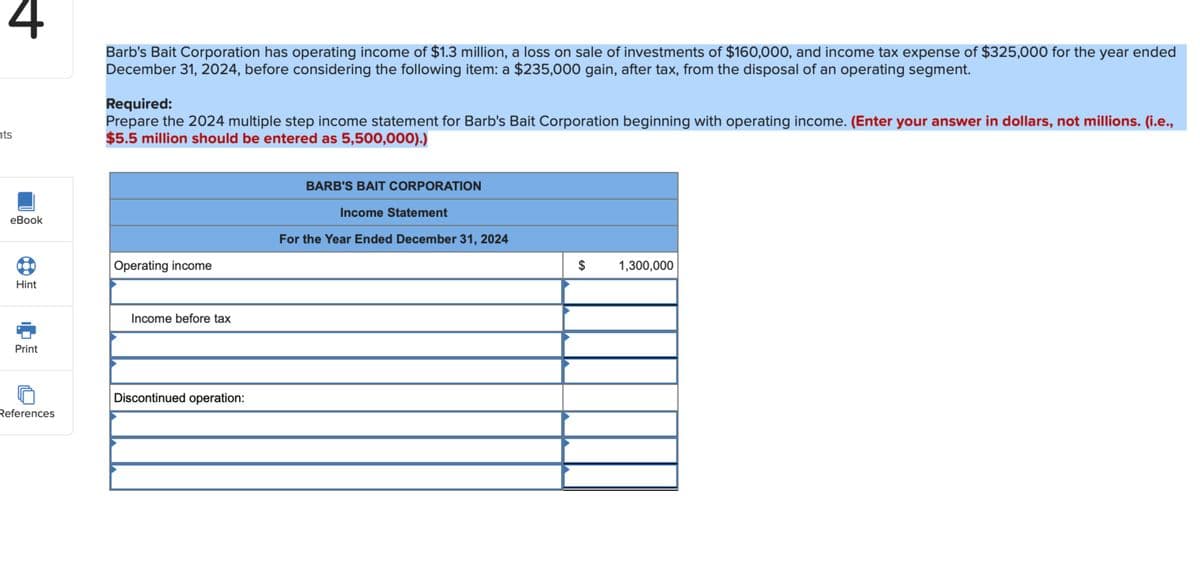

4 ts eBook Barb's Bait Corporation has operating income of $1.3 million, a loss on sale of investments of $160,000, and income tax expense of $325,000 for the year ended December 31, 2024, before considering the following item: a $235,000 gain, after tax, from the disposal of an operating segment. Required: Prepare the 2024 multiple step income statement for Barb's Bait Corporation beginning with operating income. (Enter your answer in dollars, not millions. (i.e., $5.5 million should be entered as 5,500,000).) BARB'S BAIT CORPORATION Income Statement For the Year Ended December 31, 2024 Operating income $ 1,300,000 Hint Print Income before tax Discontinued operation: References

4 ts eBook Barb's Bait Corporation has operating income of $1.3 million, a loss on sale of investments of $160,000, and income tax expense of $325,000 for the year ended December 31, 2024, before considering the following item: a $235,000 gain, after tax, from the disposal of an operating segment. Required: Prepare the 2024 multiple step income statement for Barb's Bait Corporation beginning with operating income. (Enter your answer in dollars, not millions. (i.e., $5.5 million should be entered as 5,500,000).) BARB'S BAIT CORPORATION Income Statement For the Year Ended December 31, 2024 Operating income $ 1,300,000 Hint Print Income before tax Discontinued operation: References

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 1RE: Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of...

Related questions

Question

Transcribed Image Text:4

ts

eBook

Barb's Bait Corporation has operating income of $1.3 million, a loss on sale of investments of $160,000, and income tax expense of $325,000 for the year ended

December 31, 2024, before considering the following item: a $235,000 gain, after tax, from the disposal of an operating segment.

Required:

Prepare the 2024 multiple step income statement for Barb's Bait Corporation beginning with operating income. (Enter your answer in dollars, not millions. (i.e.,

$5.5 million should be entered as 5,500,000).)

BARB'S BAIT CORPORATION

Income Statement

For the Year Ended December 31, 2024

Operating income

$

1,300,000

Hint

Print

Income before tax

Discontinued operation:

References

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning