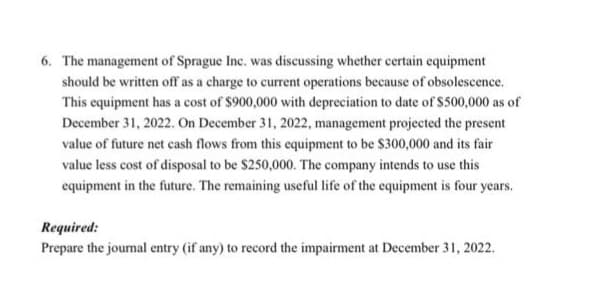

6. The management of Sprague Inc. was discussing whether certain equipment should be written off as a charge to current operations because of obsolescence. This equipment has a cost of $900,000 with depreciation to date of $500,000 as of December 31, 2022. On December 31, 2022, management projected the present value of future net cash flows from this equipment to be $300,000 and its fair value less cost of disposal to be $250,000. The company intends to use this equipment in the future. The remaining useful life of the equipment is four years. Required: Prepare the journal entry (if any) to record the impairment at December 31, 2022.

Q: 5. Journalize and post the adjusting entries using the following information: a. Insurance expired…

A: Adjusting Entry – Adjusting Entries are the entries that make the accrual principle work for the…

Q: The balance sheet of Combinee Company on October 31, Year 5, was as follows: COMBINEE COMPANY…

A: In the context of the given question, we are required to prepare journal entries to records of…

Q: Swift Corporation operates a number of branches in Metro Manila. On June 30, 2011, its San Lorenzo…

A: Reconciliation is an accounting process to check that the figures or amounts of two sets of records…

Q: Assume a company sells a given product for $12 per unit. How many units must be sold to break even…

A: Total variable cost per unit = $3.5 + $0.5 = $4 Contribution per unit= Selling price per unit -…

Q: udmilla Construction Company is composed of two divisions: (1) Home Construction and (2) Commercial…

A: Requirement of above question are answered below

Q: In July 1, 20X1, CBC acquired 25% of the outstanding ordinary shares of Yellow Corp at a total cost…

A: Here discuss about the details of the carrying value of the investment account after the acquisition…

Q: 2) After completion of problem 1 above, change the account balances to their adjusted totals and…

A: Income Statement - The income statement is the statement that shows the income earned during the…

Q: Req 1 Req 2 Req 3 Reg 4 Reg 5A Reg 5B Req 5C Refer to the original data. By automating, the company…

A: Working note :- Particulars Not Automated Automated Total Per unit % Total Per unit %…

Q: Find the present value of the following annuities: 1. 100 at time 1 and increasing by 100 annually…

A: 1. Computation of present value of annuity Year…

Q: Denison Corporation is authorized to issue 10,000, no par value $10 convertible preferred shares and…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: The following were selected from among the transactions completed by Greco Co. during the current…

A: Journal entries are the first recording of any transaction in the books of accounts as per the…

Q: Question 4 Jason works Monday to Friday, from 10:00 AM to 6:00 PM, at $18.54/hour, including 30 min…

A: Hi student Since there are multiple questions, we will answer only first question. Pay of the…

Q: What should be reported as the carrying amount of the disposal group in the entity's accounts after…

A: Option (C) P1,700,000 is correct.

Q: K Company estimates that overhead costs for the next year will be $5,125,000 for indirect labor and…

A: Answer:- Overhead rate meaning:- A cost assigned to the manufacturing of a product or service is…

Q: What is the major difference between a periodic and a perpetual inventory system? Oa. Under the…

A: The question is related to Inventory Management. In Perpetual Inventory system the merchandise…

Q: On the first day of its fiscal year, J Co. issued $1,000,000 of five-year, 8% bonds to finance the…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: Calculate the break-even point in units for a company with multiple products. E6.35 (LO 2, 5) Veejay…

A: The Break-even point indicates that total units are to be sold by the business entity to recover its…

Q: create a monthly budget. Once the budget is established, estimate how much you would be able to save…

A: Monthly budget : Monthly income (Net) = $3000 .....(A) Estimated monthly expense Estimated Cost…

Q: Prepare a closing entries, post-closing trial balance and reversing entries, use your columnar paper…

A: Adjusting Entries: Date Account Title Debit(P) Credit(P) a) Dec 31,2018 Rent Expenses A/c Dr…

Q: On March 1, 2012, Westfield Corporation received an order for parts from a foreign customer at a…

A: Net impact on Westfield's net income for the quarter ended March 31, 2012 :- Fair value of forward…

Q: spose of a component of its business. component was sold on November 30, . Enron's income for 2011…

A: Discontinued of Business Operation: when any firm or company not able to carried out its business…

Q: Coronado Company is considering two alternatives. Alternative A will have revenues of $146,300 and…

A: The difference in revenues and costs between various courses of action is represented by…

Q: On January 1, 20X4, Passive Heating Corporation paid $104,000 for $100,000 par value, 9 percent…

A: A consolidated statement is a combined financial statement of the company and its all subsidiary and…

Q: explain why the author's assessment of the appropriateness of the going concern assumptions is so…

A: Going Concern Assumption- As per the going concern assumption business will continue its…

Q: Taxpayer is the sole owner of the home that she purchased in 2015 and that she and Spouse have lived…

A: The sole owner of the house means that the taxpayer is the only owner of the home. The primary…

Q: Phoenix Company’s 2019 master budget included the following fixed budget report. It is based on an…

A: variable costing income statement are as follows

Q: The Mazzanti Wholesale Food Company's fiscal year-end is June 30. The company issues quarterly…

A: Journalizing - Journalizing refers to the act of recording the exchange of goods in a journal, and…

Q: A theft-avoidance locking system has a first cost of $14,500, an AOC of $13,000, and no salvage…

A: Market Value is the amount which is prevailing in the market. (A/P,10%,3)=0.402115…

Q: 17. Calapan Company provided the data in the table below. In 2011, accounts written off amounted to…

A: Dear Student, Since you have asked multiple questions, we will solve the first question for you, if…

Q: Calculate break-even point and sales required to earn target operating income in dollars. E6.20 (LO…

A: Given, Selling price per copy= $ 250 Variable cost per copy= $ 50 Fixed cost= $ 450,000 copies to be…

Q: Cadbury Limited has a public traded debt (debentures) with a face value of R3 million. The coupon…

A: Present value of the amount of debenture to be paid on maturity date. Present value of interest…

Q: Omicron plc prepares financial statements to 31 December each year. On 1 January 2021, Omicron plc…

A: Here discuss about the details of the contract which are made by the company to sell the product…

Q: According to IFRS, which accounting policy may an entity apply to measure investment property in…

A: Investment property means any land or building which is neither held for sale nor for the purpose of…

Q: Lina purchased a new car for use in her business during 2021. The auto was the only business asset…

A: Depreciation is an accounting technique for distributing a tangible or fixed asset's cost over its…

Q: Cost of merchandise sold reported on the income statement was $263000. The accounts payable balance…

A: The value of products sold by a jobber or merchant is noted because the cost of merchandise sold .…

Q: 3. Compute for the following: Required: Payback period, payback reciprocal, accounting rate of…

A: Payback period is the period which indicate in how much time initial investment comes back to the…

Q: Instructions: Compute for each of the items enumerated below. Number of preference shares issued for…

A: 1) Number of Preference Shares issued for cash = ( Total Number of Preference Shares - Total Number…

Q: Them Company has a single investment property, which had original cost of P5,800,000 and estimated…

A: In case of Fair value model, assets is measured at fair value and any change in fair value during…

Q: The declaration, record, and payment dates in connection with a cash dividend of $108,000 on a…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: One of our client companies, EA Community Laundry Chain, asked us for a consultation on their…

A: Net Income- The balance left over after subtracting the cost of products sold and expenses from a…

Q: The League Corporation is authorized to issue 100,000 shares of Ordinary Share Capital with a par…

A: Journal Entry :- The purpose of preparing the journal entry to segregate the transaction which are…

Q: Analyze the truth of this statement: For an investment greater than 50%, the financial statements…

A: Introduction: When an investor company invests more than 50% of voting shares of the investee…

Q: Which of the following journal entries correctly reflect settlement date accounting? Select one: a.…

A: In case of settlement accounting, transactions have to be recorded in the books of accounts of the…

Q: 3. Compute for the following: Required: Payback period, payback reciprocal, accounting rate of…

A: Comment; Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: 1.A manager has determined that a potential new product can be sold at a price of 10.00 each. The…

A: Formulas: Break even point: =Fixed costs / Contribution per unit Variable cost: =Selling price -…

Q: q23 Which of the following is not a requirement for the recognition of an intangible asset? Select…

A: An assets which does not have any physical existence or substance and are non-monetary in nature are…

Q: Beech Corporation is a merchandising company that is preparing a master budget for the third quarter…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Branwin Corporation sold 7,200 units of its product at a price of $35.60 per unit. Total variable…

A: Contribution Margin - The contribution margin is the difference between sales and variable costs. It…

Q: G. Shown below are account balances found in the ledger of Honesty Corporation at the end of year…

A: Disclaimer: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: On September 1, a company established a petty cash fund of $120. On September 10, the petty cash…

A: Petty cash: Petty cash fund is established to manage the payment for the small business expenditure…

Step by step

Solved in 2 steps

- Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.The management of Petro Garcia Inc. was discussing whether certain equipment should be written off as a charge to current operations because of obsolescence. This equipment has a cost of $900,000 with depreciation to date of $400,000 as of December 31, 2020. On December 31, 2020, management projected its future net cash flows from this equipment to be $300,000 and its fair value to be $230,000. The company intends to use this equipment in the future. d. What accounting issues did management face in accounting for this impairment?The management of Petro Garcia Inc. was discussing whether certain equipment should be written off as a charge to current operations because of obsolescence. This equipment has a cost of $900,000 with depreciation to date of $400,000 as of December 31, 2020. On December 31, 2020, management projected its future net cash flows from this equipment to be $300,000 and its fair value to be $230,000. The company intends to use this equipment in the future. Where should the gain or loss (if any) on the write-down be reported in the income statement?

- The management of Petro Garcia Inc. was discussing whether certain equipment should be written off as a charge to current operations because of obsolescence. This equipment has a cost of $900,000 with depreciation to date of $400,000 as of December 31, 2020. On December 31, 2020, management projected its future net cash flows from this equipment to be $300,000 and its fair value to be $230,000. The company intends to use this equipment in the future. Instructions a. Prepare the journal entry (if any) to record the impairment at December 31, 2020. b. Where should the gain or loss (if any) on the write-down be reported in the income statement? c. At December 31, 2021, the equipment’s fair value increased to $260,000. Prepare the journal entry (if any) to record this increase in fair value. d. What accounting issues did management face in accounting for this impairment?The management of Petro Garcia Inc. was discussing whether certain equipment should be written off as a charge to current operations because of obsolescence. This equipment has a cost of $900,000 with depreciation to date of $400,000 as of December 31, 2020. On December 31, 2020, management projected its future net cash flows from this equipment to be $300,000 and its fair value to be $230,000. The company intends to use this equipment in the future. Prepare the journal entry (if any) to record the impairment at December 31, 2020.Refer to the situation described in BE 11–16. Assume that SCC’s fair value of $40 million approximates fairvalue less costs to sell and that the present value of SCC’s estimated future cash flows is $41 million. If WebHelper prepares its financial statements according to IFRS and SCC is considered a cash-generating unit, whatamount of impairment loss, if any, should WebHelper recognize?

- Toro Co. has equipment with a carrying amount of$700,000. The expected future net cash flows from theequipment are $705,000, and its fair value is $590,000.The equipment is expected to be used in operations inthe future. What amount (if any) should Toro report asan impairment to its equipment?4. YOU CAN DO IT Corporation has equipment with a carrying value of 450,000 on December 31, 2021. The following information was available on December 31, 2021: · Expected net cash flows (undiscounted)- P420,000 · Expected net cash flows discounted at 7%- P400,000 · Fair value, using the assets with other assets- P415,000 · Fair value, assuming the assets are sold stand-alone- P428,000 What is the impairment loss that the Company must report in its 2021 income statement for this equipment? CHOICES: P30,000 P35,000 P22,000 P50,000Swifty Corporation has equipment with a carrying amount of $2540000. The expected future net cash flows from the equipment are $2575000, and its fair value is $2049000. The equipment is expected to be used in operations in the future. What amount (if any) should Swifty report as an impairment to its equipment? $35000. $491000. $526000. No impairment should be reported.

- On January 1, 2021, Bambi Ltd. purchased equipment for $728,000. The equipment was assumed to have an 8-year useful life and no residual value and was to be depreciated using the straight-line method. On January 1, 2023, Bambi's management became concernedthat the equipment may have become obsolete. Management calculated that the undiscounted future net cash flows from the equipment was $523,250, the discounted future net cash flows was $464,100, and the current fair value of the equipment less cost ofdisposal (of $1,800 ) was $455,000. (a)Assuming that Bambi is a private Canadian company following ASPE, identify which model should be used to test for impairment. b) Record the journal entry to record the impairment loss, if any. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and…On January 1, 2021, Bambi Ltd. purchased equipment for $728,000. The equipment was assumed to have an 8-year useful life and no residual value and was to be depreciated using the straight-line method. On January 1, 2023, Bambi's management became concernedthat the equipment may have become obsolete. Management calculated that the undiscounted future net cash flows from the equipment was $523,250, the discounted future net cash flows was $464,100, and the current fair value of the equipment less cost ofdisposal (of $1,800 ) was $455,000. c) Assuming that Bambi is a public Canadian company, identify which model should be used to test for impairment. d) Record the journal entry to record the impairment loss, if any. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit…On January 1, 2022, the Vallahara Company purchased machinery for P 650,000 which it installed in a rented factory. It is depreciating the machinery over 12 years by the straight-line method to a residual value of P 50,000. Late in 2026, because of increasing competition in the industry, the company believes that its asset may be impaired and will have a remaining useful life of five years, over which it estimates the asset will produce total cash inflows of P 1,000,000 and will incur total cash outflows of P 825,000. The cash flows are independent of the company's other activities and will occur evenly each year. The company is not able to determine the fair value based on a current selling price of the machinery. The company's discount rate is 10%. Required 1. Prepare schedules to determine whether, at the end of 2026, the machinery is impaired and, if so, the impairment loss to be recognized. 2. If the machinery is impaired, prepare the journal entry to record the impairment.…