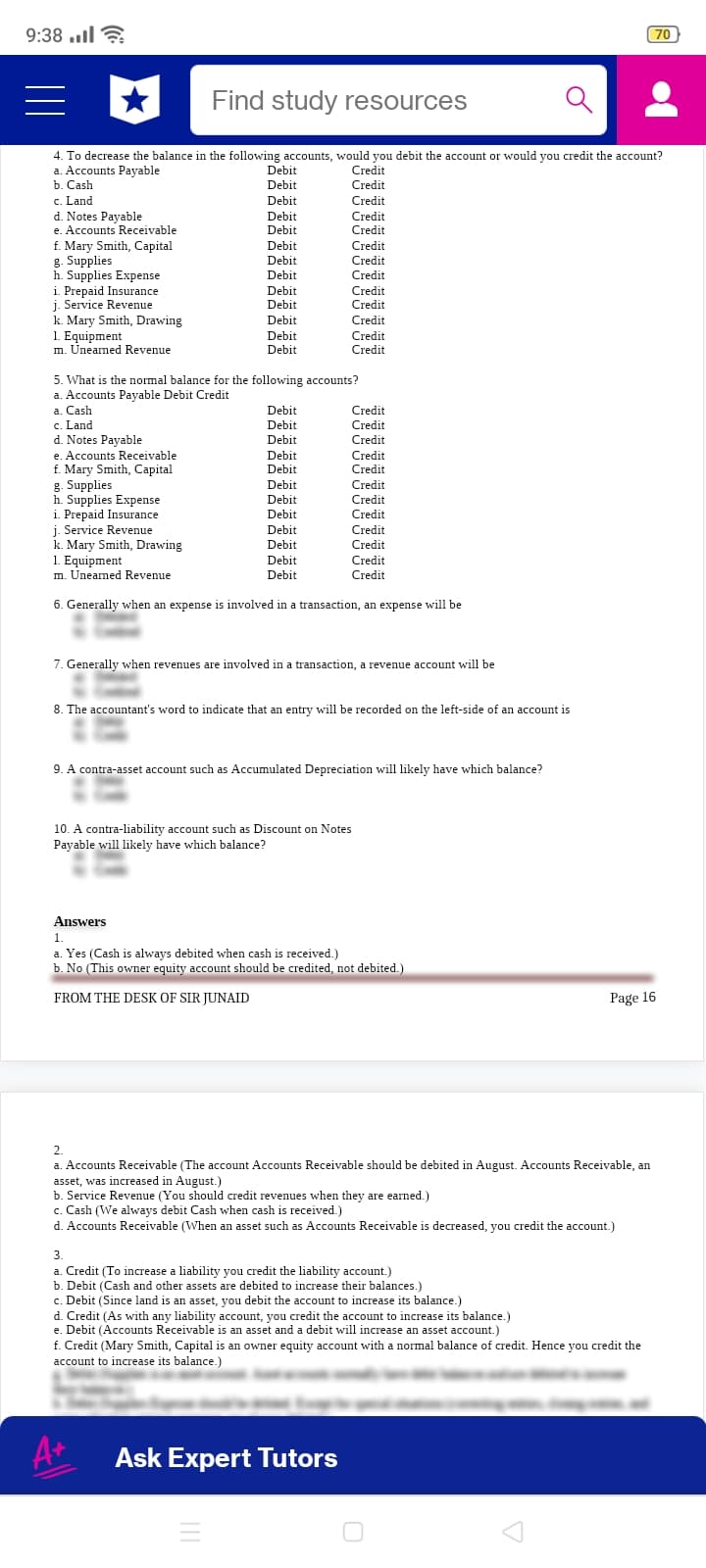

4. To decrease the balance in the following accounts, would you debit the account or would you credit the account? a. Accounts Payable b. Cash c. Land d. Notes Payable e. Accounts Receivable f. Mary Smith, Capital g. Supplies h. Supplies Expense i. Prepaid Insurance j. Service Revenue k. Mary Smith, Drawing 1. Equipment m. Uneamed Revenue Debit Credit Debit Credit Debit Credit Debit Debit Credit Credit Debit Debit Credit Credit Credit Debit Debit Debit Credit Credit Debit Credit Debit Debit Credit Credit

4. To decrease the balance in the following accounts, would you debit the account or would you credit the account? a. Accounts Payable b. Cash c. Land d. Notes Payable e. Accounts Receivable f. Mary Smith, Capital g. Supplies h. Supplies Expense i. Prepaid Insurance j. Service Revenue k. Mary Smith, Drawing 1. Equipment m. Uneamed Revenue Debit Credit Debit Credit Debit Credit Debit Debit Credit Credit Debit Debit Credit Credit Credit Debit Debit Debit Credit Credit Debit Credit Debit Debit Credit Credit

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter2: Analyzing Transactions Into Debit And Credit Parts

Section: Chapter Questions

Problem 1AP

Related questions

Question

thankyouuuu:>

Transcribed Image Text:9:38 ..il ?

70

Find study resources

4. To decrease the balance in the following accounts, would you debit the account or would you credit the account?

a. Accounts Payable

b. Cash

Debit

Credit

Debit

Сredit

c. Land

d. Notes Payable

e. Accounts Receivable

f. Mary Smith, Capital

g. Supplies

h. Supplies Expense

Debit

Сredit

Debit

Credit

Debit

Credit

Debit

Credit

Сredit

Credit

Credit

Credit

Debit

Debit

i. Prepaid Insurance

j. Service Revenue

k. Mary Smith, Drawing

1. Equipment

Debit

Debit

Debit

Credit

Debit

Credit

Credit

m. Unearned Revenue

Debit

5. What is the normal balance for the following accounts?

a. Accounts Payable Debit Credit

a. Cash

c. Land

d. Notes Payable

Сredit

Credit

Debit

Debit

Debit

Credit

e. Accounts Receivable

f. Mary Smith, Capital

g. Supplies

h. Supplies Expense

i. Prepaid Insurance

i. Service Revenue

k. Mary Smith, Drawing

1. Equipment

m. Unearned Revenue

Debit

Debit

Credit

Credit

Debit

Credit

Debit

Credit

Debit

Credit

Debit

Credit

Debit

Debit

Credit

Credit

Debit

Credit

6. Generally when an expense is involved in a transaction, an expense will be

7. Generally when revenues are involved in a transaction, a revenue account will be

8. The accountant's word to indicate that an entry will be recorded on the left-side of an account is

9. A contra-asset account such as Accumulated Depreciation will likely have which balance?

10. A contra-liability account such as Discount on Notes

Payable will likely have which balance?

Answers

1.

a. Yes (Cash is always debited when cash is received.)

b. No (This owner equity account should be credited, not debited.)

FROM THE DESK OF SIR JUNAID

Page 16

2.

a. Accounts Receivable (The account Accounts Receivable should be debited in August. Accounts Receivable, an

asset, was increased in August.)

b. Service Revenue (You should credit revenues when they are earned.)

c. Cash (We always debit Cash when cash is received.)

d. Accounts Receivable (When an asset such as Accounts Receivable is decreased, you credit the account.)

3.

a. Credit (To increase a liability you credit the liability account.)

b. Debit (Cash and other assets are debited to increase their balances.)

c. Debit (Since land is an asset, you debit the account to increase its balance.)

d. Credit (As with any liability account, you credit the account to increase its balance.)

e. Debit (Accounts Receivable is an asset and a debit will increase an asset account.)

f. Credit (Mary Smith, Capital is an owner equity account with a normal balance of credit. Hence you credit the

account to increase its balance.)

A+

Ask Expert Tutors

Transcribed Image Text:9:42 ..l ? 0

69

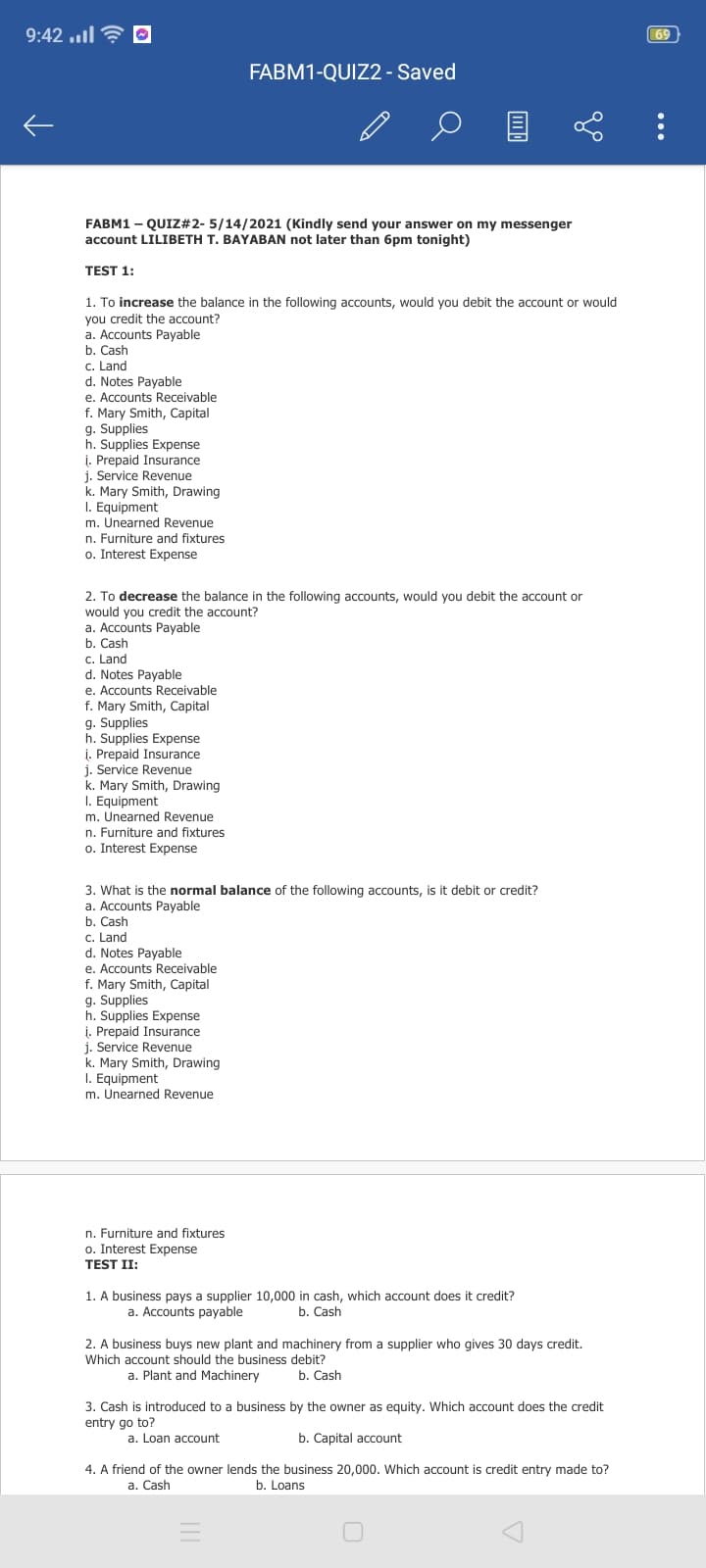

FABM1-QUIZ2 - Saved

FABM1 – QUIZ#2- 5/14/2021 (Kindly send your answer on my messenger

account LILIBETH T. BAYABAN not later than 6pm tonight)

TEST 1:

1. To increase the balance in the following accounts, would you debit the account or would

you credit the account?

a. Accounts Payable

b. Cash

c. Land

d. Notes Payable

e. Accounts Receivable

f. Mary Smith, Capital

9. Supplies

h. Supplies Expense

Prepaid Insurance

i.

j. Service Revenue

k. Mary Smith, Drawing

I. Equipment

m. Unearned Revenue

n. Furniture and fixtures

o. Interest Expense

2. To decrease the balance in the following accounts, would you debit the account or

would you credit the account?

a. Accounts Payable

b. Cash

c. Land

d. Notes Payable

e. Accounts Receivable

f. Mary Smith, Capital

g. Supplies

h. Supplies Expense

Prepaid Insurance

j. Service Revenue

k. Mary Smith, Drawing

I. Equipment

m. Unearned Revenue

n. Furniture and fixtures

o. Interest Expense

3. What is the normal balance of the following accounts, is it debit or credit?

a. Accounts Payable

b. Cash

c. Land

d. Notes Payable

e. Accounts Receivable

f. Mary Smith, Capital

9. Supplies

h. Supplies Expense

į. Prepaid Insurance

j. Service Revenue

k. Mary Smith, Drawing

I. Equipment

m. Unearned Revenue

n. Furniture and fixtures

o. Interest Expense

TEST II:

1. A business pays a supplier 10,000 in cash, which account does it credit?

b. Cash

a. Accounts payable

2. A business buys new plant and machinery from a supplier who gives 30 days credit.

Which account should the business debit?

a. Plant and Machinery

b. Cash

3. Cash is introduced to a business by the owner as equity. Which account does the credit

entry go to?

a. Loan account

b. Capital account

4. A friend of the owner lends the business 20,000. Which account is credit entry made to?

a. Cash

b. Loans

...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College