4. If the Government Spending Multiplier is 3, the value of the Tax Multiplier is 5. If taxes decrease by $300Billion and the MPC = 8, the increase in Real GDP will be 6. If taxes decrease by $350 Billion and the MPC = .75, the increase in Real GDP will be ? There's a page 2

4. If the Government Spending Multiplier is 3, the value of the Tax Multiplier is 5. If taxes decrease by $300Billion and the MPC = 8, the increase in Real GDP will be 6. If taxes decrease by $350 Billion and the MPC = .75, the increase in Real GDP will be ? There's a page 2

Chapter11: Fiscal Policy

Section: Chapter Questions

Problem 1.6P

Related questions

Question

4-5-6

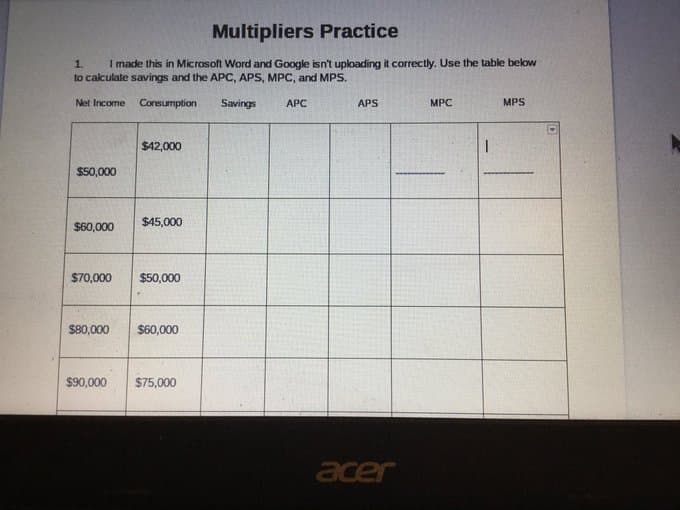

Transcribed Image Text:Multipliers Practice

I made this in Microsoft Word and Google isn't uploading it correctly. Use the table below

1.

to calculate savings and the APC, APS, MPC, and MPS.

Net Income

Consumption

Savings

APC

APS

MPC

MPS

$42,000

$50,000

$45,000

$60,000

$70,000

$50,000

$80,000

$60,000

$90,000

$75,000

acer

Transcribed Image Text:Edit View Insert Format Tools Add-ons Help

Last edit was seconds ago

+ BI UA .

E - I E

100%

Normal text

Arlal

11

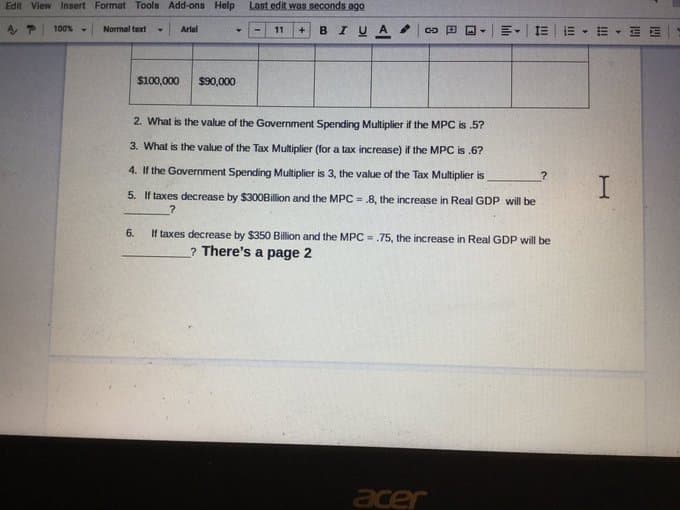

$100,000

$90,000

2. What is the value of the Government Spending Multiplier if the MPC is .5?

3. What is the value of the Tax Multiplier (for a tax increase) if the MPC is .6?

4. If the Government Spending Multiplier is 3, the value of the Tax Multiplier is

5. If taxes decrease by $300Billion and the MPC = .8, the increase in Real GDP will be

6.

If taxes decrease by $350 Billion and the MPC = .75, the increase in Real GDP will be

? There's a page 2

acer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you