4. DivisionD is considering possibi expan Ime al d cost of $8,700,000. Expected annual net cash inflows are $1,625,000, with zero residual value at the end of 10 years. Under Plan B, Division D would begin producing a new product at a cost of $8,240,000. This plan is expected to generate net cash inflows of $1,090,000 per year for 10 estimated useful life of the product line. Estimated residual value for Plan B is $1,100,000. Division D uses straight-line depreciation and requires an annual return of 10%. a. Compute the payback, the ARR, the NPV, and the profitability index for both plans. b. Compute the estimated IRR of Plan A. years, the

4. DivisionD is considering possibi expan Ime al d cost of $8,700,000. Expected annual net cash inflows are $1,625,000, with zero residual value at the end of 10 years. Under Plan B, Division D would begin producing a new product at a cost of $8,240,000. This plan is expected to generate net cash inflows of $1,090,000 per year for 10 estimated useful life of the product line. Estimated residual value for Plan B is $1,100,000. Division D uses straight-line depreciation and requires an annual return of 10%. a. Compute the payback, the ARR, the NPV, and the profitability index for both plans. b. Compute the estimated IRR of Plan A. years, the

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 2P

Related questions

Question

100%

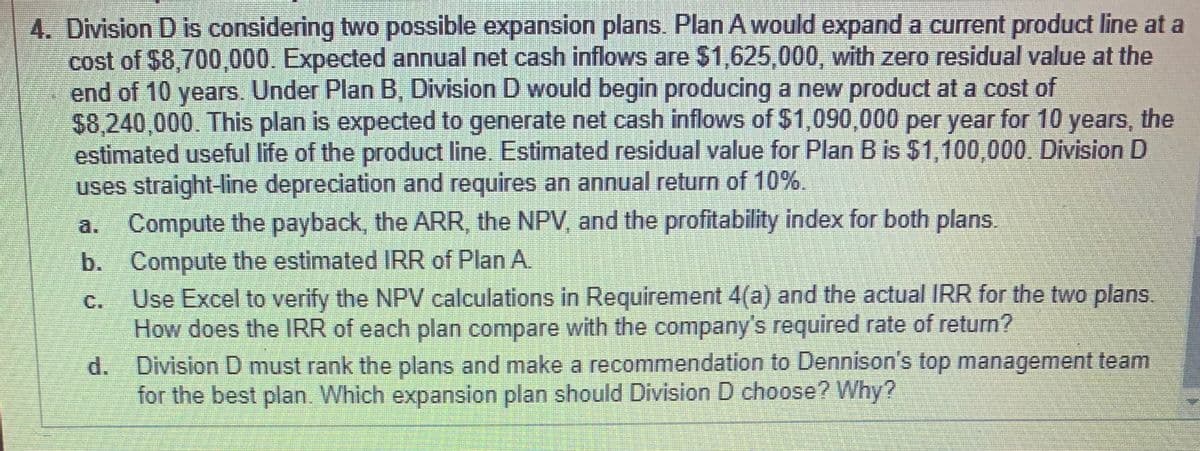

Transcribed Image Text:4. Division D is considering two possible expansion plans. Plan A would expand a current product line at a

cost of $8,700,000. Expected annual net cash inflows are $1,625,000, with zero residual value at the

end of 10 years. Under Plan B, Division D would begin producing a new product at a cost of

$8,240,000. This plan is expected to generate net cash inflows of $1,090,000 per year for 10 years, the

estimated useful life of the product line. Estimated residual value for Plan B is $1,100,000. Division D

uses straight-line depreciation and requires an annual return of 10%.

Compute the payback, the ARR, the NPV, and the profitability index for both plans.

a.

b. Compute the estimated IRR of Plan A

Use Excel to verify the NPV calculations in Requirement 4(a) and the actual IRR for the two plans.

How does the IRR of each plan compare with the company's required rate of return?

d. Division D must rank the plans and make a recommendation to Dennison's top management team

for the best plan. Which expansion plan should Division D choose? Why?

C.

S.

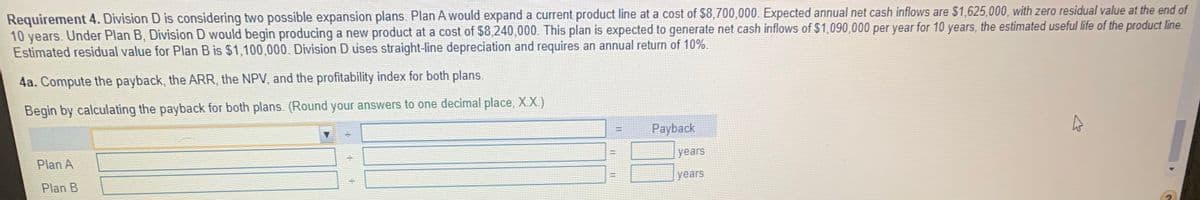

Transcribed Image Text:Requirement 4. Division D is considering two possible expansion plans. Plan A would expand a current product line at a cost of $8,700,000. Expected annual net cash inflows are $1,625,000, with zero residual value at the end of

10 years. Under Plan B, Division D would begin producing a new product at a cost of $8,240,000. This plan is expected to generate net cash inflows of $1,090,000 per year for 10 years, the estimated useful life of the product line.

Estimated residual value for Plan B is $1,100,000. Division D uses straight-line depreciation and requires an annual return of 10%.

4a. Compute the payback, the ARR, the NPV, and the profitability index for both plans.

Begin by calculating the payback for both plans. (Round your answers to one decimal place, XX)

Payback

Plan A

years

Plan B

years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning