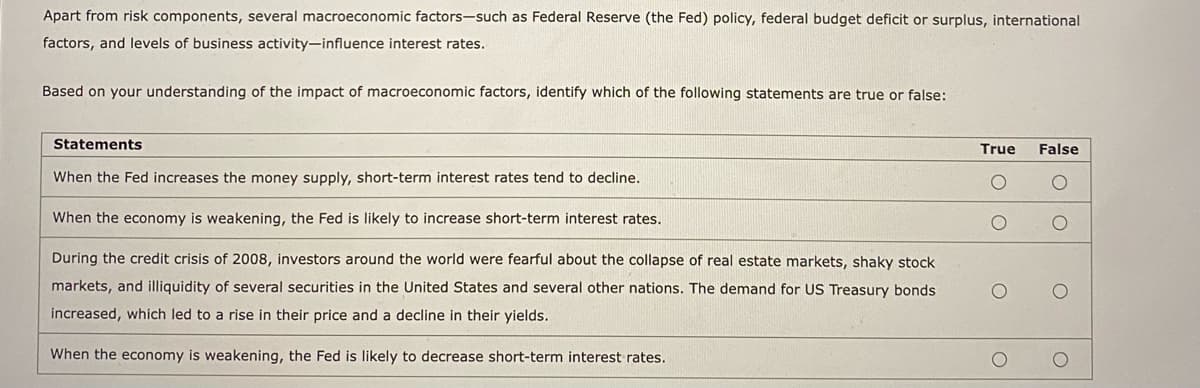

Transcribed Image Text:Apart from risk components, several macroeconomic factors-such as Federal Reserve (the Fed) policy, federal budget deficit or surplus, international

factors, and levels of business activity-influence interest rates.

Based on your understanding of the impact of macroeconomic factors, identify which of the following statements are true or false:

Statements

When the Fed increases the money supply, short-term interest rates tend to decline.

When the economy is weakening, the Fed is likely to increase short-term interest rates.

During the credit crisis of 2008, investors around the world were fearful about the collapse of real estate markets, shaky stock

markets, and illiquidity of several securities in the United States and several other nations. The demand for US Treasury bonds

increased, which led to a rise in their price and a decline in their yields.

When the economy is weakening, the Fed is likely to decrease short-term interest rates.

True False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you