4. Based on the answer to the previous question (question #3), if half of those government expenditures are financed through lump sum taxes, calculate the new level if NI? (C+I+G)

Q: The greater amount of crowd-out from Social Security, the less ________ there is. a. consumer…

A: Social Security: It is the policy or the programme of the government that helps the worker to their…

Q: Consider an economy described by the following equations: Y=C+I+G C=100+.75(Y−T)C=100+.75(Y−T)…

A: GDP refers to the total value of all goods and services produced in the country over a period of…

Q: If government policy makers were worried about the inflationary potential of the economy, which of…

A: When government worried about inflation, it can use contractionary fiscal policy to reduce the…

Q: What do economists mean when they say government purchases are “exhaustive” expenditures whereas…

A: Public expenditure refers to the expenditure that is incurred by the government in providing goods…

Q: Suppose that autonomous consumption (a) is 300, private investment spending (I) is 420, government…

A: It is given that, a=300 I=420 G=400 T=400 MPC(b)=0.8 t=0.25Y

Q: Increasing taxes to reduce national debt is more damaging to the economy than spending reforms…

A: Answer is number 2 i.e. Tax hikes harm economic recovery slowing growth, reducing GDP by more than…

Q: If the Ricardian equivalence holds true, then... Select the correct answer below: increasing the…

A: Expansionary fiscal policies are such policies that are implemented by the government in order to…

Q: Willam H. Branson" of "Macroeconomic Theory and policy" states that the "Fiscalist Model is an…

A: Monetary policy is policy in which the central bank change money supply to affect the interest to…

Q: Naked Economics: Undressing the Dismal Science Book by Charles Wheelan This question is based on…

A: Answer: Budget deficit: it the government spending is more than the government revenue then there…

Q: A short-run AS/AD economy has an AS/AD spending multiplier of 2.0 and an income tax rate of t = 0.3.…

A: Spending multiplier refers to the multiplier effect of change in spending on the total output.…

Q: Historically, which of the following are reasons that a large US public debt might not threaten to…

A: An increase in US public debt might not threaten to bankrupt the Federal government on account of…

Q: An appropriate way for the government to help stabilize economic activity consists in Select one…

A: In order to stabilize the economy, the government should change its spendings according to the…

Q: True/False 1) Unemploymen benefits are an example of fiscal policy.2) According to Ricardian…

A: A transfer payment is a redistribution of income facilitated by the government of an economy as it…

Q: If the MPS in an economy is 0.4. What is the government spending multiplier? Group of answer choices…

A: In an economy, there used to be a proportionate link between economic factors that helps to…

Q: Assume i=0%, beta=1. Consumer has income of 80 in year 1, 100 in year 2. Now suppose gov't gives…

A: In the policy of the fiscal expansion that government starts the policy of borrowing and using the…

Q: Suppose the government raises its revenue by a net tax of 25 percent on income, t = 0.25, the…

A: The public debt ratio shows how much a nation owes in the form of debts and indicates the capability…

Q: Assume that, without taxes, the consumption schedule for an economy is as shown in the first two…

A: Please find the attached calculation below-

Q: “Crowding out” refers to the situation in whicha. borrowing by the federal government raisesinterest…

A: OPTION A Increase in government borrowing shifts the IS curve to the right. LM curve remains…

Q: Assume that initial GDP is $1,000 and we want to expand it to $1,600. Average MPC for the country is…

A: Economists use the marginal propensity to save (MPS) to measure the link between income and savings.…

Q: Which of the following are ways for domestic governments to raise capital for spending? Please…

A: Government raises capital from various sources . Government spending is done for social welfare for…

Q: Suppose at period t we denote Gt = government expenditure, Bt = government debt, i = interest rate…

A: Fiscal policy manifests the actions adopted by the federal government with a view to maximize the…

Q: One of the main arguments against using Fiscal Policy is the crowding out effect. Suppose the…

A: Crowding out effect Crowding out effect can be defined as a situation when increase in interest rate…

Q: Explain why increased government spending of, for example, $15 billion, will have a different impact…

A: The changes in tax and public expenditure are the major fiscal policy measures used by the…

Q: ts need not cro

A: Ricardian equivalence occurs when there is an increase in the government deficit which leads to an…

Q: The structure of an economy is completely described by the following equations: (1) C = 20 +…

A: C = 20 + 0.7(Y-T)T = 0.3Y Putting T in C C = 20 + 0.7(Y-0.3Y) C = 20 + 0.7(0.7Y) C = 20 + 0.7(0.7Y)…

Q: Suppose that autonomous consumption (a) is 300, private investment spending (I) is 420, government…

A: Note, Since you have posted a question with multiple sub parts, we will answer the first Sub part,…

Q: crowding out

A: Crowding out is a situation when increased interest rate leads to reduction in private investment…

Q: If the multiplier in a closed economy with government is 4 and government spending increases by £200…

A: Given: Multiplier=4 Change in government expenditure=200 million To find: Rise in income

Q: What is the role of the Council Economic Advisers (CEA) as it relates to the effectiveness of the…

A: The CEA was settled under the Employment Act,1946. It was established to provide the president with…

Q: 2022 budget: China increases public spending to stabilize economy. China plans to expand public…

A: IS curve shows the negative relationship between the interest rate and output. The IS curve is…

Q: Some liken quantitative easing to that of directing a firehose of money to emerging economies that…

A: In an economy, action of governement and central bank have significant impact on the behavior of…

Q: government expenditure towards infrastructure increases and is deficit financed, then: a. The debt…

A: Government spending or use incorporates all government utilization, investments, and transfer…

Q: TRUE/FALSE We argued that the tax multiplier is higher in absolute value than the government…

A: Multiplier is one of the major economic tool to understand the change in one variable due to the…

Q: hich of the following policy measures is not discretionary? a. Income tax surcharges designed to…

A: In an economy, discretionary policy refers to the one that is implemented for a specific purpose or…

Q: Multiple choice questions. Color only one correct answer 4- Each country that joins the EU: a- Can…

A: European Union provides a lot of access and advantages to its member countries.

Q: Describe three ways in which government spending can be financed.

A: Government spending refers to the expenditure made by the government on national defense, education,…

Q: The goods markets of countries A and B are described by the following equations: C = co + c¡ (Y –…

A: Given C=c0+c1Y-T .... (1) I=b0+b1Y-d2i .... (2) G=G For country A: T=t0 For country B:…

Q: An increase in investment spending because companies become more optimistic about investment…

A: We will answer the first question since the exact one was not specified. Please submit a new…

Q: Assume i=0%, beta=1. Consumer has income of 80 in year 1, 100 in year 2. Now suppose gov't gives…

A: Given information beta=1 i=0% Income in period 1=80 Income in period 2=100 Government gives free…

Q: What does the phrase "crowding out" refer to? Why does it occur? What are its implications for…

A: Crowding out refers to the rise in public sector spending, which drives down private sector…

Q: Refer to the information provided in Table below to answer the question that follow. All Figures in…

A: MPS stands for marginal propensity to save. It is the proportion of disposable income that an…

Q: As the economy declines into recession, the collection of personal income tax revenues automatically…

A: A recession is a significant slowing or contraction of the economy. A recession typically results…

Q: Part of the spending on the Caldecott Tunnel project in northern California came from the American…

A: In an economy, fiscal policy is when government make changes in aggregate demand and other…

PLEASE ONLY ANSWER QUESTION FOUR (i am giving you the others as context) (i need this by 11:55pm tonight, so in like 25 minutes, so please hurry!!)

ANSWER THIS ONE:

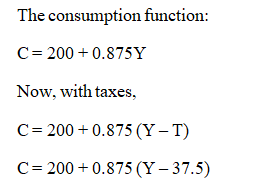

4. Based on the answer to the previous question (question #3), if half of those government expenditures are financed through lump sum taxes, calculate the new level if NI? (C+I+G)

HERE ARE THE FIRST THREE QUESTIONS AS CONTEXT:

1. Calculate the MPC in the above diagram.

2. Based on Diagram 1, If private Investment of $100 is added to the existing C, calculate the new equilibrium level of NI.

3. Given your answer to the previous question (question #2) calculate by how much G should change, if the full employment level in the economy is at $3000.

4) The government expenditure should be increased by 75. Half of this is financed by taxes. The taxes are 37.5. Remaining government expenditure is 37.5

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- "Willam H. Branson" of "Macroeconomic Theory and policy" states that the "Fiscalist Model is an improbable, extreme case of the general model and not a stance to be taken seriously". However, the economic scenario during COVID 19 might indicate otherwise. Write an essay in about 500-600 words expressing your thoughts on this matter. Instructions: Please provide relevant statistics/data in order to substantiate your opinions.True/False 1) Unemploymen benefits are an example of fiscal policy.2) According to Ricardian Equivalence in a strict sense, the tax multiplier is zero.3) When looking at the GDP data from quarter 3 of 2012, government purchases accounted for a larger share of the economy than investment expenditures did.4) According to one of the lectures featuring a pie chart on federal government expenditures, transfer payments went from about 25% of total expenditures in the 1960s to over 46% of total expenditures in 2010.5) As of 2010, interest payments on the federal debt exceeded 10% of totalexpenditures.6) We argued that the tax revenue that the federal government collects ispro-cyclical, that is, when economic activity is growing so is taxrevenue. An example of this is the new economy when tax revenue increased along with the economic growth.7) If aggregate expenditures exceed aggregate income then inventories will rise and firms will eventually lay off workers.8) We argued that cutting the…What do economists mean when they say government purchases are “exhaustive” expenditures whereas government transfer payments are “nonexhaustive” expenditures? Cite an example of a government purchase and a government transfer payment.

- Answer the following questions on fiscal policy: (a) According to data from the Office of National Statistics, in January 2022 the UK public sector spent less than it received in taxes resulting in a primary surplus. Considering that the UK government was previously running a deficit, and assuming that UK GDP growth is higher than the real interest rate paid on the debt, use a phase line to show how the surplus may affect debt accumulation in the UK. (100 words excluding the graph) (b) In the Financial Times article “UK public finances vulnerable to higher inflation, says Sunak” (2 March 2022), we read: “Rishi Sunak[*] warned that the UK economy and public finances were “vulnerable” to higher inflation and interest rates in comments ahead of the spring statement suggesting that tough decisions could be required in the months ahead.” “The [Treasury] committee expressed concern that the government had contributed to the UK’s high rate of inflation which hit by 5.5 per cent in January…Some liken quantitative easing to that of directing a firehose of money to emerging economies that cannot manage the cash, while others worry that the flood of cash has encourages reckless financial behavior. What specific types of "reckless" financial behavior comes from quantitative easing and by whom? Which measure will reduce employment best: government tax reduction, or increased government spending? Can you compare the multiplier effect of a tax reduction versus the multiplier effect of an increase in government spending? There are TWO formulas. Which of the two will have a bigger impact in the economy and why based on the two formulas? Using the formulas, figure this out: If $30 billion in new investment is added to the economy and MPC is 0.9, how much would the national income (GDP) increase by?A short-run AS/AD economy has an AS/AD spending multiplier of 2.0 and an income tax rate of t = 0.3. A budget deficit of 60 dollars can be eliminated if government spending is reduced by ________ dollars. Round your final answer to two decimal places.

- Asap Suppose that Shen, an economist from a research facility in Washington, and Valerie, another economist from an investigative reporting group, are both guests on a popular science podcast. The host of the podcast is facilitating their, debate over budget deficits. The following dialogue represents a portion of the transcript of their discussion: Valerie: Most people recognize that the budget deficit has been rising considerably over the last century. We need to find the best course. of action to remedy this situation. Shen: I believe that a cut in income tax rates would boost economic growth and raise tax revenue enough to reduce budget deficits Valerie: I actually feel that raising the top income tax rate would reduce the budget deficit more effectively. The disagreement between these economists is most likely due to Despite their differences, with which proposition are two economists chosen at random most likely to agree? Business managers can raise profit more easily by…Crowding out occurs when Question 25 options: increased money supply causes private expenditures to fall increased consumption causes private expenditures to fall increased government expenditures causes private expenditures to fall increased taxes causes private expenditures to fallHow do the instances when expansionary fiscal policy should be used compare with those for contractionary fiscal policy? Expansionary fiscal policy should be used during recessions to help build the economy and contractionary fiscal policy should be used when there is high inflation. Expansionary fiscal policy should be used to increase government revenue and contractionary fiscal policy should be used to increase consumer spending. Expansionary fiscal policy should be used to combat high inflation and contractionary fiscal policy should be used to increase government revenue. Expansionary fiscal policy should be used to decrease the unemployment rate and contractionary fiscal policy should be used when economic growth is too fast.

- Suppose that Shen, an economist from a research facility in Washington, and Valerie, another economist from an investigative reporting group, are both guests on a popular science podcast. The host of the podcast is facilitating their, debate over budget deficits. The following dialogue represents a portion of the transcript of their discussion: Valerie: Most people recognize that the budget deficit has been rising considerably over the last century. We need to find the best course. of action to remedy this situation. Shen: I believe that a cut in income tax rates would boost economic growth and raise tax revenue enough to reduce budget deficits Valerie: I actually feel that raising the top income tax rate would reduce the budget deficit more effectively. The disagreement between these economists is most likely due to Despite their differences, with which proposition are two economists chosen at random most likely to agree? Business managers can raise profit more easily by reducing…Is is possible for federal investment to have a negative rate of return? Yes, if the spending results in a strong crowding-out effect or if state and local governments substitute towards federal investment by reducing stateand local investment. Either would potentially reduce future productivity and output (GDP), resulting in a negative return. Yes, if the spending results in a weak crowding-out effect or if state and local investments complement the increase in federal investment by. Either would potentially reduce future productivity and output (GDP) and hence result in a negative return. No. At worst, federal investment can have no future return as the expenditure offered some form of service (ex. jobs training) or useful infrastructure (ex. highways). No. If in the future there were a negative return, the federal government would increase expenditures again to offset it.Can you solve just the last three subparts of the question? (Solve for equilibrium levels of Y, C, and S after the tax cut and check to ensure that the multiplier worked. What arguments are likely to be used in support of such a tax cut? What arguments might be used to oppose such a tax cut?) You guys are the best! <3