4. During December 20x3, BubBa Ih been a significant decrease in the value of its equipment used in its manufacturing process. At December 31, 20x3, Bubba compiled the information below. Original cost of the equipment Accumulated depreciation Present value of expected net future cash inflows had 500,000 300,000 related to the continued use and eventual disposal of the equipment Fair value less costs of disposal of the equipment 175,000 125,000 What is the amount of impairment loss that should be reported on Bubba's income statement prepared for the ended December 31, 20х3? year

4. During December 20x3, BubBa Ih been a significant decrease in the value of its equipment used in its manufacturing process. At December 31, 20x3, Bubba compiled the information below. Original cost of the equipment Accumulated depreciation Present value of expected net future cash inflows had 500,000 300,000 related to the continued use and eventual disposal of the equipment Fair value less costs of disposal of the equipment 175,000 125,000 What is the amount of impairment loss that should be reported on Bubba's income statement prepared for the ended December 31, 20х3? year

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter7: Fixed Assets, Natural Resources, And Intangible Assets

Section: Chapter Questions

Problem 7.3.4MBA

Related questions

Question

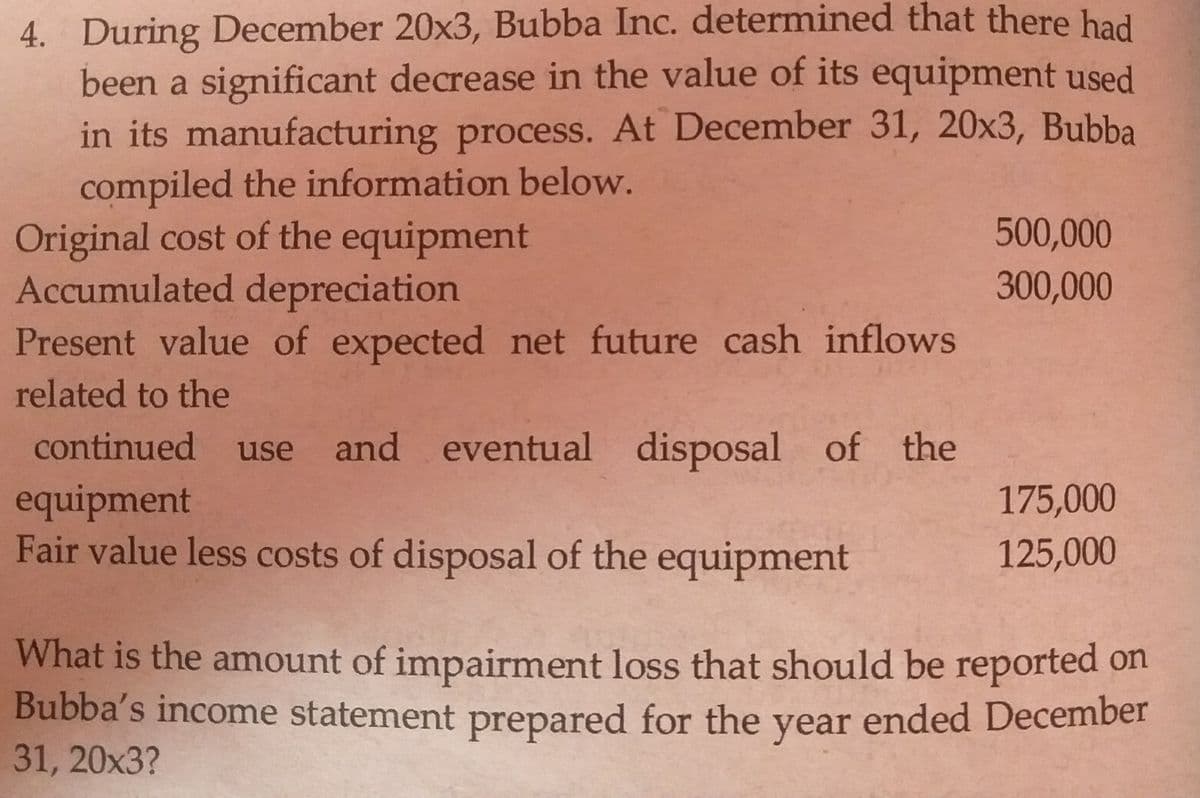

Transcribed Image Text:4. During December 20x3, Bubba Inc. determined that there had

been a significant decrease in the value of its equipment used

in its manufacturing process. At December 31, 20x3, Bubba

compiled the information below.

Original cost of the equipment

Accumulated depreciation

Present value of expected net future cash inflows

500,000

300,000

related to the

continued use and eventual

disposal of the

equipment

Fair value less costs of disposal of the equipment

175,000

125,000

What is the amount of impairment loss that should be reported on

Bubba's income statement prepared for the year ended December

31, 20х3?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning