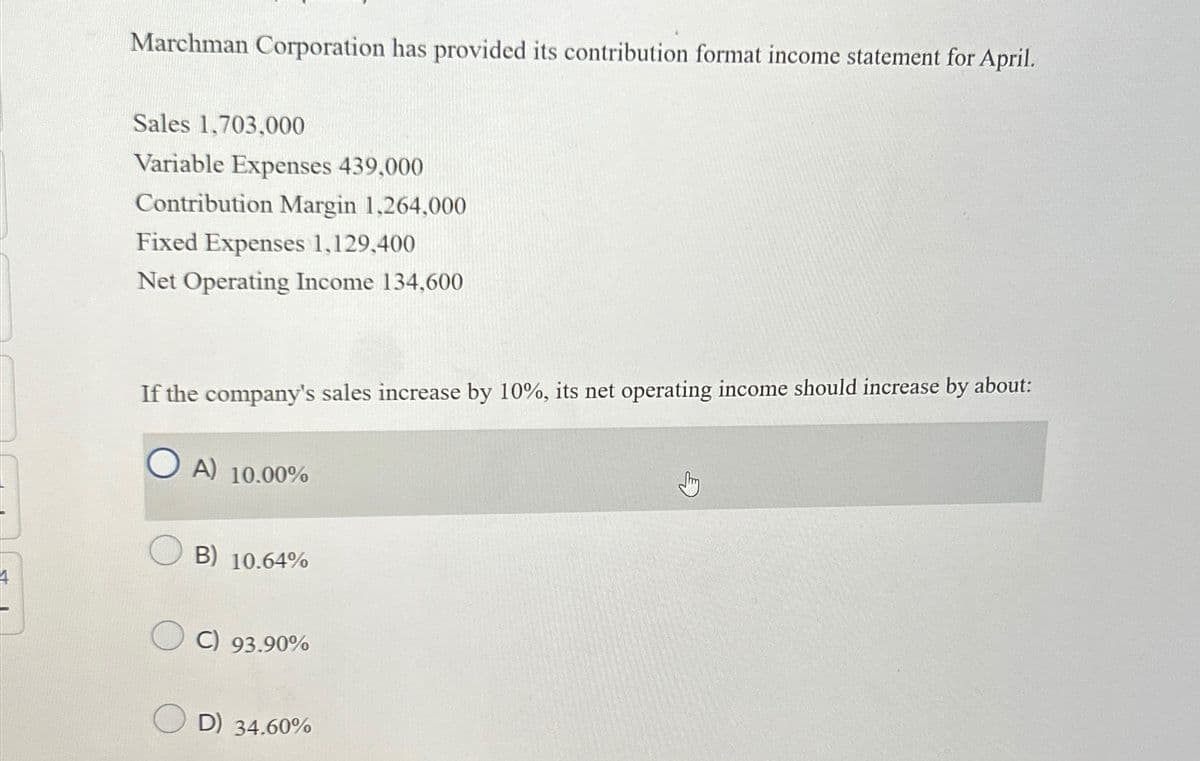

4 Marchman Corporation has provided its contribution format income statement for April. Sales 1,703,000 Variable Expenses 439,000 Contribution Margin 1,264,000 Fixed Expenses 1,129,400 Net Operating Income 134,600 If the company's sales increase by 10%, its net operating income should increase by about: A) 10.00% B) 10.64% C) 93.90% D) 34.60%

Q: Required information [The following information applies to the questions displayed below.] In 2024,…

A: The construction contract normally takes more than a year to complete the construction work and it…

Q: Colah Company purchased $2,300,000 of Jackson, Incorporated, 6% bonds at their face amount on July…

A: Colah company planned to keep them for less than 3 years, so they are classified as available for…

Q: Presented below are summary financial data from the Jackson Co. annual report: Amounts in millions…

A: Financial ratios are fine measures used to assess a company's fiscal performance, position, and…

Q: tion started a construction job with a contract price of $3.5 difficulties during construction but…

A: The percentage of the completion method is used mainly in the construction industry to recognize the…

Q: Luna Company accepted credit cards in payment for $7,100 of services performed during July Year 1.…

A: A journal entry is a record of a business transaction in double- entry secretary. It's the first…

Q: Company A acquires 80% of Company B's outstanding shares for $7 million. The fair value of Company…

A: The objective of this question is to calculate the amount of goodwill to be recognized as a result…

Q: A company has total assets of $500,000, total liabilities of $200,000, and total equity of $300,000.…

A: The objective of the question is to calculate the company's debt-to-equity ratio. The debt-to-equity…

Q: Current Attempt in Progress The accounting records of Cullumber Inc. show the following data for…

A: Taxable income is the fraction of your gross income used to determine how much tax you owe in a…

Q: Pronghorn Ltd. is a Canadian publicly-traded business with a December 31 fiscal year end. In order…

A: Journal Entries are posting of the accounting transactions made during the accounting period using…

Q: Salt and Mineral (SAM) began 2024 with 320 units of its one product. These units were purchased near…

A: Lets understand the basics.Ending inventory and cost of goods sold can be calculated using,(1)…

Q: On October 1, 2020, Santana Rey launched a computer services company, Business Solutions, that is…

A: An accounting equation is a basic equation which expresses that the assets of an entity are always…

Q: 5. Compute the price of $86,708,402 received for the bonds by using the Present value at compound…

A: The objective of the question is to verify the price of the bonds received using the present value…

Q: On January 1, 2023, Novak Corporation, a public company following IFRS, acquired 15,900 of the…

A: Journal entries are the primary method used to record financial transactions in accounting. They…

Q: Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling…

A: A costing system refers to calculating the cost of producing goods or providing services. Costing…

Q: Required: Prepare schedules that compute the balances in each partner's capital account at the end…

A:

Q: Required information [The following information applies to the questions displayed below.] Astro…

A: Cost volume profit analysis is the technique used by management for decision-making. The methods…

Q: Saved Help Save & Exit Submit Direct Complete for Assembly Department Units Materials Conversion…

A: Equivalent cost is evaluated based on the percentage of the work that is completed during the…

Q: Greta, a CPA, specializes in accounting for discontinued operations for her clients. Of the…

A: This question is regarding Accounting standard 24, and Ind Accounting standard 105

Q: Current Attempt in Progress Prepare journal entries to record the following sales transactions in…

A: Journal Entry: A journal entry is basically the recording the company's financial or monetary events…

Q: Problem 5: Sort the data by portfolio, then by revenue. Then write a fuction in the Blue cell that…

A: It is one of the key features of a spreadsheet that allows the user to arrange the data as per the…

Q: Required information [The following information applies to the questions displayed below] As of…

A: Income statement: It refers to one of the company's financial statements that shows the total…

Q: Problem 17-12 (Algo) Determine pension expense; journal entries; two years [LO17-3, 17-4, 17-5,…

A: The pension plan is the retirement plan established for employee benefits, the employer contributes…

Q: Evergreen Corporation (calendar year-end) acquired the following assets during the current year:…

A: Depreciation: An asset's monetary value declines with usage, wear and tear, or obsolescence. The…

Q: Bosco Company adopted the dollar value LIFO retail method at the beginning of 2024. Information for…

A: It is a variation method of LIFO ( Last in first out) . It specifically desined for ratail business…

Q: Analyse the above transactions in tabular form as follows: A/C.DEBIT A/C.CREDIT A E+

A: Identify the Accounts whether it is Asset or liability

Q: Garden Sales, Incorporated, usually has to borrow money during the second quarter to support peak…

A: Sales budget for the period of February to July is as below. SALES…

Q: Adams Company has two divisions, A and B. Division A manufactures 6,100 units of product per month.…

A: Variable cost means the cost which vary with the level of output where as fixed cost remain fixed…

Q: Find Exxon Mobile Corp income statement and Cash flow statement and fill in the spreadsheet.…

A: The objective of the question is to fill in the spreadsheet with the given data from Exxon Mobile…

Q: On January 1, 2021. Ameen Company purchased major pieces of manufacturing equipment for a total of…

A: Deferred tax liability is the amount of taxes that are required to be paid in the future. Thus, this…

Q: Changing the method used to calculate depreciation from method 1 to method 2 in one year, then back…

A: Consistency is one of the qualitative characteristics of financial information outlined in the…

Q: Chamberlain Enterprises Incorporated reported the following receivables in its December 31, 2024,…

A: Account Receivable:Accounts receivable is a type of current asset and it is recorded on the balance…

Q: The weekly time tickets indicate the following distribution of labor hours for three direct labor…

A: Journal Entry:— It is an act of recording transactions in books of account when transaction…

Q: The following information was taken from a company's bank reconciliation at the end of the year:…

A: The cash balance is the amount of money that an individual, company, or other legal entity has on…

Q: Miracle Consulting Corporation has its headquarters in Chicago and operates from three branch…

A: The objective of the question is to calculate the amount of headquarters cost allocation that the…

Q: SnowDreams operates a Rocky Mountain ski resort. The company is planning its lift ticket pricing for…

A: Variable costs are costs that vary with the change in the level of output whereas fixed costs are…

Q: SecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveries in the Los…

A: First stage allocation is the allocation of overhead costs to different activity cost pools. It is…

Q: Sandhill Traders is one of the largest RV dealers in Austin, Texas, and sells about 2,800…

A: Economic Order Quantity:The Economic Order Quantity (EOQ) formula helps in figuring out the order…

Q: Current Attempt in Progress Sandhill Corp. reported the following amounts in the shareholders'…

A: Dividends on stocks increase the number of outstanding shares, which might improve the stock's…

Q: During the current year, Newtech Corporation sold a segment of its business at a loss of $225,000.…

A: Discontinued Operations are the operations of the business discontinued by the organization. The…

Q: Required information [The following information applies to the questions displayed below.] Altira…

A: A technique used to determine the worth of inventory stock at the time financial statements are…

Q: Sandhill Ltd. sold 10-year, 5% convertible bonds with face value $1,590,000. The bonds pay interest…

A: Early retirement of bonds refers to the redemption of bonds by a company before their scheduled…

Q: Rahul

A: The objective of the question is to determine the effect on the company's operating income if a…

Q: you run a school in Florida. Fixed monthly cost is $5,421.00 for rent and utilities, $5,585.00 is…

A: A variable cost is an expense that changes in proportion to production output or sales. When…

Q: Wildhorse Company uses a periodic inventory system. Its records show the following for the month of…

A: Inventory valuation is based on the method of flow used by the organization. It can be the first in…

Q: The following sales information is available for Forever Fragrance Company's Southern and Northern…

A: Sales mix refers to the relative sales made by different products based on total sales. Sales mix is…

Q: Sandhill Corporation acquired a patent on May 1, 2025. Sandhill paid cash of $86000 to the seller.…

A: Journal entries are made to record the transactions as the first process in the books of accounts…

Q: AuditorAs audit senior in Carollo and Co and you are commencing the planning of the audit of this…

A: (a) Assessing risks in the strategy planning stage of an audit is crucial for numerous…

Q: In the learning curve equation Y = aXb, the Y term represents: Multiple Choice the…

A: the labor time required to produce the last single unit.Explanation:The cumulative average time per…

Q: t The following information pertains to the Inventory of Parvin Company January 1 Apr 11 1 Beginning…

A: The income statement is prepared by the companies at the year-end which indicates the profit earned…

Q: (Click the icon to view the data) Requirements 1. 2 Journalize the entry to record Midland's…

A: Goodwill-Goodwill is the difference between the sum of capital and total liabilities and total…

Step by step

Solved in 3 steps

- During the current year, Sokowski Manufacturing earned income of $350,000 from total sales of $5,500,000 and average capital assets of $12,000, 000. What is the sales margin?During the current year, Plainfield Manufacturing earned income of $845,000 from total sales of $9,350,000 and average capital assets of $13,500,000. Using the sales margin from the previous exercise, what is the total ROI for the company during the current year?During the current year. Plainfield Manufacturing earned income of $845,000 from total sales of $9,350,000 and average capital assets of $13,500,000. What is the sales margin?

- Macom Manufacturing has total contribution margin of $61,250 and net income of $24,500 for the month of June. Marcus expects sales volume to increase by 10% in July. What are the degree of operating leverage and the expected percent change in income for Macom Manufacturing? 0.4 and 10% 2.5 and 10% 2.5 and 25% 5.0 and 50%Division A of Kern Co. has sales of $350,000, cost of goods sold of $200,000, operating expenses of $30,000, and invested assets of $600000. What is the return on investment for Division A? A. 20% B. 25% C. 33% D. 40%Green Valley Corp.'s contribution format income statement for the most recent month follows: Sales $ 506,000 Variable expenses 236,500 Contribution margin 269,500 Fixed expenses 241,700 Net operating income $ 27,800 Required: a. Compute the degree of operating leverage to two decimal places. b. Using the degree of operating leverage, estimate the percentage change in net operating income that should result from a 3% increase in sales. c. If Green Valley’s competitor Black Mountain Inc. has a degree of operating leverage as 8, which company has the higher operating risk?

- The February contribution format income statement of Mcabier Corporation appears below: Sales $ 211,200 Variable expenses 96,000 Contribution margin 115,200 Fixed expenses 84,100 Net operating income $ 31,100 The degree of operating leverage is closest to: a/ 0.27 b/ 6.79 c/ 3.70 d/ 0.15*CAN YOU ANSWER PARTS 4-7* The contribution format income statement for Huerra Company for last year is given below: Total Unit Sales $ 992,000 $ 49.60 Variable expenses 595,200 29.76 Contribution margin 396,800 19.84 Fixed expenses 318,800 15.94 Net operating income 78,000 3.90 Income taxes @ 40% 31,200 1.56 Net income $ 46,800 $ 2.34 The company had average operating assets of $492,000 during the year. Required: 1. Compute the company’s return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of…Slowhand Corporation has provided its contribution format income statement for April. Sales…………………………………………….. $280,000 Variable Expenses……………………….. $105,000 Contribution Margin……………………. $ 175,000 Fixed Expenses……………………………. $ 125,000 Net Operating Income………………… $ 50,000 Required: Compute the degree of operating leverage to two decimal place. Using the degree of operating leverage, estimate the percentage change to two decimal places in net operating income that should result from a 9% increase in sales.

- The contribution format income statement for Huerra Company for last year is given below: Total Unit Sales $ 4,000,000 $ 80.00 Variable expenses 2,800,000 56.00 Contribution margin 1,200,000 24.00 Fixed expenses 840,000 16.80 Net operating income 360,000 7.20 Income taxes @ 30% 108,000 2.16 Net income $ 252,000 $ 5.04 The company had average operating assets of $2,000,000 during the year. At the beginning of the year, the company uses $200,000 of cash (received on accounts receivable) to repurchase and retire some of its common stock Effect Margin ____ % ____ Turnover ____ ____ ROI ____ % ____The contribution format income statement for Huerra Company for last year is given below: Total Unit Sales $ 4,000,000 $ 80.00 Variable expenses 2,800,000 56.00 Contribution margin 1,200,000 24.00 Fixed expenses 840,000 16.80 Net operating income 360,000 7.20 Income taxes @ 30% 108,000 2.16 Net income $ 252,000 $ 5.04 The company had average operating assets of $2,000,000 during the year. At the beginning of the year, the company uses $200,000 of cash (received on accounts receivable) to repurchase and retire some of its common stock At the beginning of the year, the company uses $200,000 of cash (received on accounts receivable) to repurchase and retire some of its common stock. (Round your intermediate calculations and final answers to 2 decimal places.) Effect Margin 6.30selected answer incorrect % not attempted Turnover 2.00selected answer incorrect not attempted ROI 12.60selected…The contribution format income statement for Huerra Company for last year is given below: Total Unit Sales $ 1,006,000 $ 50.30 Variable expenses 603,600 30.18 Contribution margin 402,400 20.12 Fixed expenses 324,400 16.22 Net operating income 78,000 3.90 Income taxes @ 40% 31,200 1.56 Net income $ 46,800 $ 2.34 The company had average operating assets of $508,000 during the year. Required: 1. Compute the company’s margin, turnover, and return on investment (ROI) for the period. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $91,000. 3. The company achieves a cost savings of $6,000 per year by using less…