Concept explainers

Analyzing the Accounts

The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year:

a. Purchased supplies on credit, $18,600

b. Paid $14,800 cash toward the purchase in Transaction a

c. Provided services to customers on credit1 $46,925

d. Collected $39,650 cash from accounts receivable

e. Recorded

f. Employee salaries accrued, $15,650

g. Paid $15,650 cash to employees for salaries earned

h. Accrued interest expense on long-term debt, $1,950

i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h

j. Paid $2,220 cash for l year’s insurance coverage in advance

k. Recognized insurance expense, $1,340, that was paid in a previous period

l. Sold equipment with a book value of $7,500 for $7,500 cash

m. Declared cash dividend, $12,000

n. Paid cash dividend declared in Transaction m

o. Purchased new equipment for $28,300 cash.

p. Issued common stock for $60,000 cash

q. Used $10,700 of supplies to produce revenues

Summit Sales uses the indirect method to prepare its statement of

Required:

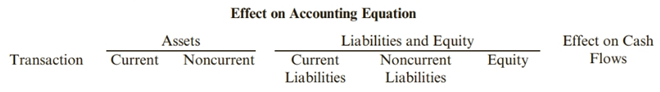

1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental

2. Indicate whether each transaction results in a

3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.

(a)

Concept introduction:

Cash flow statement shows inflow and outflow of cash and it is divided into three categories, i.e., operating, investing and financing activities. It is also known as statement of cash flows.

To construct:

A table and to indicate the effect of each transaction on the financial accounts in terms of cash inflow and cash outflow.

Answer to Problem 38E

The table is constructed providing the effect in the accounts due to each transaction by giving

Explanation of Solution

Table showing the effect of each transaction on the financial accounts:

| Assets |

Liabilities and Equity |

||||

| Transactions | Current | Non-Current | Current | Non-Current | Equity |

| Purchased supplies on credit, |

|||||

| Paid |

|||||

| Provided services to customer on credit, |

|||||

| Collected |

|||||

| Record Depreciation expense, |

|||||

| Employee salary accrued, |

|||||

| Paid |

|||||

| Accrues Interest expense on long-term debt, |

|||||

| Paid a total of |

|||||

| Paid |

|||||

| Recognised insurance expense, |

|||||

| Sold equipment with a book value of |

|||||

| Declared cash dividend, |

|||||

| Paid cash dividend declared in above | |||||

| Purchased new equipment for |

|||||

| Issued common stock for |

|||||

| Used |

|||||

(b)

Concept introduction:

Cash flow statement shows inflow and outflow of cash and it is divided into three categories, i.e., operating, investing and financing activities. Itis also known as statement of cash flows.

To construct:

A table and indicate the effect of each transaction on the financial accounts in terms of cash inflow and cash outflow.

Answer to Problem 38E

The table is constructed providing the effect in the accounts due to each transaction in terms of cash inflow and cash outflow.

Explanation of Solution

Table showing the effect of each transaction on the financial accounts:

| Transactions | Cash Flow |

| Purchased supplies on credit, |

None |

| Paid |

|

| Provided services to customer on credit, |

None |

| Collected |

|

| Record Depreciation expense, |

None |

| Employee salary accrued, |

None |

| Paid |

|

| Accrued Interest expense on long-term debt, |

None |

| Paid a total of |

|

| Paid |

|

| Recognised insurance expense, |

None |

| Sold equipment with a book value of |

|

| Declared cash dividend, |

None |

| Paid cash dividend declared in above | |

| Purchased new equipment for |

|

| Issued common stock for |

|

| Used |

None |

(c)

Concept introduction:

Cash flow statement shows inflow and outflow of cash and it is divided into three categories, i.e., operating, investing and financing activities. Itis also known as statement of cash flows.

To construct:

A table and indicate the effect of each transaction on the financial accounts in terms of cash inflow and cash outflow.

Answer to Problem 38E

The table is constructed providing the classification of each transaction on the financial accounts in terms of cash flow from operating, investing and financing activities.

Explanation of Solution

Table showing the classification of each transaction on the financial accounts:

| Transactions | Classification |

| Purchased supplies on credit, |

Non-cash activity |

| Paid |

Operating activity |

| Provided services to customer on credit, |

Non-cash activity |

| Collected |

Operating activity |

| Record Depreciation expense, |

Non-cash activity |

| Employee salary accrued, |

Non-cash activity |

| Paid |

Operating activity |

| Accrued Interest expense on long-term debt, |

Non-cash activity |

| Paid a total of |

Investing activity |

| Paid |

Operating activity |

| Recognised insurance expense, |

Non-cash activity |

| Sold equipment with a book value of |

Investing activity |

| Declared cash dividend, |

Non-cash activity |

| Paid cash dividend declared in above | Financing activity |

| Purchased new equipment for |

Investing activity |

| Issued common stock for |

Financing activity |

| Used |

Non-cash activity |

Want to see more full solutions like this?

Chapter 11 Solutions

Cornerstones of Financial Accounting

- Transactions Interstate Delivery Service is owned and operated by Katie Wyer. The following selected transactions were completed by Interstate Delivery during May: 1. Received cash in exchange for common stock, 18,000. 2. Paid advertising expense, 4,850. 3. Purchased supplies on account, 2,100. 4. Billed customers for delivery services on account, 14,700. 5. Received cash from customers on account, 8,200. Indicate the effect of each transaction on the following accounting equation elements: Assets, Liabilities, Common Stock, Dividends, Revenue, and Expense. To illustrate, the answer to (1) follows: (1) Asset (Cash) increases by 18,000; Common Stock increases by 18,000.arrow_forwardTo demonstrate the difference between cash account activity and accrual basis profits (net income), note the amount each transaction affects cash and the amount each transaction affects net income. A. paid balance due for accounts payable $6,900 B. charged clients for legal services provided $5,200 C. purchased supplies on account $1,750 D. collected legal service fees from clients for current month $3,700 E. issued stock in exchange for a note payable $10,000arrow_forwardIn March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001. e. Sold services for cash for the first half of the month, 6,927. f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004. i. Received a bill for gas and oil for the truck, 218. j. Sold services on account, 3,603. k. Sold services for cash for the remainder of the month, 4,612. l. Paid wages to the employees, 3,958, Ck. Nos. 30053007. m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. Record the transactions and the balance after each transaction 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

- Post the following July transactions to T-accounts for Accounts Receivable, Sales Revenue, and Cash, indicating the ending balance. Assume no beginning balances in these accounts. A. on first day of the month, sold products to customers for cash, $13,660 B. on fifth day of month, sold products to customers on account, $22,100 C. on tenth day of month, collected cash from customer accounts, $18,500arrow_forwardIn March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardKrespy Corp. has a cash balance of $7,500 before the following transactions occur: A. received customer payments of $965 B. supplies purchased on account $435 C. services worth $850 performed, 25% is paid in cash the rest will be billed D. corporation pays $275 for an ad in the newspaper E. bill is received for electricity used $235. F. dividends of $2,500 are distributed What is the balance in cash after these transactions are journalized and posted?arrow_forward

- The transactions completed by AM Express Company during March, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and twocolumn general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardOn January 24, 20Y8, Niche Consulting collected $5,700 it had hilled its clients for services rendered on December 31, 20Y7. How would you record the January 24 transaction, using the accrual basis? A. Increase Cash, $5,700; decrease Fees Earned, $5,700 B. Increase Accounts Receivable, $5,700; increase Fees Earned, $5,700 C. Increase Cash, $5,700; decrease Accounts Receivable, $5,700 D. Increase Cash, $5,700; increase Fees Earned, $5,700arrow_forwardTRANSACTION ANALYSIS George Atlas started a business on June 1,20--. Analyze the following transactions for the first month of business using T accounts. Label each T account with the title of the account affected and then place the transaction letter and the dollar amount on the debit or credit side. (a) Invested cash in the business, 7,000. (b) Purchased equipment for cash, 900. (c) Purchased equipment on account, 1,500. (d) Paid cash on account for equipment purchased in transaction (c), 800. (e) Withdrew cash for personal use, 1,100.arrow_forward

- EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first month (March 20--), the following transactions occurred. Show the effect of each transaction on the accounting equation: Assets= Liabilities + Owners Equity. After each transaction, show the new account totals. (a) Invested cash in the business, 30,000. (b) Bought office equipment on account, 4,500. (c) Bought office equipment for cash, 1,600. (d) Paid cash on account to supplier in transaction (b), 2,000. EFFECTS OF TRANSACTIONS (REVENUE, EXPENSE, WITHDRAWALS) This exercise is an extension of Exercise 2-3B. Lets assume Jon Wallace completed the following additional transactions during March. Show the effect of each transaction on the basic elements of the expanded accounting equation: Assets = Liabilities + Owners Equity (Capital Drawing + Revenues Expenses). After transaction (k), report the totals for each element. Demonstrate that the accounting equation has remained in balance. (e) Performed services and received cash, 3,000. (f) Paid rent for March, 1,000. (g) Paid March phone bill, 68. (h) Jon Wallace withdrew cash for personal use, 800. (i) Performed services for clients on account, 900. (j) Paid wages to part-time employee, 500. (k) Received cash for services performed on account in transaction (i), 500.arrow_forwardJournal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.arrow_forwardFinancial statements Outlaw Realty, organized August 1. 20Y7, is owned and operated by Julie Baxter. How many errors can you find in the following financial statements for Outlaw Realty, prepared after its first month of operations? Assume that the cash balance on August 31, 20Y7, is $51,600 and that cash flows from operating activities is reported correctly.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College