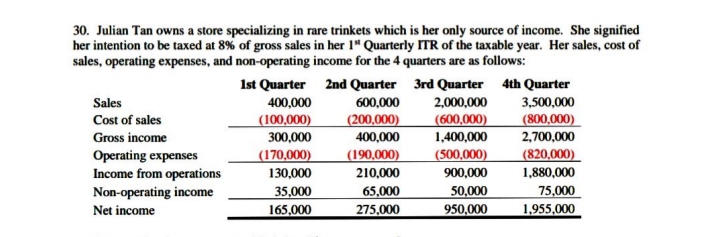

30. Julian Tan owns a store specializing in rare trinkets which is her only source of income. She signified her intention to be taxed at 8% of gross sales in her 1" Quarterly ITR of the taxable year. Her sales, cost of sales, operating expenses, and non-operating income for the 4 quarters are as follows: Ist Quarter 2nd Quarter 3rd Quarter 4th Quarter 3,500,000 (800,000) 2,700,000 Sales 400,000 600,000 2,000,000 Cost of sales (100,000) (200,000) 400,000 (600,000) 1,400,000 Gross income 300,000 (170,000) (190,000) 210,000 (500,000) (820,000) Operating expenses Income from operations Non-operating income Net income 130,000 900,000 1,880,000 35,000 165,000 65,000 275,000 50,000 950,000 75,000 1,955,000

30. Julian Tan owns a store specializing in rare trinkets which is her only source of income. She signified her intention to be taxed at 8% of gross sales in her 1" Quarterly ITR of the taxable year. Her sales, cost of sales, operating expenses, and non-operating income for the 4 quarters are as follows: Ist Quarter 2nd Quarter 3rd Quarter 4th Quarter 3,500,000 (800,000) 2,700,000 Sales 400,000 600,000 2,000,000 Cost of sales (100,000) (200,000) 400,000 (600,000) 1,400,000 Gross income 300,000 (170,000) (190,000) 210,000 (500,000) (820,000) Operating expenses Income from operations Non-operating income Net income 130,000 900,000 1,880,000 35,000 165,000 65,000 275,000 50,000 950,000 75,000 1,955,000

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 43P

Related questions

Question

Compute her income tax payable in her Annual ITR?

a. 613,400

b. 638,400

c. 920,400

d. 628,200

Transcribed Image Text:30. Julian Tan owns a store specializing in rare trinkets which is her only source of income. She signified

her intention to be taxed at 8% of gross sales in her 1" Quarterly ITR of the taxable year. Her sales, cost of

sales, operating expenses, and non-operating income for the 4 quarters are as follows:

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Sales

Cost of sales

400,000

600,000

2,000,000

3,500,000

(200,000)

400,000

(600,000)

1,400,000

(500,000)

|(800,000)

(100,000)

300,000

Gross income

2,700,000

(170,000)

130,000

(820,000)

Operating expenses

Income from operations

Non-operating income

(190,000)

210,000

900,000

1,880,000

35,000

165,000

65,000

275,000

50,000

950,000

75,000

Net income

1,955,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT