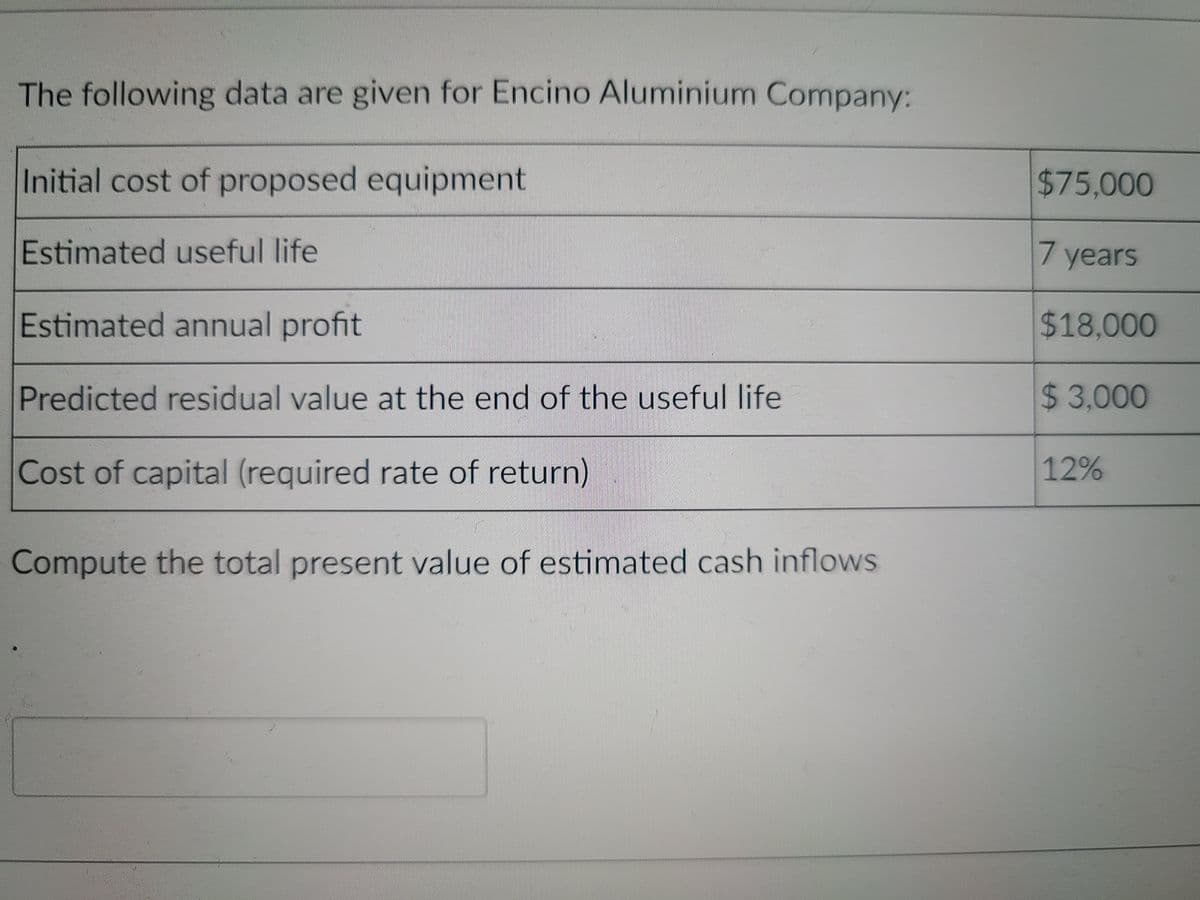

The following data are given for Encino Aluminium Company: Initial cost of proposed equipment $75,000 Estimated useful life 7 years Estimated annual profit $18,000 Predicted residual value at the end of the useful life $ 3,000 Cost of capital (required rate of return) 12% Compute the total present value of estimated cash inflows

The following data are given for Encino Aluminium Company: Initial cost of proposed equipment $75,000 Estimated useful life 7 years Estimated annual profit $18,000 Predicted residual value at the end of the useful life $ 3,000 Cost of capital (required rate of return) 12% Compute the total present value of estimated cash inflows

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.6EX: a. (1) Current year working capital. 1,090,000 Current position analysis The following data were...

Related questions

Question

100%

Transcribed Image Text:The following data are given for Encino Aluminium Company:

Initial cost of proposed equipment

$75,000

Estimated useful life

7 years

Estimated annual profit

$18,000

Predicted residual value at the end of the useful life

$3,000

Cost of capital (required rate of return)

12%

Compute the total present value of estimated cash inflows

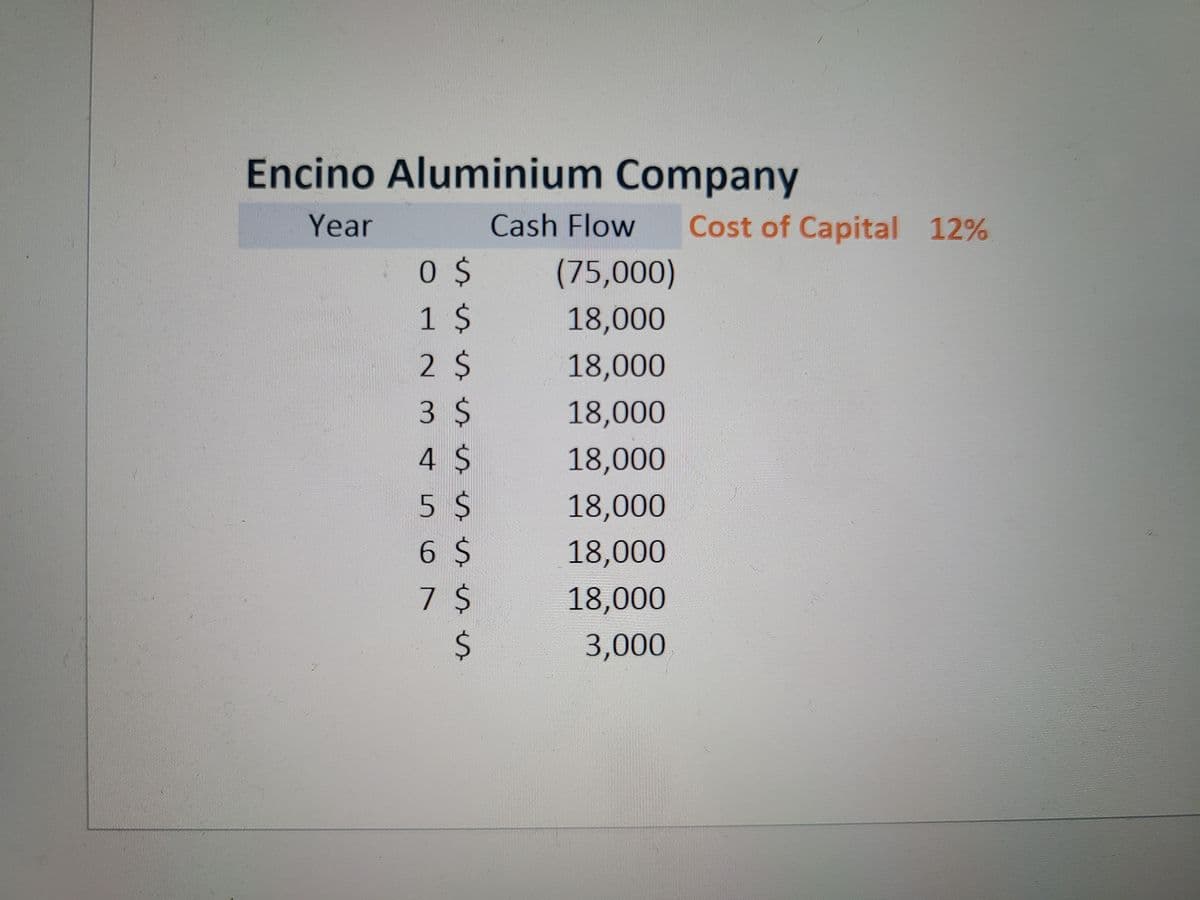

Transcribed Image Text:Encino Aluminium Company

Year

Cash Flow

Cost of Capital 12%

(75,000)

1 $

2 $

3 $

18,000

18,000

18,000

4 $

18,000

5 $

6 $

7 $

18,000

18,000

18,000

24

3,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning