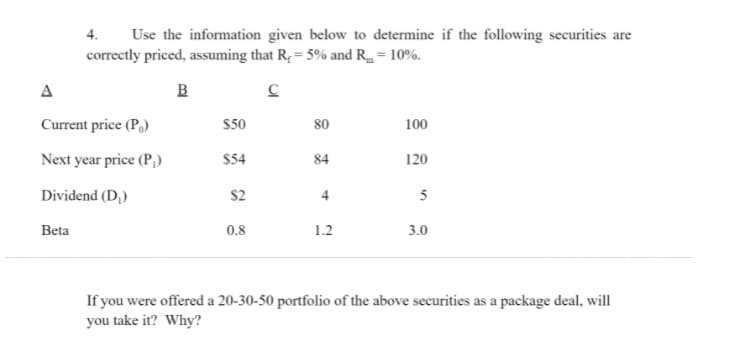

4. Use the information given below to determine if the following securities are correctly priced, assuming that R, = 5% and R = 10%. A в Current price (P,) S50 80 100 Next year price (P,) $54 84 120 Dividend (D,) $2 4 5 Beta 0.8 1.2 3.0 If you were offered a 20-30-50 portfolio of the above securities as a package deal, will you take it? Why?

Q: Consider the following data for two risk factors (1 and 2) and two securities (J and L): λ0 = 0.07…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: a)A stock hasa beta of 1.5 and an is the risk free rate if the mauked rate of retum is 12.57.…

A: Answer 1 A) Information Provided: Beta = 1.5 Expected return = 16.35% Market rate of return = 12.5%

Q: Saunders Corporation's convertible bonds: Maturity: 10 Stock Price: $30.00 Par value: $1,000.00…

A: Bond's straight value is the PV of Coupons and Par value discounted at straight debt yield. This can…

Q: С. DRISTA stock is now trading at RM45 per share on Bursa Malaysia. The risk-free rate is 7% and the…

A: Underpriced and Overpriced refers to the situation where the intrinsic worth of stock, derivative or…

Q: 1. Assume you buy a March RM1625 FBM-KLCI call option for RM25 and hold until expiry. What will be…

A: Solution:- Call option is right to buy the asset if price of asset at maturity exceeds the strike…

Q: 1. An investor is contemplating the purchase of common stock at the beginning of this year and to…

A: Year end price (P1) = P 40 Year end dividend (D1) = P 2 Required rate of return (i) = 10%

Q: Consider two stocks: Stocks Current Price Possible Prices after one year Stock ABC $12.00 ABC + =…

A: To mitigate the risk that arises due to market fluctuations, investors enter into forwards and…

Q: You have two options to invest $1000 in: i) A $1050 face value bond with coupon rate c = 6%. ii) A…

A: Bond is the debt security that investors uses to reduce the risk and increase stable return from…

Q: Assume that Umbrella Corp. stock has a required rate of return (rs) = 31. If 30 year T-Bonds are…

A: The ratio of the covariance of an individual stock return and market return by the variance of the…

Q: Currently you own no stock or options. Today's data for Green Corporation, where the call and put…

A: A put option would be exercised if the price of the stock at the time of expiration of the put…

Q: You have the following share price of XYZ. DATE Price 2-Mar-2021 $100 3-Mar-2021 $60…

A: Geometric average rate of return will be calculated considering return in each period. Following is…

Q: correctly priced, assuming that R; = 5% and Rm = 10%. A B Current price (P) $50 80 100 Next year…

A: First we will calculate the return required from these securities using CAPM approach given as…

Q: 4. Use the information given below to determine if the following securities are correctly priced,…

A: Given: Particulars A B C Current price(P0) 50 80 100 Next year price (P1) 54 84 120…

Q: 4. Use the information given below to determine if the following securities are correctly priced,…

A: Here,

Q: 1. The following two portfolios have a market value of $500 million. The bonds in both portfolios…

A: Given: Two bond portfolio with different years to maturity and Par value. Coupon rate and Yield to…

Q: hat is your expectation of the market P/E ratio?

A: P/E Ratio: It is the ratio of the firm's share price to its EPS (earnings per share). A higher P/E…

Q: Consider the following for a firm. Its stock price (P0) is at $50, its payout ratio (POR) is 0.4,…

A: The dividend yield is the ratio that shows the percentage dividend paid to shareholders in…

Q: ISE THE FOLLOWING INFORMATION TO ANSWER THE FOLLOWING PROBLEM(S) Est $ Last Last EST Company Ticker…

A: 1) Annual Dollar Coupon Amount: = Coupon Rate * Face Value of Bond = 4.75% * $1000 = $47.50

Q: ns. Bartman Industries Reynolds Inc. Year Stock Price Dividend Holding period return…

A: In its most basic form, the average annual return (AAR) is a metric that quantifies how much money a…

Q: You have estimated spot rates as follows: r1 = 4.00%, r2 = 4.50%, r3 = 5.70%, r4 = 5.90%, r5 =…

A: Given: r1 = 4.00%, r2 = 4.50%, r3 = 5.70%, r4 = 5.90%, r5 = 6.00%.

Q: Suppose you held a diversified portfolio consisting of a $7,500 investment in each of 20 different…

A: Given information: Initial portfolio’s beta is 1.81 Investment in diversified portfolio is $7,500 in…

Q: 4. Use the information given below to determine if the following securities are correctly priced,…

A: Given: Particulars A B C Current price(P0) 50 80 100 Next year price (P1) 54 84 120…

Q: The current price of a stock is $55. In 1 year, the price will be either $50or $65. The annual…

A: Excel Spreadsheet: Excel Workings:

Q: 3. A property holdings declared a dividend of P9 per share for the common stock. If the common stock…

A: The company carry on its functions for the purpose of gaining earnings. These earnings would be…

Q: Sha is expected to pay a dividend of 1.00 at the end of the year. The market's risk free rate is…

A: Stock price refers to the market value of the stock. Stock price is influenced by many external and…

Q: What is the cost of a preferred stock with a $100 par value that pays a $9.60 dividend per year? The…

A: Cost of Preferred Stock = Annual Dividend / (Price - Floatation Cost)

Q: 4. Use the information given below to determine if the following securities are correctly priced,…

A: required return of A = 5 + 0.8*5 = 9% required return of B = 5 + 1.2*5 = 11% required return of C =…

Q: You buy a share of stock, write a 1-year call option with X = $80, and buy a 1-year put option with…

A: The net payoff is the profit or loss from the sale of a product or service after the selling cost…

Q: of different c tocks each stock value is $15,000. The portfolio beta is equal to 1.5. You ecided to…

A: Beta of portfolio is the weighted average beta of each stock.

Q: In which case did the price of the stock change?

A: Formulas to calculate the price of the preferred stock: P = D/K Where P is the price, D is the…

Q: what should be the prices of the following prefered stocks if comparable securities yield 7 percent?…

A: a. Calculation of Price of Preferred Stock if the preferred stock pays at $8 and $100 par value:

Q: Sioux Financial Corp. has forecasted its bond portfolio value for one year ahead to be P105 million.…

A: A bond is a liability on which a percentage of interest has to be paid till the maturity of the…

Q: 4. Consider the following zero-coupon yields on default free securities: r₁= 5.80%, r2 = 5.50%, r3 =…

A: Given: Year Particulars Amount 1 r1 5.80% 2 r2 5.50% 3 r3 5.20%

Q: Suppose you invest in 230 shares of Johnson and Johnson at $70 per share and 240 shares of Yahoo at…

A: To find: Rate of return of portfolio

Q: Suppose you held a diversified portfolio consisting of a $7,500 investment in each of 20 different…

A: portfolio beta formula: βportfolio=∑i=1nwi×βiwhere,wi= weight of ithstockβi=beta of ithstockn = no…

Q: what would be the fair price of stock X 3 year from today?

A: Dividend Discounted Model (DDM) is an financial approach that helps in computing the price of the…

Q: The risk-free rate of return (r) is 2% and the expected market rate of return (rm) is 10%. The…

A: In this we have to calculate expected return using CAPM model.

Q: 4. Use the information given below to determine if the following securities are correctly priced,…

A: Given: Particulars A B C Current price(P0) 50 80 100 Next year price (P1) 54 84 120…

Q: investor Treasury securities expects on to be 1.6% in Ye 1, 3.65% each year thereafter. Assume the…

A: The question is based on the concept of determination of yield of bond , which changes with change…

Q: Nodebt Inc. is a firm with all-equity financing. Its equity beta is 0.80. The Treasury bill rate is…

A: Equity beta = 0.80 Risk free rate = 3% Market risk premium = 7% Cost of equity = Risk free…

Q: Consider two stocks: Stocks Current Price Possible Prices after one year Stock ABC $12.00 ABC + =…

A: Arbitraging is the process of buying and selling stocks in order to create balance in the market.…

Q: As an investor, you are holding the following investments: Stock Amount invested beta A $40…

A: Given:

Q: Zust preferred stock is selling for $42.16 per share and pays $1.95 in dividends. What is your…

A: Given details are : Current selling price of preferred stock = $42.16 Annual Dividend = $1.95 We…

Q: Suppose you held a diversified portfolio consisting of a $7,500 investment in each of 20 different…

A: Portfolio refers to a combination or collection of financial instruments or securities being stocks,…

Pls help with homework :

Step by step

Solved in 2 steps with 3 images

- Consider the following data for two risk factors (1 and 2) and two securities (J and L):λ0 = 0.07 λ1 = 0.04 λ2 = 0.06bJ1 = 0.10 bJ2 = 1.60 bL1 = 1.80 bL2 = 2.45a. Compute the expected returns for both securities. b. Suppose that Security J is currently priced at $50 while the price of Security L is $15.00.Further, it is expected that both securities will pay a dividend of $0.95 during the coming year.What is the expected price of each security one year from now? c. Compute the correlation between stock A and stock B considering the following data.Standard deviation of stock A = 10 percentStandard deviation of stock B = 17 percentCovariance between the two stocks = 90.The following facts are available about a convertible bond: Market Price of issuer's common stock = S = 100, uS = 110, dS = 90, Interest Rate = 3%, Face Value of a Convertible Bond (E) = 1,000. Using the One Period Binomial Model to create a replicating portfolio, calculate the price of this convertible bond. a. $1,001.67 b. $1,018.51 c. $1,033.98 d. $1,041.15 Do it correctly with step by step explanation.Consider the following zero coupon bonds:Bond Yrs to Mat. Yield to Maturitya 1 0.0433b 2 0.046c 3 0.0495d 4 0.0511e 5 0.0531f 6 0.0555What is the forward rate for year5 Group of answer choices 0.0630 0.0593 0.0648 0.0611 0.0668 Please answer fast i give you upvote.

- Show how you would make a portfolio delta-neutral and also self-financing by including bonds and call options to a stock that is currently traded at sh. 100, given that the delta for the call = 0.2499 and the call price = sh5.55.Assume that the current yield on one-year securities is 7 percent, and that the yield on a two-year security is 8 percent. If the liquidity premium on a two-year security is 0.6 percent, then the one-year forward rate is approximately: Group of answer choices 8.6 percent. 7.4 percent. 8.4 percent. 7.6 percent.The following data apply to Saunders Corporation's convertible bonds: Maturity: 10 Stock Price: $30.00 Par value: $1,000.00 Conversion price: $35.00 Annual coupon: 5.00% Straight-debt yield: 8.00% What is the bond's straight-debt value? Based on your answers to the three preceding questions, what is the minimum price (or "floor" price) at which the Saunders' bonds should sell? Please solve the problem by using algebra and formulas instead of excel.

- What should be the prices of the following preferred stocks if comparable securities yield 4 percent? Use Appendix B and Appendix D to answer the questions. Round your answers to the nearest cent. MN, Inc., $8 preferred ($120 par) $ CH, Inc., $8 preferred ($120 par) with mandatory retirement after 7 years $ What should be the prices of the following preferred stocks if comparable securities yield 8 percent? Round your answers to the nearest cent. MN, Inc., $8 preferred ($120 par) $ CH, Inc., $8 preferred ($120 par) with mandatory retirement after 7 years $ In which case did the price of the stock change? As with the valuation of bonds, an increase in interest rates causes the value of preferred stock to -Select-fallriseItem 5 . In which case was the price more volatile? While the prices of both preferred stocks -Select-declinedincreasedItem 6 , the price of the -Select-perpetual preferred stockstock with mandatory retirementItem 7 was more volatile.Suppose a stock is currently (time t = 0) worth 100. Further, suppose the one year annually compounded interest rate is 2%, and the two year annually compounded rate is 3%. Find the following:a) The forward price for a forward contract on the stock with maturity year T1 = 1. b) The forward price for a forward contract on the stock with maturity year T2 = 2.c) The forward price for a forward contract with maturity T1 = 1 on a ZCB with maturity T2 = 2.d) The forward price for a forward contract with maturity T1 = 1 on a forward contract on the stock with maturity T2 = 2 and delivery price K = 101.What should be the prices of the following preferred stocks if comparable securities yield 8 percent? Use Appendix B and Appendix D to answer the questions. Round your answers to the nearest cent. a. MN, Inc., $7 preferred ($200 par) b. CH, Inc., $7 preferred ($200 par) with mandatory retirement after 20 years

- What should be the prices of the following preferred stocks if comparable securities yield 3 percent? Use Appendix B and Appendix D to answer the questions. Round your answers to the nearest cent. MN, Inc., $10 preferred ($90 par) $ CH, Inc., $10 preferred ($90 par) with mandatory retirement after 11 years $The following information pertains to a portfolio of a company on 12/31/21: Security Cost at 12/31/21 Fair value at 12/31/21 X $220,000 $159,000 Y 246,000 190,000 Total: (figure out the total on your own) What is the balance of the Fair Value Adjustment account for these securities at December 31, 2021? (Very Important: just enter the amount. DO NOT put a plus or minus sign in front of the amount.)A non-dividend-paying stock has a current price of 800 ngwee. In any unit of time (t, t + 1) the price of the stock either increases by 25% or decreases by 20%. K1 held in cash between times t and t + 1 receives interest to become K1.04 at time t + 1. The stock price after t time units is denoted by St.Required:I. Calculate the risk-neutral probability measure for the model.II. Calculate the price (at t = 0) of a derivative contract written on the stock with expiry date t = 2 which pays 1,000 ngwee if and only if S2 is not 800 ngwee (and otherwise pays 0).