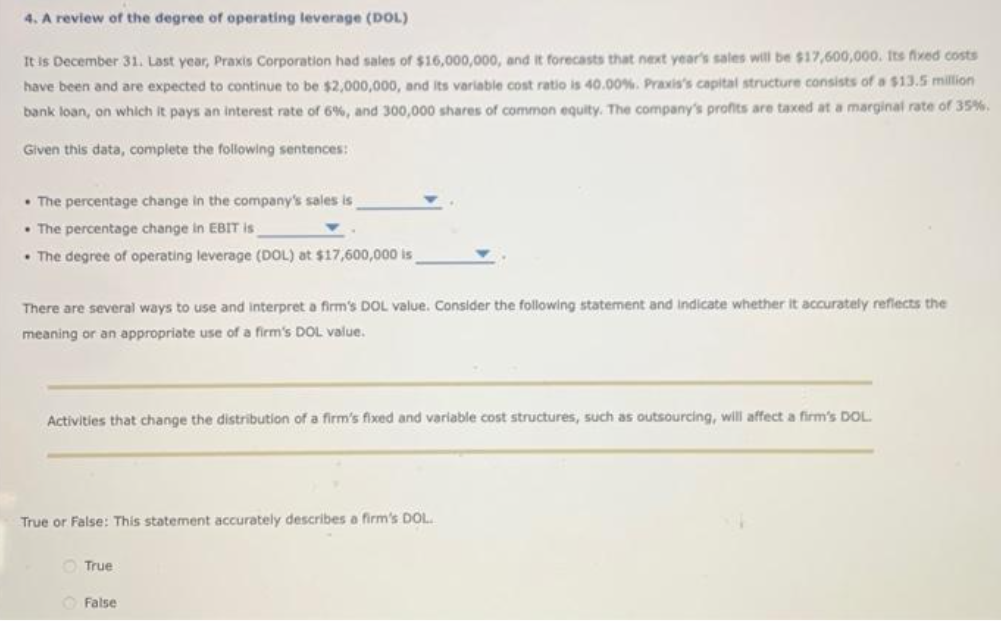

4. A review of the degree of operating leverage (DOL) It is December 31. Last year, Praxis Corporation had sales of $16,000,000, and it forecasts that next year's sales will be $17,600,000. Its fixed costs have been and are expected to continue to be $2,000,000, and its variable cost ratio is 40.00%. Praxis's capital structure consists of a $13.5 million bank loan, on which it pays an interest rate of 6%, and 300,000 shares of common equity. The company's profits are taxed at a marginal rate of 35%. Given this data, complete the following sentences: The percentage change in the company's sales is • The percentage change in EBIT is The degree of operating leverage (DOL) at $17,600,000 is

4. A review of the degree of operating leverage (DOL) It is December 31. Last year, Praxis Corporation had sales of $16,000,000, and it forecasts that next year's sales will be $17,600,000. Its fixed costs have been and are expected to continue to be $2,000,000, and its variable cost ratio is 40.00%. Praxis's capital structure consists of a $13.5 million bank loan, on which it pays an interest rate of 6%, and 300,000 shares of common equity. The company's profits are taxed at a marginal rate of 35%. Given this data, complete the following sentences: The percentage change in the company's sales is • The percentage change in EBIT is The degree of operating leverage (DOL) at $17,600,000 is

Chapter16: Financial Planning And Control

Section: Chapter Questions

Problem 20PROB

Related questions

Question

A 137.

Subject:- finance

Transcribed Image Text:4. A review of the degree of operating leverage (DOL)

It is December 31. Last year, Praxis Corporation had sales of $16,000,000, and it forecasts that next year's sales will be $17,600,000. Its fixed costs

have been and are expected to continue to be $2,000,000, and its variable cost ratio is 40.00%. Praxis's capital structure consists of a $13.5 million

bank loan, on which it pays an interest rate of 6%, and 300,000 shares of common equity. The company's profits are taxed at a marginal rate of 35%.

Given this data, complete the following sentences:

• The percentage change in the company's sales is

. The percentage change in EBIT is

The degree of operating leverage (DOL) at $17,600,000 is

There are several ways to use and interpret a firm's DOL value. Consider the following statement and indicate whether it accurately reflects the

meaning or an appropriate use of a firm's DOL value.

Activities that change the distribution of a firm's fixed and variable cost structures, such as outsourcing, will affect a firm's DOL

True or False: This statement accurately describes a firm's DOL

True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College