,3,4) For each of the following independent situations, indicate the type of financial ent audit report that you would issue, and briefly explain your reasoning. Assume that em is at least material. management of Bonner Corporation has decided to exclude the statement of cash flows its financial statements because it believes that its bankers do not find the statement to ery useful. are auditing Diverse Carbon, a manufacturer of nerve gas for the military, for the year ed 30 September. On 1 September, one of its manufacturing plants caught fire, releasing e gas into the surrounding area. Thirteen people were killed and numerous others lysed. The company's legal counsel indicates that the company is liable and that the unt of theliability can be ronsc nably ostimated but the comnany rofuses to discloso this

,3,4) For each of the following independent situations, indicate the type of financial ent audit report that you would issue, and briefly explain your reasoning. Assume that em is at least material. management of Bonner Corporation has decided to exclude the statement of cash flows its financial statements because it believes that its bankers do not find the statement to ery useful. are auditing Diverse Carbon, a manufacturer of nerve gas for the military, for the year ed 30 September. On 1 September, one of its manufacturing plants caught fire, releasing e gas into the surrounding area. Thirteen people were killed and numerous others lysed. The company's legal counsel indicates that the company is liable and that the unt of theliability can be ronsc nably ostimated but the comnany rofuses to discloso this

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter2: The Auditor’s Responsibilities Regarding Fraud And Mechanisms To Address Fraud: Regulation And Corporate Governance

Section: Chapter Questions

Problem 25RQSC

Related questions

Question

Please explain the answers as detailed as possible for why this audit opinion was given.

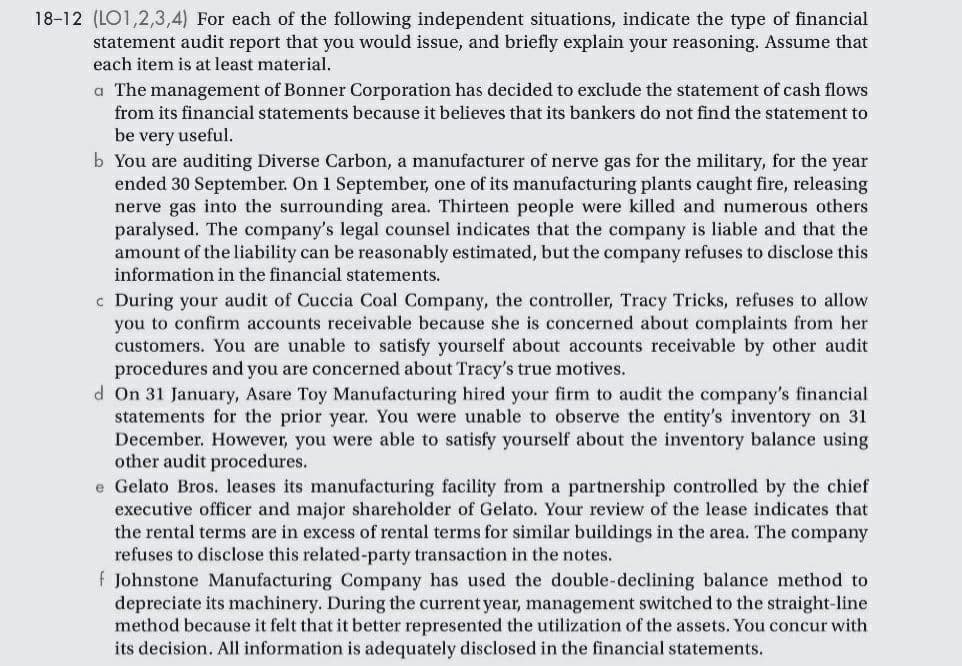

Transcribed Image Text:18-12 (LO1,2,3,4) For each of the following independent situations, indicate the type of financial

statement audit report that you would issue, and briefly explain your reasoning. Assume that

each item is at least material.

a The management of Bonner Corporation has decided to exclude the statement of cash flows

from its financial statements because it believes that its bankers do not find the statement to

be very useful.

b You are auditing Diverse Carbon, a manufacturer of nerve gas for the military, for the year

ended 30 September. On 1 September, one of its manufacturing plants caught fire, releasing

nerve gas into the surrounding area. Thirteen people were killed and numerous others

paralysed. The company's legal counsel indicates that the company is liable and that the

amount of the liability can be reasonably estimated, but the company refuses to disclose this

information in the financial statements.

c During your audit of Cuccia Coal Company, the controller, Tracy Tricks, refuses to allow

you to confirm accounts receivable because she is concerned about complaints from her

customers. You are unable to satisfy yourself about accounts receivable by other audit

procedures and you are concerned about Tracy's true motives.

d On 31 January, Asare Toy Manufacturing hired your firm to audit the company's financial

statements for the prior year. You were unable to observe the entity's inventory on 31

December. However, you were able to satisfy yourself about the inventory balance using

other audit procedures.

e Gelato Bros. leases its manufacturing facility from a partnership controlled by the chief

executive officer and major shareholder of Gelato. Your review of the lease indicates that

the rental terms are in excess of rental terms for similar buildings in the area. The company

refuses to disclose this related-party transaction in the notes.

f Johnstone Manufacturing Company has used the double-declining balance method to

depreciate its machinery. During the current year, management switched to the straight-line

method because it felt that it better represented the utilization of the assets. You concur with

its decision. All information is adequately disclosed in the financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub