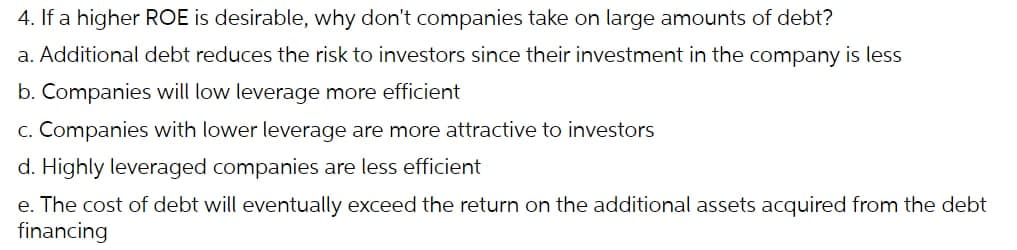

4. If a higher ROE is desirable, why don't companies take on large amounts of debt? a. Additional debt reduces the risk to investors since their investment in the company is less b. Companies will low leverage more efficient c. Companies with lower leverage are more attractive to investors d. Highly leveraged companies are less efficient e. The cost of debt will eventually exceed the return on the additional assets acquired from the debt financing

Q: Manly Inc. has 50,000shares of 5% cumulative preference shares 50 par and 100,000 ordinary shares…

A: Earnings per share is the amount which is received by the shareholders in consideration to the…

Q: Using the folowing information, prepare a bank recorciliation. • Bank balance: $4,687 • Book…

A: Introduction: BRS: BRS stands for Bank Reconciliation statement. To reconcile the difference between…

Q: Cost of Goods Sold Budget Play-Disc makes Frisbee-type plastic discs. Each 12-inch diameter plastic…

A: Direct costs of manufacturing includes cost of direct materials and direct labour which is to be…

Q: 1. In 2022, a corporation earns $65,000 from its business operations and has $10,000 of dividend…

A: Taxable income means the base income on which the tax would be levied and it involves some or all of…

Q: Juliet Company is in the business for leasing new sophisticated equipment. As lessor, Juliet Company…

A: Following information are summarized for calculation of required information: Commencement of lease…

Q: Clyde Corp is considering the purchase of a new piece of equipment. The cost savings from the…

A: Following formula used for answering above questions: Accounting rate of return = Annual Income /…

Q: Operating Budget, Comprehensive Analysis Ponderosa, Inc., produces wiring harness assemblies used…

A: The direct materials budget is prepared to estimate the raw materials required during the period and…

Q: Question Content Area Operating Budget, Comprehensive Analysis Ponderosa, Inc., produces wiring…

A: Budget is set by companies annually, It is related to incomes and expenditures of the company, It is…

Q: Dexter Industries purchased packaging equipment on January 8 for $116,600. The equipment was…

A: Introduction: Depreciation occurs when assets lose value over time until the asset's worth is zero…

Q: Alice, Melvyn and Lorely are partners with capital balances of P100,800; P162,000 and P57,000…

A: Partnership

Q: Weekend Warriors, Inc., has 35% debt and 65% equity in its capital structure. The firm’s estimated…

A: Weighted average cost of capital is the overall cost of capital. It is calculating by multiplying…

Q: Please prepare a bank reconciliation and journal entries for the month ended April 30th for Bannon…

A: The bank reconciliation statement is prepared to adjust the balances of cash book and pass book with…

Q: Balance per bank.... .$14,500 Balance per company records..... .13,875 Bank service charges.. 75…

A: Introduction: Bank Reconciliation statement: To reconcile the differences between bank book and cash…

Q: Williams Company sells women’s hats for $12 each. Actual and budgeted sales in units for nine months…

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. %…

Q: Activity-base usage data for each line of insurance were retrieved from the corporate records and…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Reggie Wilmore has just started a new business—building and installing custom garage organization…

A: The overhead rate is determined by dividing the total indirect expenditures (also known as overhead)…

Q: 3. A component auditor, which is a different accounting firm, may audit a component or subsidiary of…

A: Since you have posted multiple questions, as per answering guidelines we shall be solving first…

Q: The company's accounts receivable to 500,000. Prepaid Expenses and unearned income are 30,000 and…

A: Introduction: Balance sheet: All Assets and liabilities are to be shown in Balance sheet. It tells…

Q: On June 30, 2017 Naruto Company sold to Sasuke Company P1,000,000, 8% 5 year term bonds. The bonds…

A: Carrying value of the bonds on December 31, 2017 = Issue price + Interest accrued - Interest paid

Q: On 1 July 2021, Sydney Ltd issued a prospectus inviting applications for 400,000 ordinary shares, at…

A: Shareholder equity means the amount that belong to the owner of the company i.e. share holder.…

Q: not wish to commit to a renta d contribute $178,000 per mo , what is the net amount of C

A: The answer has been mentioned below.

Q: Larner Corporation is a diversified manufacturer of industrial goods. The company's activity-based…

A: Under Activity based costing manufacturing overhead costs are first allocated to Activity Cost…

Q: What is the total Tease liability (principal and interest) which Darwin Company should recognized in…

A: The fair value of the machinery was 4900000 as on January 1, 2020. Annual rental payment on January…

Q: n, in roper soid, and gross profit for the year ended December 31, 2020 using the data. Write your…

A: Solution: Gross profit = Net Sales - Cost of goods sold Net Sales = Gross sales - Sales returns and…

Q: In preparation for developing its statement of cash flows for the year ended December 31, 2021,…

A: Cash flow from Financing activities includes the transactions relating to the loan/debt,…

Q: Leni Co. acquired all of BBM Co's assets and liabilities on October 2, 2021. BBM reported assets…

A:

Q: INMANAC: Accounting Records and Systems Illustrative Problem: Computer King Company Balance Sheet…

A: 1. Income Statement 2. Balance Sheet The first statement shows the income earned and loss incurred…

Q: P11-11B (LO2,3) (Depreciation for Partial Periods–SL, Act., SYD, and DDB) On January 1, 2014, a…

A: 1. Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of…

Q: for 5 years. Sale price at fair value 20,000,000 Carrying amount of building 24,000,000 Annual…

A: Cost of the right use of assets refers to the right of a lessee to utilize the asset till the life…

Q: Zorzi Corporation purchased a Machine on January 1, 2017 for $80,000. The machinery is estirnated to…

A: Formula used: Depreciation rate = ( 100 / Useful life years ) x 2

Q: Notting Hill Hospital needs to expand its facilities and desires to obtain a new building on a piece…

A: GIVEN Notting Hill Hospital needs to expand its facilities and desires to obtain a new building…

Q: 1.1. Nhyiraba Limited lease a building worth R4 million to Quintin Limited under an operating lease…

A: Investment Property: It is property (land or a building or part of a building or both) held (by the…

Q: ABC Co established a petty cash fund of P40,000. Fund disbursements during the period was P27,363.…

A: At the end of the period, petty cash fund should stand at P40,000.

Q: At the end of the year, Mercy Cosmetics' balance of Allowance for Uncollectible Accounts is $440…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Operating Budget, Comprehensive Analysis Ponderosa, Inc., produces wiring harness assemblies used…

A: The sales budget is prepared to estimate the number of units to be sold and revenue to earned during…

Q: Cost of Goods Sold Budget Play-Disc makes Frisbee-type plastic discs. Each 12-inch diameter plastic…

A: Total budgeted manufacturing cost=Budgeted direct materials+Budgeted direct labor+Budgeted overhead

Q: On the first day of its fiscal year, Chin Company issued $21,300,000 of five-year, 4% bonds to…

A: Interest expense= Issue value of the Bonds x market interest rate x no. of months / 12 Interest…

Q: On January 1, 2021, the start of the current financial year, Tubble Ltd had in issue 36 million…

A: 1. Determination of Journal entries to record issue of bonus shares Date Account title and…

Q: Problem IV (113) - Entries for bonds payable. Prepare the necessary journal entries to record the…

A: The bonds are long-term liabilities because the payment of liability is to be made in more than a…

Q: Cash P 84,000 Accounts Receivable 48,000 Accrued Service Income 13,000 Prepaid Expenses 18,000…

A: Current assets: Assets that are expected to be sold or used within one year are classified as…

Q: Cash Payments for Merchandise—Direct Method Cost of merchandise sold reported on the income…

A: Cash Payments for Merchandise—Direct Method = Cost of merchandise sold +accounts payable balance…

Q: Given the information below, using the discounted cash flow method to determine the market value of…

A:

Q: Njabulo is a 72 year old accountant at an accounting firm.He earns a taxable income of R58 470 per…

A: Monthly salary is the amount, which a person get after one month of hard work and dedication, at the…

Q: On January 1, 2023, Jones Corporation issued $2.982.000, 9%, 5- year bonds with interest payable on…

A: Interest expense is computed on issue price of bond and interest rate that should be used for…

Q: Business transaction analysis 1. Paid loan payables amounting to 15,000 2. Bought office supplies on…

A: The journal entries are prepared to record day to day transactions of the business on regular basis…

Q: Delray Leasing Company signs an agreement on January 1, 2020, to lease equipment to Swifty Company.…

A: Introduction Lease is an agreement between leaser and lessee in which leaser allows lessee to use…

Q: Quantity (Product X) - 1,200.00 Quantity (Product Y) - 1,800.00 Purchase cost per unit (Product X) -…

A: Cost of goos sold include all direct cost of production such as direct material cost, direct labour…

Q: Beta Limited has an operating gearing of 3. If activity increases by 10% the profit of the business…

A: Change in profit = Change in sales x Operating gearing ratio

Q: Present Value Computation You will receive $2,500 in 3 years. What is the present value if you can…

A: The present is today's value of a money to in future. It is calculated by discounting the amount to…

Q: 15-Assume that your senior manager provided you the following data to find out the breakeven point…

A: Introduction: Break even point in sales units: The level where there is no profit nor loss to the…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Which of the following is a valid reason for a firm not to use as much debt as it can raise? Group of answer choices The use of more debt is expected to result in an increase in the firmʹs cost of capital when everything is considered More debt will increase the firmʹs riskiness All of them are valid reasons for a firm to use less debt than might be available The use of more debt is expected to result in a lower price/earnings ratioThere are advantages and disadvantages of debt financing in contrast to equity financing. Which of the following is less likely to represent an advantage of debt financing? a. The cost of debt should be lower than the cost of equity for most companies due to the lower risk to the lender and the tax deductibility of interest b. The repayment of debt capital may affect the liquidity of the company c. If the return on assets exceeds the cost of debt, then this will result in a higher return on shareholders’ funds as compared to the return on assets d. The increase in borrowings will not normally affect the voting control of the current shareholders as compared to the issue of shares e. Fixed interest rate loans will result in the variability in the market value of such loans over time which will normally be less than the variability in the value of the equity of the companyAn analyst at a company notes that its cost of debt is far below that of equity. He concludes that it is important for the firm to maintain the ability to increase its borrowing because if it cannot borrow, it will be forced to use more expensive equity to finance some projects. This might lead it to reject some projects that would have seemed attractive if evaluated at the lower cost of debt. How do you balance the amount of equity and debt? Explain the significance of maintaining the ability to increase borrowing capacity for a company with a lower cost of debt compared to equity. How does this impact project evaluation and investment decisions, and what role does the concept of cost of capital play in such considerations?

- Which of the following statements is FALSE? As debt increases, the risk associated with bankruptcy and agency costs is reduced. Debt is often the least costly form of financing for a firm. Firms should probably use some debt in their capital structure. Different firms are subject to different levels of risk.Regarding the EPS fallacy, which of the following statements is correct: a. When a company issues debt and uses all the proceeds to buy back equity and as a result EPS rises, the fact that some analysts associate the rise of EPS to an improvement in the company's performance is called the EPS fallacy. b. All given statements are correct. c. One of the reasons behind the EPS fallacy is not to take into account that when EPS rises mechanically due to a leveraged recapitalisation, the cost of equity also rises in the same proportion and the share price does not change (assume no taxes and perfect capital markets world). d. Suppose companies A and B have identical cash flows but different capital structures. Suppose further that EPS(A) > EPS(B). We cannot conclude that A has a better performance than B.Which statement is most correct? * A. Since debt financing raises the firm’s financial risk, increasing debt ratio will increase WACC. B. Since debt financing is cheaper than equity financing, increasing debt ratio will reduce WACC. C. Increasing a firm’s debt ratio will typically reduce the marginal costs of both debt and equity financing; however, it still may raise the firm’s WACC. D. Statements a and c are correct. E. None of the above

- If we drop the assumption that there are no information and transaction costs, in addition to dropping the no-tax assumption, then the Modigliani and Miller model suggests: Companies will not always increase their use of debt. Capital structure has no impact on companies’ value Capital structure has impact on companies’ cost of capital Companies will always increase their use of debt.Please explain if a company has already taken too much debt (exceeded the amount that they can borrow) but has strong equity value, can this company be a leverage buyout (LBO) target? Please reply. Thanks.Which of the following statements are incorrect regarding how much debt a company should borrow? Choose all that apply. Question 9 options: A As long as the company can generate higher returns on its new projects than its borrowing interest rate, borrowing more debt will enhance the company's ROE. B Borrowing more debt will increase a company's distress level. C The bigger the company, the more it should borrow D Debt is considered a more expensive capital source.

- For each statement indicate whether it is true or false and briefly explain why. a) In a perfect capital market with no corporate taxes, as a firm takes on more and more debt its weighted average cost of capital remains unchanged while its required return on equity rises. b) If a firm issues riskfree debt the risk of the firm’s equity will not change. So, risk-free debt allows the firm to get the benefit of a low cost of debt without raising its cost of equity. c) In the context of firms’ capital structure decisions, the theory predicts that the value of a firm’s equity will rise in direct proportion to the level of debt in its capital structure.A company will prefer debt in its capital structure, if (tick the most appropriate alternative) (a) It wants to dilute control (b) Stock market conditions are bullish (c) Tax rates are high (d) It has already used its debt potential to the full.Which statement about capital structure is the most correct? a. The more the company borrows, the lower will be the after-tax WACC. This increases the present value of the firm free cash flows which represents the value of the levered firm. Therefore, a firm should always seek to borrow as much debt as possible. b. The more the company borrows, the higher will be its tax shields, therefore a company will always prefer to issue debt than equity. c. Because the cost of debt is cheaper than the cost of equity, a company should use as much debt as possible to finance their projects d. Lenders rank ahead of shareholders when the company goes bankrupt. This increased risk for shareholders means the cost of equity is higher than the cost of debt. e. A company should always try to reduce its debt because of the high bankruptcy risk associated with debt. A company should aim to have 100% equity financing if it is possible.