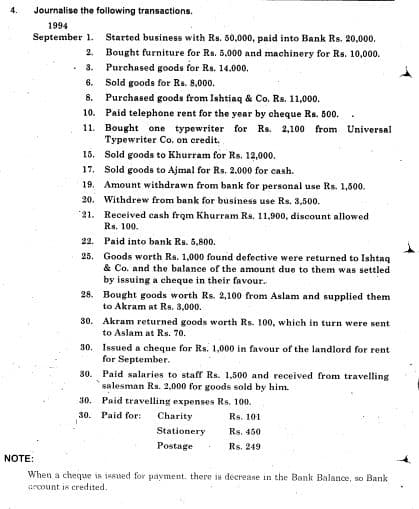

4. Journalise the following transactions. 1994 September 1. Started business with Rs. 50,000, paid into Bank Rs. 20,000. 2. Bought furniture for Rs. 5,000 and machinery for Rs. 10,000. • 3. Purchased goods for Rs. 14.000. 6. Sold goods for Rs. 8,000. 8. Purchased goods from Ishtiaq & Co. Rs. 11,000. 10. Paid telephone rent for the year by cheque Rs. 500. 11. Bought one typewriter for Rs. 2,100 from Universal Typewriter Co. on credit. 15. Sold goods to Khurram for Rs. 12,000. 17. Sold goods to Ajmal for Rs. 2.000 for cash. 19. Amount withdrawn from bank for personal use Rs. 1,500. 20. Withdrew from bank for business use Rs. 3,500. 21. Received cash from Khurram Rs. 11,900, discount allowed Rs. 100. 22. Paid into bank Rs. 5,800. 25. Goods worth Rs. 1,000 found defective were returned to Ishtag & Co. and the balance of the amount due to them was settled by issuing a cheque in their favour. 28. Bought goods worth Rs. 2,100 from Aslam and supplied them to Akram at Rs. 3,000. 30. Akram returned goods worth Rs. 100, which in turn were sent to Aslam at Rs. 70. 30. Issued a cheque for Rs. 1,000 in favour of the landlord for rent for September. 30. Paid salaries to staff Rs. 1,500 and received from travelling salesman Rs. 2,000 for goods sold by him. 30. Paid travelling expenses Rs. 100. 30. Paid for: Charity Rs. 101 Rs. 450 Stationery Postage Rs. 249 NOTE: When a cheque is issued for payment. there is decrease in the Bank Balance, so Bank arcount is credited.

4. Journalise the following transactions. 1994 September 1. Started business with Rs. 50,000, paid into Bank Rs. 20,000. 2. Bought furniture for Rs. 5,000 and machinery for Rs. 10,000. • 3. Purchased goods for Rs. 14.000. 6. Sold goods for Rs. 8,000. 8. Purchased goods from Ishtiaq & Co. Rs. 11,000. 10. Paid telephone rent for the year by cheque Rs. 500. 11. Bought one typewriter for Rs. 2,100 from Universal Typewriter Co. on credit. 15. Sold goods to Khurram for Rs. 12,000. 17. Sold goods to Ajmal for Rs. 2.000 for cash. 19. Amount withdrawn from bank for personal use Rs. 1,500. 20. Withdrew from bank for business use Rs. 3,500. 21. Received cash from Khurram Rs. 11,900, discount allowed Rs. 100. 22. Paid into bank Rs. 5,800. 25. Goods worth Rs. 1,000 found defective were returned to Ishtag & Co. and the balance of the amount due to them was settled by issuing a cheque in their favour. 28. Bought goods worth Rs. 2,100 from Aslam and supplied them to Akram at Rs. 3,000. 30. Akram returned goods worth Rs. 100, which in turn were sent to Aslam at Rs. 70. 30. Issued a cheque for Rs. 1,000 in favour of the landlord for rent for September. 30. Paid salaries to staff Rs. 1,500 and received from travelling salesman Rs. 2,000 for goods sold by him. 30. Paid travelling expenses Rs. 100. 30. Paid for: Charity Rs. 101 Rs. 450 Stationery Postage Rs. 249 NOTE: When a cheque is issued for payment. there is decrease in the Bank Balance, so Bank arcount is credited.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter3: Journalizing Transactions

Section: Chapter Questions

Problem 4.1AP

Related questions

Question

Transcribed Image Text:4.

Journalise the following transactions.

1994

September 1.

Started business with Rs. 50,000, paid into Bank Rs. 20,000.

2. Bought furniture for Rs. 5,000 and machinery for Rs. 10,000.

• 3.

Purchased goods for Rs. 14.000.

6.

Sold goods for Rs. 8,000.

8.

Purchased goods from Ishtiaq & Co. Rs. 11,000.

10. Paid telephone rent for the year by cheque Rs. 500.

11. Bought one typewriter for Rs. 2,100 from Universal

Typewriter Co. on credit.

15. Sold goods to Khurram for Rs. 12,000.

17. Sold goods to Ajmal for Rs. 2.000 for cash.

19. Amount withdrawn from bank for personal use Rs. 1,500.

20. Withdrew from bank for business use Rs. 3,500.

21. Received cash from Khurram Rs. 11,900, discount allowed

Rs. 100.

22. Paid into bank Rs. 5,800.

25. Goods worth Rs. 1,000 found defective were returned to Ishtag

& Co. and the balance of the amount due to them was settled

by issuing a cheque in their favour.

28. Bought goods worth Rs. 2,100 from Aslam and supplied them

to Akram at Rs. 3,000.

30. Akram returned goods worth Rs. 100, which in turn were sent

to Aslam at Rs. 70.

30. Issued a cheque for Rs. 1,000 in favour of the landlord for rent

for September.

30. Paid salaries to staff Rs. 1,500 and received from travelling

salesman Rs. 2,000 for goods sold by him.

30. Paid travelling expenses Rs. 100.

30.

Paid for:

Charity

Rs. 101

Rs. 450

Stationery

Postage

Rs. 249

NOTE:

When a cheque is issued for payment. there is decrease in the Bank Balance, so Bank

arcount is credited.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning