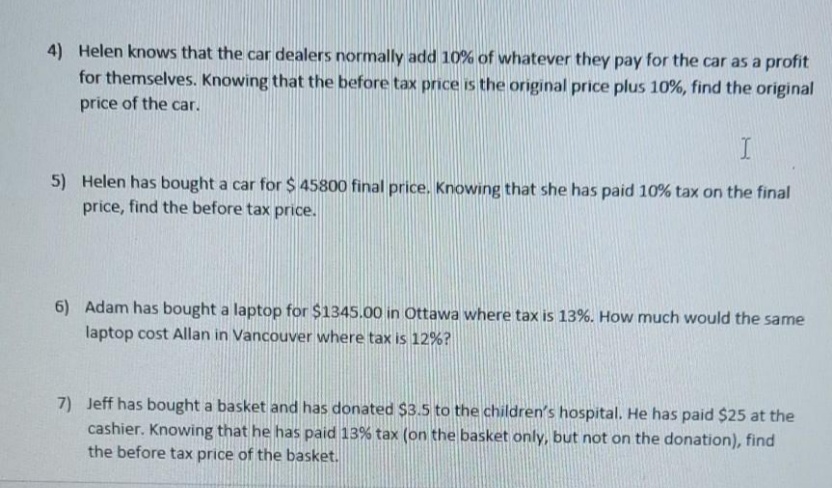

4) Helen knows that the car dealers normally add 10% of whatever they pay for the car as a profit for themselves. Knowing that the before tax price is the original price plus 10%, find the original price of the car. 5) Helen has bought a car for $ 45800 final price, Knowing that she has paid 10% tax on the final price, find the before tax price. 6) Adam has bought a laptop for $1345.00 in Ottawa where tax is 13%. How much would the same laptop cost Allan in Vancouver where tax is 12%? 7) Jeff has bought a basket and has donated $3.5 to the children's hospital. He has paid $25 at the cashier. Knowing that he has paid 13% tax (on the basket only, but not on the donation), find the before tax price of the basket.

4) Helen knows that the car dealers normally add 10% of whatever they pay for the car as a profit for themselves. Knowing that the before tax price is the original price plus 10%, find the original price of the car. 5) Helen has bought a car for $ 45800 final price, Knowing that she has paid 10% tax on the final price, find the before tax price. 6) Adam has bought a laptop for $1345.00 in Ottawa where tax is 13%. How much would the same laptop cost Allan in Vancouver where tax is 12%? 7) Jeff has bought a basket and has donated $3.5 to the children's hospital. He has paid $25 at the cashier. Knowing that he has paid 13% tax (on the basket only, but not on the donation), find the before tax price of the basket.

Chapter2: The Domestic And International Financial Marketplace

Section2.A: Taxes

Problem 7P

Related questions

Question

Solve all parts

I mentioned already solve all parts

Transcribed Image Text:4) Helen knows that the car dealers normally add 10% of whatever they pay for the car as a profit

for themselves. Knowing that the before tax price is the original price plus 10%, find the original

price of the car.

5) Helen has bought a car for $ 45800 final price. Knowing that she has paid 10% tax on the final

price, find the before tax price.

6) Adam has bought a laptop for $1345.00 in Ottawa where tax is 13%. How much would the same

laptop cost Allan in Vancouver where tax is 12%?

7) Jeff has bought a basket and has donated $3.5 to the children's hospital. He has paid $25 at the

cashier. Knowing that he has paid 13% tax (on the basket only, but not on the donation), find

the before tax price of the basket.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning