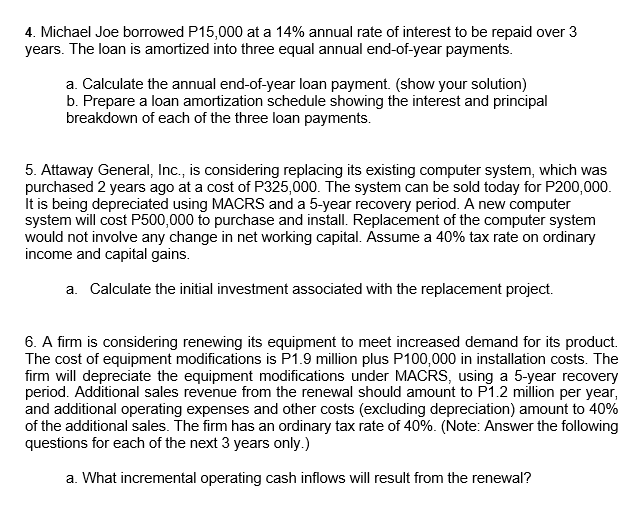

4. Michael Joe borrowed P15,000 at a 14% annual rate of interest to be repaid over 3 years. The loan is amortized into three equal annual end-of-year payments. a. Calculate the annual end-of-year loan payment. (show your solution) b. Prepare a loan amortization schedule showing the interest and principal breakdown of each of the three loan payments. 5. Attaway General, Inc., is considering replacing its existing computer system, which was purchased 2 years ago at a cost of P325,000. The system can be sold today for P200,000. it is being depreciated using MACRS and a 5-year recovery period. A new computer system will cost P500,000 to purchase and install. Replacement of the computer system would not involve any change in net working capital. Assume a 40% tax rate on ordinary income and capital gains. a. Calculate the initial investment associated with the replacement project. 6. A firm is considering renewing its equipment to meet increased demand for its product. The cost of equipment modifications is P1.9 million plus P100,000 in installation costs. The firm will depreciate the equipment modifications under MACRS, using a 5-year recovery period. Additional sales revenue from the renewal should amount to P1.2 million per year, and additional operating expenses and other costs (excluding depreciation) amount to 40% of the additional sales. The firm has an ordinary tax rate of 40%. (Note: Answer the following questions for each of the next 3 years only.) a. What incremental operating cash inflows will result from the renewal?

4. Michael Joe borrowed P15,000 at a 14% annual rate of interest to be repaid over 3 years. The loan is amortized into three equal annual end-of-year payments. a. Calculate the annual end-of-year loan payment. (show your solution) b. Prepare a loan amortization schedule showing the interest and principal breakdown of each of the three loan payments. 5. Attaway General, Inc., is considering replacing its existing computer system, which was purchased 2 years ago at a cost of P325,000. The system can be sold today for P200,000. it is being depreciated using MACRS and a 5-year recovery period. A new computer system will cost P500,000 to purchase and install. Replacement of the computer system would not involve any change in net working capital. Assume a 40% tax rate on ordinary income and capital gains. a. Calculate the initial investment associated with the replacement project. 6. A firm is considering renewing its equipment to meet increased demand for its product. The cost of equipment modifications is P1.9 million plus P100,000 in installation costs. The firm will depreciate the equipment modifications under MACRS, using a 5-year recovery period. Additional sales revenue from the renewal should amount to P1.2 million per year, and additional operating expenses and other costs (excluding depreciation) amount to 40% of the additional sales. The firm has an ordinary tax rate of 40%. (Note: Answer the following questions for each of the next 3 years only.) a. What incremental operating cash inflows will result from the renewal?

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 15P

Related questions

Question

PLS PROVIDE SOLUTION EVERY ANSWER

THANK YOU!

Transcribed Image Text:4. Michael Joe borrowed P15,000 at a 14% annual rate of interest to be repaid over 3

years. The loan is amortized into three equal annual end-of-year payments.

a. Calculate the annual end-of-year loan payment. (show your solution)

b. Prepare a loan amortization schedule showing the interest and principal

breakdown of each of the three loan payments.

5. Attaway General, Inc., is considering replacing its existing computer system, which was

purchased 2 years ago at a cost of P325,000. The system can be sold today for P200,000.

It is being depreciated using MACRS and a 5-year recovery period. A new computer

system will cost P500,000 to purchase and install. Replacement of the computer system

would not involve any change in net working capital. Assume a 40% tax rate on ordinary

income and capital gains.

a. Calculate the initial investment associated with the replacement project.

6. A firm is considering renewing its equipment to meet increased demand for its product.

The cost of equipment modifications is P1.9 million plus P100,000 in installation costs. The

firm will depreciate the equipment modifications under MACRS, using a 5-year recovery

period. Additional sales revenue from the renewal should amount to P1.2 million per year,

and additional operating expenses and other costs (excluding depreciation) amount to 40%

of the additional sales. The firm has an ordinary tax rate of 40%. (Note: Answer the following

questions for each of the next 3 years only.)

a. What incremental operating cash inflows will result from the renewal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning