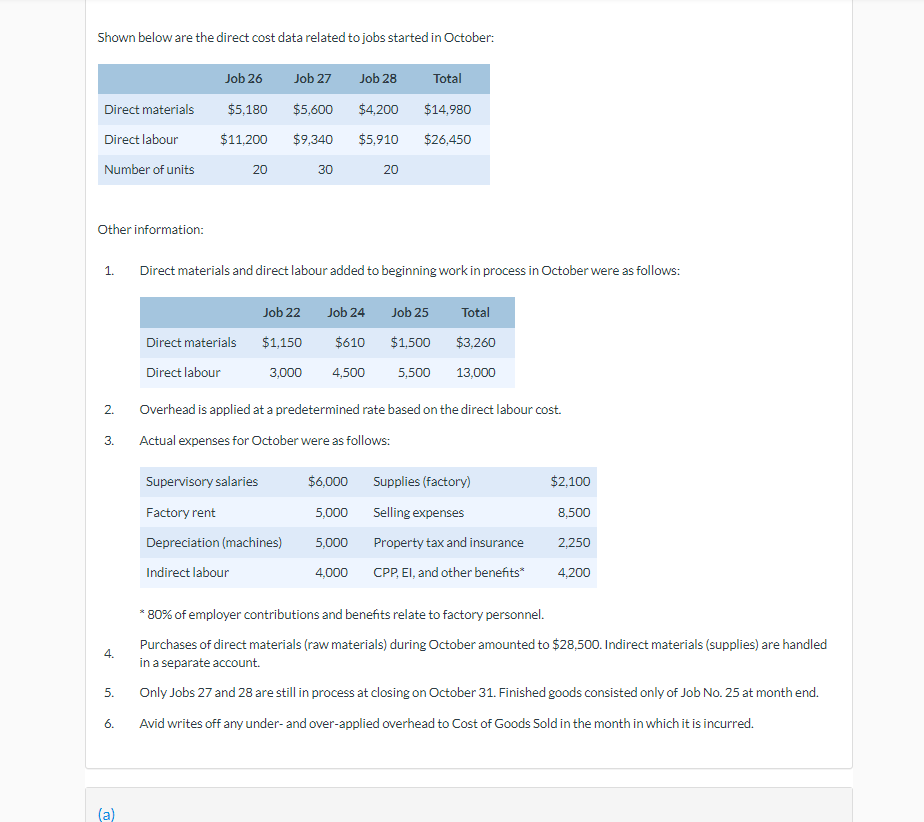

Shown below are the direct cost data related to jobs started in October: Job 26 Job 27 Job 28 Total Direct materials $5,180 $5,600 $4,200 $14,980 Direct labour $11,200 $9,340 $5,910 $26,450 Number of units 20 30 20 Other information: 1. Direct materials and direct labour added to beginning work in process in October were as follows: Job 22 Job 24 Job 25 Total Direct materials $1,150 $610 $1,500 $3,260 Direct labour 3,000 4,500 5,500 13,000 2. Overhead is applied at a predetermined rate based on the direct labour cost. 3. Actual expenses for October were as follows: Supervisory salaries $6,000 Supplies (factory) $2,100 Factory rent 5,000 Selling expenses 8,500 Depreciation (machines) 5,000 Property tax and insurance 2,250 Indirect labour 4,000 CPP, EI, and other benefits 4,200 * 80% of employer contributions and benefits relate to factory personnel. 4. Purchases of direct materials (raw materials) during October amounted to $28,500. Indirect materials (supplies) are handled in a separate account. 5. Only Jobs 27 and 28 are still in process at closing on October 31. Finished goods consisted only of Job No. 25 at month end. 6. Avid writes off any under- and over-applied overhead to Cost of Goods Sold in the month in which it is incurred.

Shown below are the direct cost data related to jobs started in October: Job 26 Job 27 Job 28 Total Direct materials $5,180 $5,600 $4,200 $14,980 Direct labour $11,200 $9,340 $5,910 $26,450 Number of units 20 30 20 Other information: 1. Direct materials and direct labour added to beginning work in process in October were as follows: Job 22 Job 24 Job 25 Total Direct materials $1,150 $610 $1,500 $3,260 Direct labour 3,000 4,500 5,500 13,000 2. Overhead is applied at a predetermined rate based on the direct labour cost. 3. Actual expenses for October were as follows: Supervisory salaries $6,000 Supplies (factory) $2,100 Factory rent 5,000 Selling expenses 8,500 Depreciation (machines) 5,000 Property tax and insurance 2,250 Indirect labour 4,000 CPP, EI, and other benefits 4,200 * 80% of employer contributions and benefits relate to factory personnel. 4. Purchases of direct materials (raw materials) during October amounted to $28,500. Indirect materials (supplies) are handled in a separate account. 5. Only Jobs 27 and 28 are still in process at closing on October 31. Finished goods consisted only of Job No. 25 at month end. 6. Avid writes off any under- and over-applied overhead to Cost of Goods Sold in the month in which it is incurred.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter4: Job-order Costing And Overhead Application

Section: Chapter Questions

Problem 47E: Cost Flows Consider the following independent jobs. Overhead is applied in Department 1 at the rate...

Related questions

Question

What is the cost of goods manufactured in October?

Transcribed Image Text:Shown below are the direct cost data related to jobs started in October:

Job 26

Job 27

Job 28

Total

Direct materials

$5,180

$5,600

$4,200

$14,980

Direct labour

$11,200

$9,340 $5,910

$26,450

Number of units

20

30

20

Other information:

1. Direct materials and direct labour added to beginning work in process in October were as follows:

Job 22 Job 24

Job 25

Total

Direct materials

$1,150

$610 $1,500

$3,260

Direct labour

3,000

4,500 5,500 13,000

2.

Overhead is applied at a predetermined rate based on the direct labour cost.

3.

Actual expenses for October were as follows:

Supervisory salaries

$6,000

Supplies (factory)

$2,100

Factory rent

5,000

Selling expenses

8,500

Depreciation (machines)

5,000

Property tax and insurance

2,250

Indirect labour

4,000

CPP, EI, and other benefits*

4,200

* 80% of employer contributions and benefits relate to factory personnel.

4.

Purchases of direct materials (raw materials) during October amounted to $28,500. Indirect materials (supplies) are handled

in a separate account.

5.

Only Jobs 27 and 28 are still in process at closing on October 31. Finished goods consisted only of Job No. 25 at month end.

6.

Avid writes off any under- and over-applied overhead to Cost of Goods Sold in the month in which it is incurred.

(a)

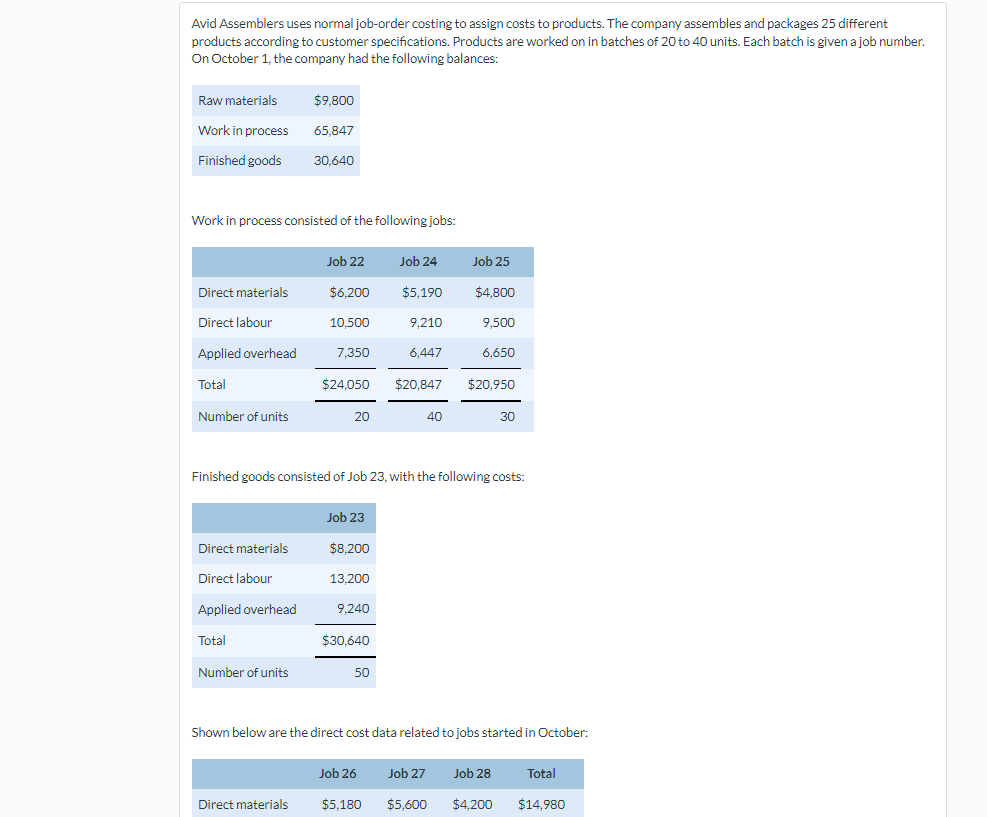

Transcribed Image Text:Avid Assemblers uses normal job-order costing to assign costs to products. The company assembles and packages 25 different

products according to customer specifications. Products are worked on in batches of 20 to 40 units. Each batch is given a job number.

On October 1, the company had the following balances:

Raw materials

$9,800

Work in process

65.847

Finished goods

30,640

Work in process consisted of the following jobs:

Job 22

Job 24

Job 25

Direct materials

$6,200

$5,190

$4,800

Direct labour

10,500

9,210

9,500

Applied overhead

7,350

6,447

6,650

Total

$24,050

$20,847 $20,950

Number of units

20

40

30

Finished goods consisted of Job 23, with the following costs:

Job 23

Direct materials

$8,200

Direct labour

13,200

Applied overhead

9.240

Total

$30,640

Number of units

50

Shown below are the direct cost data related to jobs started in October:

Job 27 Job 28

Total

Job 26

$5,180

Direct materials

$5,600

$4,200

$14,980

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning