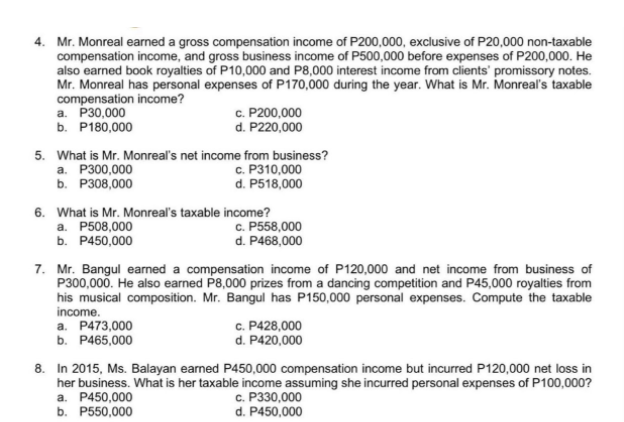

4. Mr. Monreal earned a gross compensation income of P200,000, exclusive of P20,000 non-taxable compensation income, and gross business income of P500,000 before expenses of P200,000. He also earned book royalties of P10,000 and P8,000 interest income from clients" promissory notes. Mr. Monreal has personal expenses of P170,000 during the year. What is Mr. Monreal's taxable compensation income? а. Р30,000 b. P180,000 c. P200,000 d. P220,000 5. What is Mr. Monreal's net income from business? a. P300,000 b. Р308,000 c. P310,000 d. P518,000 6. What is Mr. Monreal's taxable income? а. Р508,000 b. P450,000 c. P558,000 d. P468,000 7. Mr. Bangul earned a compensation income of P120,000 and net income from business of P300,000. He also earned P8,000 prizes from a dancing competition and P45,000 royalties from his musical composition. Mr. Bangul has P150,000 personal expenses. Compute the taxable income. a. P473,000 b. P465,000 c. P428,000 d. P420,000 8. In 2015, Ms. Balayan earned P450,000 compensation income but incurred P120,000 net loss in her business. What is her taxable income assuming she incurred personal expenses of P100,000? a. P450,000 с. Р330,000 d PA50 00o P550.000

4. Mr. Monreal earned a gross compensation income of P200,000, exclusive of P20,000 non-taxable compensation income, and gross business income of P500,000 before expenses of P200,000. He also earned book royalties of P10,000 and P8,000 interest income from clients" promissory notes. Mr. Monreal has personal expenses of P170,000 during the year. What is Mr. Monreal's taxable compensation income? а. Р30,000 b. P180,000 c. P200,000 d. P220,000 5. What is Mr. Monreal's net income from business? a. P300,000 b. Р308,000 c. P310,000 d. P518,000 6. What is Mr. Monreal's taxable income? а. Р508,000 b. P450,000 c. P558,000 d. P468,000 7. Mr. Bangul earned a compensation income of P120,000 and net income from business of P300,000. He also earned P8,000 prizes from a dancing competition and P45,000 royalties from his musical composition. Mr. Bangul has P150,000 personal expenses. Compute the taxable income. a. P473,000 b. P465,000 c. P428,000 d. P420,000 8. In 2015, Ms. Balayan earned P450,000 compensation income but incurred P120,000 net loss in her business. What is her taxable income assuming she incurred personal expenses of P100,000? a. P450,000 с. Р330,000 d PA50 00o P550.000

Chapter22: S Corporations

Section: Chapter Questions

Problem 22CE

Related questions

Question

Multiple choice

Transcribed Image Text:4. Mr. Monreal earned a gross compensation income of P200,000, exclusive of P20,000 non-taxable

compensation income, and gross business income of P500,000 before expenses of P200,000. He

also earned book royalties of P10,000 and P8,000 interest income from clients' promissory notes.

Mr. Monreal has personal expenses of P170,000 during the year. What is Mr. Monreal's taxable

compensation income?

а. Р30,000

b. P180,000

c. P200,000

d. P220,000

5. What is Mr. Monreal's net income from business?

c. P310,000

d. P518,000

a. P300,000

b. Р308,000

6. What is Mr. Monreal's taxable income?

а. Р508,000

b. P450,000

c. P558,000

d. P468,000

7. Mr. Bangul earned a compensation income of P120,000 and net income from business of

P300,000. He also earned P8,000 prizes from a dancing competition and P45,000 royalties from

his musical composition. Mr. Bangul has P150,000 personal expenses. Compute the taxable

income.

a. P473,000

b. P465,000

c. P428,000

d. P420,000

8. In 2015, Ms. Balayan earned P450,000 compensation income but incurred P120,000 net loss in

her business. What is her taxable income assuming she incurred personal expenses of P100,000?

a. P450,000

b. P550,000

с. Р330,000

d. P450,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT