37. Share warrants (from the bonds with detachable warrants) a.5,400 b.9,000 c.14,400 d.0 http://e.No answer from the given choices. 38. Ordinary share capital (year-end balance, 2021) a.21,411,000 b.21,611,000 c.21,000,000 d.5,411,000 http://e.No answer from the given choices. 39. Share premium from bond conversion a.473,184 b.463,408 c.400,000 d.126,816 http://e.No answer from the given choices. 40. Share premium from the exercise of share warrants (Nov.1, 2021) a.5,600 b.41,800 c.14,400 d.0 e.No answer from the given choices

37. Share warrants (from the bonds with detachable warrants) a.5,400 b.9,000 c.14,400 d.0 http://e.No answer from the given choices. 38. Ordinary share capital (year-end balance, 2021) a.21,411,000 b.21,611,000 c.21,000,000 d.5,411,000 http://e.No answer from the given choices. 39. Share premium from bond conversion a.473,184 b.463,408 c.400,000 d.126,816 http://e.No answer from the given choices. 40. Share premium from the exercise of share warrants (Nov.1, 2021) a.5,600 b.41,800 c.14,400 d.0 e.No answer from the given choices

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 5MC: Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par...

Related questions

Concept explainers

Question

37. Share warrants (from the bonds with detachable warrants)

a.5,400

b.9,000

c.14,400

d.0

http://e.No answer from the given choices.

38. Ordinary share capital (year-end balance, 2021)

a.21,411,000

b.21,611,000

c.21,000,000

d.5,411,000

http://e.No answer from the given choices.

39. Share premium from bond conversion

a.473,184

b.463,408

c.400,000

d.126,816

http://e.No answer from the given choices.

40. Share premium from the exercise of share warrants (Nov.1, 2021)

a.5,600

b.41,800

c.14,400

d.0

e.No answer from the given choices

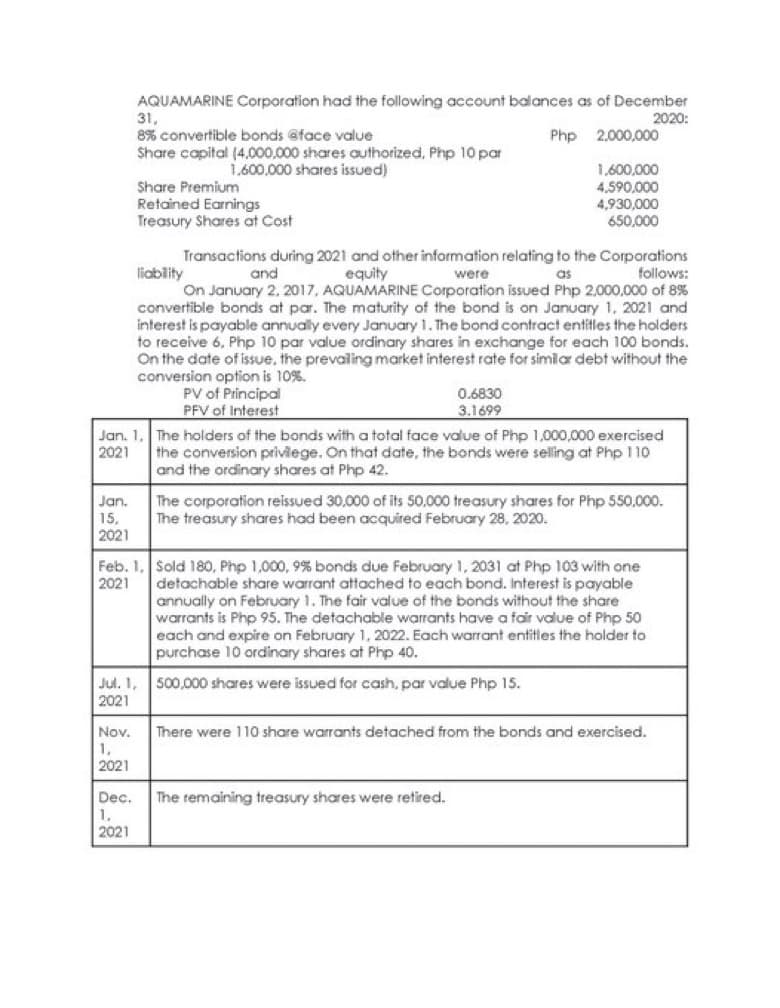

Transcribed Image Text:AQUAMARINE Corporation had the following account balances as of December

31,

2020:

8% convertible bonds @face value

Php 2,000,000

Share capital (4,000,000 shares authorized, Php 10 par

1,600,000 shares issued)

1,600,000

Share Premium

4,590,000

Retained Earnings

4,930,000

Treasury Shares at Cost

650,000

Transactions during 2021 and other information relating to the Corporations

liability

and

equity

follows:

were

as

On January 2, 2017, AQUAMARINE Corporation issued Php 2,000,000 of 8%

convertible bonds at par. The maturity of the bond is on January 1, 2021 and

interest is payable annually every January 1. The bond contract entitles the holders

to receive 6. Php 10 par value ordinary shares in exchange for each 100 bonds.

On the date of issue, the prevailing market interest rate for similar debt without the

conversion option is 10%.

PV of Principal

0.6830

3.1699

PFV of Interest

Jan. 1.

2021

The holders of the bonds with a total face value of Php 1,000,000 exercised

the conversion privilege. On that date, the bonds were selling at Php 110

and the ordinary shares at Php 42.

Jan.

The corporation reissued 30,000 of its 50,000 treasury shares for Php 550,000.

The treasury shares had been acquired February 28, 2020.

15,

2021

Feb. 1,

2021

Sold 180, Php 1,000, 9% bonds due February 1, 2031 at Php 103 with one

detachable share warrant attached to each bond. Interest is payable

annually on February 1. The fair value of the bonds without the share

warrants is Php 95. The detachable warrants have a fair value of Php 50

each and expire on February 1, 2022. Each warrant entitles the holder to

purchase 10 ordinary shares at Php 40.

500,000 shares were issued for cash, par value Php 15.

Jul. 1,

2021

Nov.

There were 110 share warrants detached from the bonds and exercised.

1,

2021

Dec.

The remaining treasury shares were retired..

1,

2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning