4. Juan Rodriguez earns $14.00/hour, and worked 48 hours during the most recent week. He makes a 403(b) retirement plan contribution of 13% of gross pay each period. Juan Rodriguez is single, and claims one withholding allowance for both federal and state. Juan Rodriguez voluntarily deducts life insurance of $25 each pay period. His year-to-date taxable earnings for Social Security tax, prior to the current pay period, are $139,300, and he is paid with check #0503.

4. Juan Rodriguez earns $14.00/hour, and worked 48 hours during the most recent week. He makes a 403(b) retirement plan contribution of 13% of gross pay each period. Juan Rodriguez is single, and claims one withholding allowance for both federal and state. Juan Rodriguez voluntarily deducts life insurance of $25 each pay period. His year-to-date taxable earnings for Social Security tax, prior to the current pay period, are $139,300, and he is paid with check #0503.

Chapter4: Income Tax Withholding

Section: Chapter Questions

Problem 5PB

Related questions

Question

I need help with #4 getting the Social Security , Medicare, and Vol. Withholding and the Net Pay!!

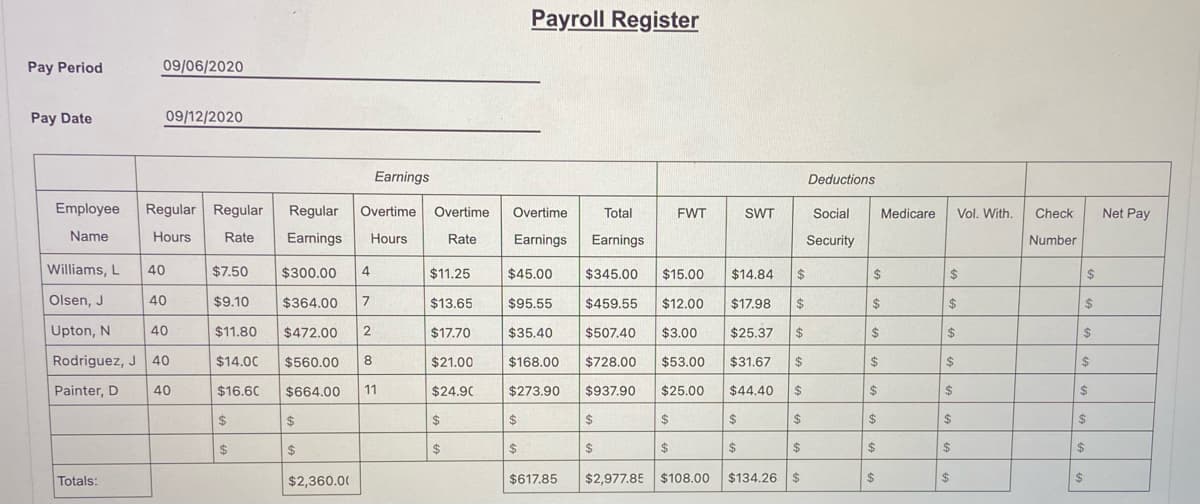

Transcribed Image Text:Complete the remaining columns of the payroll register for the five employees whose information was provided in PSa 2-4, PSa 2-12, and PSa 3-8. All employees work in a state that does not require the

withholding of disability insurance, and none of the employees files a tax return under married filing separately status. Additional information for each employee is provided below:

4. Juan Rodriguez earns $14.00/hour, and worked 48 hours during the most recent week. He makes a 403(b) retirement plan contribution of 13% of gross pay each period. Juan Rodriguez is single, and claims

one withholding allowance for both federal and state. Juan Rodriguez voluntarily deducts life insurance of $25 each pay period. His year-to-date taxable earnings for Social Security tax, prior to the current pay

period, are $139,300, and he is paid with check #0503.

Notes:

• For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

Transcribed Image Text:Payroll Register

Pay Period

09/06/2020

Pay Date

09/12/2020

Earnings

Deductions

Employee

Regular Regular

Regular

Overtime

Overtime

Overtime

Total

Vol. With.

Net Pay

FWT

SWT

Social

Medicare

Check

Name

Hours

Rate

Earnings

Hours

Rate

Earnings

Earnings

Security

Number

Williams, L

40

$7.50

$300.00

4

$11.25

$45.00

$345.00

$15.00

$14.84

%24

$

24

$

Olsen, J

40

$9.10

$364.00

$13.65

$95.55

$459,55

$12.00

$17.98

$

$

24

24

Upton, N

40

$11.80

$472.00

2

$17.70

$35.40

$507.40

$3.00

$25.37

$

$

24

Rodriguez, J 40

$14.00

$560.00

8.

$21.00

$168.00

$728.00

$53.00

$31.67

2$

24

2$

24

Painter, D

40

$16.60

$664.00

11

$24.90

$273.90

$937.90

$25.00

$44.40

%24

2$

2$

%24

$

$

%24

24

%2$

2$

$

$

2$

%24

$

$

$

$

$

$

$

Totals:

$2,360.00

$617.85

$2,977.85 $108.00

$134.26 $

24

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning