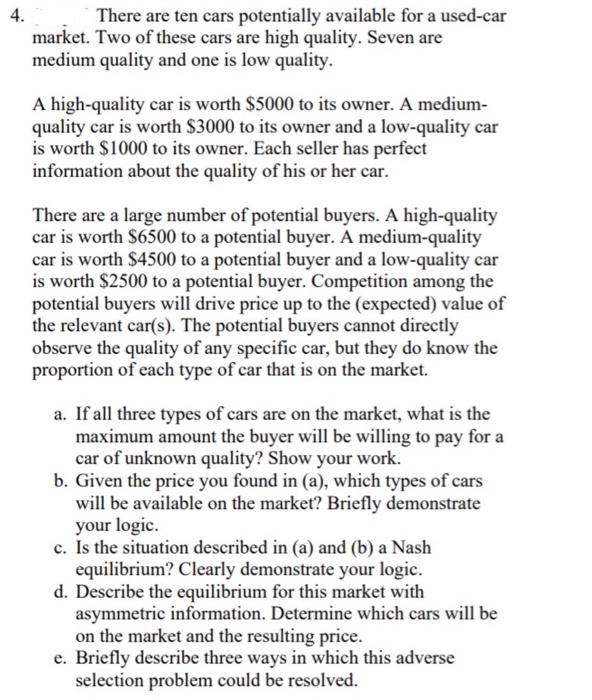

4. There are ten cars potentially available for a used-car market. Two of these cars are high quality. Seven are medium quality and one is low quality. A high-quality car is worth $5000 to its owner. A medium- quality car is worth $3000 to its owner and a low-quality car is worth $1000 to its owner. Each seller has perfect information about the quality of his or her car. There are a large number of potential buyers. A high-quality

4. There are ten cars potentially available for a used-car market. Two of these cars are high quality. Seven are medium quality and one is low quality. A high-quality car is worth $5000 to its owner. A medium- quality car is worth $3000 to its owner and a low-quality car is worth $1000 to its owner. Each seller has perfect information about the quality of his or her car. There are a large number of potential buyers. A high-quality

Chapter14: Transaction Costs, Asymmetric Information, And Behavioral Economics

Section: Chapter Questions

Problem 3.8P

Related questions

Question

Plz all part a b c d e

Transcribed Image Text:4.

There are ten cars potentially available for a used-car

market. Two of these cars are high quality. Seven are

medium quality and one is low quality.

A high-quality car is worth $5000 to its owner. A medium-

quality car is worth $3000 to its owner and a low-quality car

is worth $1000 to its owner. Each seller has perfect

information about the quality of his or her car.

There are a large number of potential buyers. A high-quality

car is worth $6500 to a potential buyer. A medium-quality

car is worth $4500 to a potential buyer and a low-quality car

is worth $2500 to a potential buyer. Competition among the

potential buyers will drive price up to the (expected) value of

the relevant car(s). The potential buyers cannot directly

observe the quality of any specific car, but they do know the

proportion of each type of car that is on the market.

a. If all three types of cars are on the market, what is the

maximum amount the buyer will be willing to pay for a

car of unknown quality? Show your work.

b. Given the price you found in (a), which types of cars

will be available on the market? Briefly demonstrate

your logic.

c. Is the situation described in (a) and (b) a Nash

equilibrium? Clearly demonstrate your logic.

d. Describe the equilibrium for this market with

asymmetric information. Determine which cars will be

on the market and the resulting price.

e. Briefly describe three ways in which this adverse

selection problem could be resolved.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co