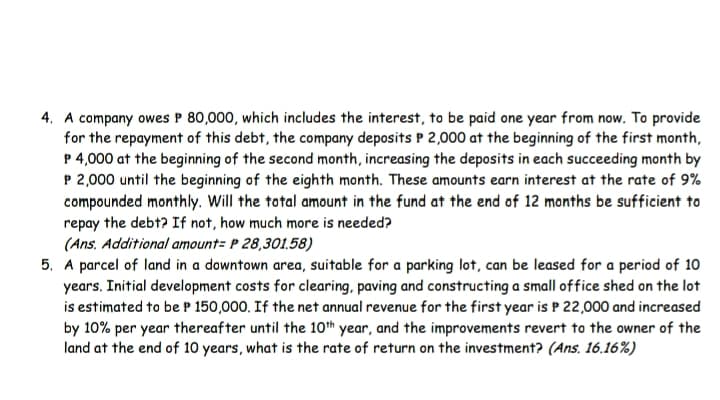

4. A company owes P 80,000, which includes the interest, to be paid one year from now. To provide for the repayment of this debt, the company deposits P 2,000 at the beginning of the first month, P 4,000 at the beginning of the second month, increasing the deposits in each succeeding month by P 2,000 until the beginning of the eighth month. These amounts earn interest at the rate of 9% compounded monthly. Will the total amount in the fund at the end of 12 months be sufficient to repay the debt? If not, how much more is needed? (Ans. Additional amount= P 28,301.58)

4. A company owes P 80,000, which includes the interest, to be paid one year from now. To provide for the repayment of this debt, the company deposits P 2,000 at the beginning of the first month, P 4,000 at the beginning of the second month, increasing the deposits in each succeeding month by P 2,000 until the beginning of the eighth month. These amounts earn interest at the rate of 9% compounded monthly. Will the total amount in the fund at the end of 12 months be sufficient to repay the debt? If not, how much more is needed? (Ans. Additional amount= P 28,301.58)

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EA: Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank...

Related questions

Question

Answer step by step

Transcribed Image Text:4. A company owes P 80,000, which includes the interest, to be paid one year from now. To provide

for the repayment of this debt, the company deposits P 2,000 at the beginning of the first month,

P 4,000 at the beginning of the second month, increasing the deposits in each succeeding month by

P 2,000 until the beginning of the eighth month. These amounts earn interest at the rate of 9%

compounded monthly. Will the total amount in the fund at the end of 12 months be sufficient to

repay the debt? If not, how much more is needed?

(Ans, Additional amount= P 28,301,58)

5. A parcel of land in a downtown area, suitable for a parking lot, can be leased for a period of 10

years. Initial development costs for clearing, paving and constructing a small of fice shed on the lot

is estimated to be P 150,000. If the net annual revenue for the first year is P 22,000 and increased

by 10% per year thereafter until the 10th year, and the improvements revert to the owner of the

land at the end of 10 years, what is the rate of return on the investment? (Ans. 16.16%)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT