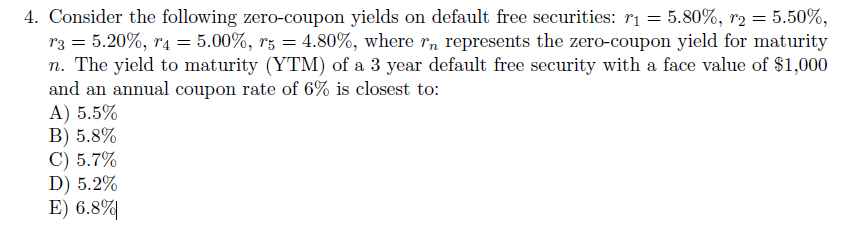

4. Consider the following zero-coupon yields on default free securities: r₁= 5.80%, r2 = 5.50%, r3 = 5.20%, r4 = 5.00%, r5 = 4.80%, where rn represents the zero-coupon yield for maturity n. The yield to maturity (YTM) of a 3 year default free security with a face value of $1,000 and an annual coupon rate of 6% is closest to: A) 5.5% B) 5.8% C) 5.7% D) 5.2% E) 6.8%

Q: Vincent has chosen to buy a new car with a cost of $14 000, inclusive of HST. He has saved $5000 for…

A: The cars are purchased by the loans which are paid by the equal monthly installments but we have to…

Q: ou sell short 18 shares of Wells Fargo &Co that are currently selling at $54 per share. You post the…

A: A short seller borrows securities from a broker in order to sell them now. He provides an initial…

Q: A P28,000 debt at 15% interest compounded semi-annually is to be amortized at P2,250 every 6 months.…

A: The following is the amortization table. From this we can answer the 3 questions. Please note the…

Q: (Immunization of FI) Consider a financial institution whose asset and liability both consist of…

A: Note: This post has multiple questions. The first two have been solved below. Duration:…

Q: Mickey & Minnie have $47 million in cash. Before they retire, they want the $47 million to grow to…

A: Retirement planning is essential and hence savings is required. This is because the greater the…

Q: A project with a life of 6 years is expected to provide annual sales of $380,000 and costs of…

A: Given: Particulars Base case Sales $380,000.00 Cost $269,000.00 Tax rate =21%

Q: 4) Use this week's activity to write the formula for placing $300 in a 7.5% account compounded…

A: We will use the concept of time value of money here. As per the concept of time value of money the…

Q: b. The firm proposes to offer new common stock to the preferred stockholders to wipe out the…

A: Introduction Dividends are a portion of company earnings paid out to shareholders. Dividends can be…

Q: You have valued a business, using discounted cash flow models, at $250 million for a private sale.…

A: A) Introduction:- According to the idea of the regression coefficient, regression can take the form…

Q: The economic report outlined a bullish outlook for the renewable energy industry in Malaysia. Solar…

A:

Q: odaFizz paid a dividend of $2 per share last year; its dividend has been growing at a rate of 2% per…

A: The dividend is paid to equity shareholders as a share in the profit. The dividends are the amount…

Q: Identify the main ethical arguments that

A: Insider trading is considered as unethical in corporate world and there are huge punishment for…

Q: The following data is reported for a fund and an appropriate benchmark as well as the risk-free rate…

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: QUESTION THREE Lackson PLC and Hardy Corp. both have 8 percent coupon bonds outstanding, with…

A: The price of bond is the present value of coupon payment and present value of par value that is…

Q: Fill the correct inputs on the T184 finance application to determine what initial investment would…

A: Given: Future value = $28,000 Interest rate = 2.14% Years = 3

Q: Nadhirah needs to pay RM168.28 every month for a loan of RM7,000 from XYZ Bank at 7.2% compounded…

A: Given, The monthly payment is RM 168.28 Loan amount is RM 7000 Rate is 7.2% compounded monthly

Q: Suppose the discount rate is 10%. You bought a 10-year, 8% coupon bond with 7 years after it is…

A: The coupon rate indicates the interest rate on the bound. The period payment is determined using the…

Q: ohn has just borrowed an amount of K5,000 to pay his school fees. The loan is to be repaid in equal…

A: Loans are paid by the annual payment that carry the payment of loan and payment of interest also but…

Q: b) Ameena borrowed a certain sum of money from a financial institution that charged 4.5% compounded…

A: Monthly payment (a) = RM725 Monthly interest rate (r) = 0.00375 (i.e. 0.045 / 12) Monthly period (n)…

Q: All rates in this question use semi-annual compounding. You observe a two year spot rate of 6.00%,…

A: Pure Expectation theory of interest rate states that the return of holding two year bond is the same…

Q: The amount of $122,000 is invested todat at a rate of 8.77% per annum, with monthly compounding,…

A: Time Value of money states that a dollar today is worth more than any time in the future, this is…

Q: An asset has values S(0) = 10 and S(1, 1) = 9 with up factor u = 1.1 and the return over one…

A: The no arbitrage rule is as follows:0< d< 1+r or R < u or 0 < π < 1 we are given S(1,…

Q: Risk and return are related in that investor expectations for returns are a function of the risk…

A: Investor expectation refers to the efforts, commitments, and passion of the entrepreneur for…

Q: You just purchased a parcel of land for $40,000. To earn a 9% annual rate of return on your…

A: Future value of a present amount The future value (FV) for a present value (PV) that earns annual…

Q: 1. Latona Hitchens purchases 25 hanging file folders for $6.9

A: Unit price is the price per unit of a product being purchased. In other words it is the per piece…

Q: A steam boiler is needed as part of the design of a new plant. The boiler can be fired natural gas,…

A: Present worth is equivalent cost of all cost that going to occur during the economic life of the…

Q: Two treasury bonds (with semi-annual coupons) are traded. The first bond matures in six months, has…

A: Bond 1: Annual coupon rate = 6% Semi-annual rate = 6%/2 = 3% Dirty price “P” = $99.50 Let Face Value…

Q: In 6 years Dawn wants her current savings of $3700 to grow to $7300? What per annum rate, compounded…

A: Current saving (P0) = $3700 Future value after 6 years (FV) = $7300 Annual rate (r) = ? Period (p) =…

Q: A flat-screen TV can be purchased with payments of P12,500 at the end of each month for 2 years. If…

A: payment 12500 Interest rate 18% per month 1.5 present value…

Q: In early 2008, you purchased and remodeled a 120-room hotel to handle the increased number of…

A: Average fixed cost = (current selling price * cost of capital)/ 10,000 room nights. Break even…

Q: Makhado Limited has a target capital structure of 60% equity and 40% debt. The before-tax cost of…

A: Weighted average cost of capital is very important from point of view of the capital decision making…

Q: er deposits P15,500 each quarter in a savings bank paying 12.5% compounded quarterly. If she desires…

A: Future value of amount include the amount being deposited and interest being accumulated over the…

Q: Using the Black-Scholes model (BSOPM), compute the standard deviation that is implied by the…

A: The Black Scholes Model is a model that uses differential equations for the valuation of options. It…

Q: Following is a table for the present value of an annuity of $1 at compound interest: Year 6%…

A: Given: Future value = $57,000 Interest rate = 6% Years = 3

Q: Analyze the capital gains and the growth in share price for the five year period

A: Trend analysis is the change in the share price annually over a period. It helps to determine…

Q: How long will it take for P 1,000.00 to amount to P 1,346.00 if invested at 6 compounded quarterly?

A: Interest is the amount charged or received by investing or borrowing some amount. It can be simple…

Q: What is the relationship between the price, coupon rate and market yield?

A: The coupon rate is the bond's interest rate. The coupon rate is not the same as the market interest…

Q: 6. (Compounding using a calculator and annuities due) Carsten Bo, the Danisa Traditional Butter…

A: There is need of proper planning for retirement and if done at proper time and with proper planning…

Q: Which of the following earns a fixed rate of return? Whole life insurance. Term-life insurance.…

A: There are two main types of life insurance:- Term life insurance and whole life insurance. Term life…

Q: What are the different arrangements for who pays the ongoing expenses related to a leased property?…

A: In this question, we will be discussing about different method of ongoing expenses related to a…

Q: Why there is a need for exporters to understand “International Commercial Documents” which directly…

A: In international trade, a number of documents are created to protect both parties from counter…

Q: If the minimum rate of return was 11% (instead of the percentage shown above), Division A's residual…

A: Information Provided: Minimum rate of return = 11% Operating Income = $81,900 Average Investment =…

Q: j. Bonds Payable - Series 1 On January 1, 2015, Hazer issued $400,000 12% 10-year bonds. Interest is…

A: Bond refers to the borrowing security issued by the company to raise funds from the market by making…

Q: Investment required in equipment Expected life of the project Salvage value of equipment Annual…

A: The net cash flows: The net cash flows are considered while evaluating a project. The net cash…

Q: The Bloomberg screen below shows the Nasdaq Index price over the last year. Desc the technical…

A: The chart gives one year candlestick data along with volumes traded (the part below). The technical…

Q: onthly. After this period, the accumulated money was left in the account for another 5.5 yea e same…

A: Future value of deposit includes the amount being deposited and amount of compounding interest…

Q: Earnest T needs $900 for his next trip to Raleigh. He has $660 in cash. How long in years will it…

A: Current value (P0) = $660 Future value (FV) = $900 Quarterly interest rate (r) = 0.03325 (i.e. 0.133…

Q: The current price of a non-dividend paying stock is 172.5. The continuously compounded risk free…

A: A forward contract is a contract between two parties where the underlying asset will be exchanged at…

Q: Optimus stock price started the year at $32.00 and ended the year at $38.00. It paid a dividend of…

A: To calculate the rate of return we will use the below formula Rate of return = [(P1-P0)+D1]/P0…

Q: b-1. After considering the hedging, what is the net cost to the firm of the increased interest…

A: a. Profit on future contract = Value per contract * % it goes down * number of contracts

Step by step

Solved in 2 steps with 2 images

- Suppose there is a large probability that L will default on its debt. For the purpose of this example, assume that the value of Ls operations is 4 million (the value of its debt plus equity). Assume also that its debt consists of 1-year, zero coupon bonds with a face value of 2 million. Finally, assume that Ls volatility, , is 0.60 and that the risk-free rate rRF is 6%.Assume that Temp Force has a beta coefficient of 1.2, that the risk-free rate (the yield on T-bonds) is 7.0%, and that the market risk premium is 5%. What is the required rate of return on the firms stock?Assume the zero-coupon yields on default-free securities are as summarized in the following table: Maturity 1 year 2 years 3 years 4 years 5 years Zero-Coupon Yields 7.00% 7.60% 7.90% 8.30% 8.70% What is the maturity of a default-free security with annual coupon payments and a yield to maturity of 7.00%? Why? What is the maturity of a default-free security with annual coupon payments and a yield to maturity of 7.00%? A. One year B. Two years C. Three years D. Four years E. Five years

- ****THIS IS A DIFFERENT QUESTION********* Assume the zero-coupon yields on default-free securities are as summarized in the following table: Maturity 1 year 2 years 3 years 4 years 5 years Zero-Coupon Yields 5.70% 6.20% 6.40% 6.60% 6.80% What is the price of a three-year, default-free security with a face value of $1,000 and an annual coupon rate of 3%? What is the yield to maturity for this bond? What is the price of a three-year, default-free security with a face value of $1,000 and an annual coupon rate of 3%? The price is $______________ (Round to the nearest cent.)Assume the zero-coupon yields on default-free securities are as summarized in the following table: Maturity(Years) 1 2 3 4 5 YTM for this bond 6.20% 6.80% 7.00% 7.30% 7.60% What is the price of a three-year, default-free security with a face value of $1,000 and an annual coupon rate of 7%? What is the yield to maturity for this bond?Assume the zero-coupon yields on default-free securities are as summarized in the following table: Maturity 1 year 2 years 3 years 4 years 5 years Zero-Coupon Yields 4.0% 4.3% 4.5% 4.7% 4.8% What is the price today of a two-year, default-free security with a face value of $1,000 and an annual coupon rate of 6%? Does this bond trade at adiscount, at par, or at a premium? What is the price today of a two-year, default-free security with a face value of $1,000 and an annual coupon rate of 6%? The price is $_____. (Round to the nearest cent.)

- Consider the following zero‐coupon yields on default free securities: Maturity (years) 1 2 3 4 5 Zero‐Coupon YTM 5.80% 5.50% 5.20% 5.00% 4.80% The price today of a 3 year default free security with a face value of $1000 and an annual coupon rate of 6% is closest to: A. $1024.36 B. $1021 C. $1013 D. $1032Assume the zero-coupon yields on default-free securities are as summarized in the following table: Maturity 1 year 2 years 3 years 4 years 5 years Zero-Coupon Yields 7.00% 7.60% 7.90% 8.20% 8.30% Consider a four-year, default-free security with annual coupon payments and a face value of $1,000 that is issued at par. What is the coupon rate of this bond? The par coupon rate is _____%The yield on 1-year Treasury securities is 6%, 2-year securities yield 6.2%, 3-year securities yield 6.3%, and 4-year securities yield 6.5%. There is no maturity risk premium. A.) Using expectations theory and geometric averages, forecast the yields on a 1-year security, 1 year from now. B.) Using expectations theory and geometric averages, forecast the yields on a 1-year security, 2 years from now. C.) Using expectations theory and geometric averages, forecast the yields on a 2-year security, 1 year from now.

- Assume the zero-coupon yields on default-free securities are as summarized in the following table: (Click on the following icon in order to copy its contents into a spreadsheet.) Maturity (years) 1 2 3 4 5 Zero-coupon YTM 4.30% 4.70% 5.10% 5.30% 5.50% What is the price of a five-year, zero-coupon, default-free security with a face value of $1,000 Question content area bottom Part 1 The price is ___$enter your response here.(Round to the nearest cent.)step by step solution 1) Consider the following zero-coupon yields on default-free securities: Maturity (years) 1 2 3 4 5 Zero-Coupon YTM 4.80% 4.50% 4.20% 4.00% 3.80% What is the price today of a 4-year default-free security with a face value of $1,000 and an annual coupon rate of 6%? Show all your work. 2) The ABC company has a bond outstanding with a face value of $2,000 that reaches maturity in 10 years. The bond certificate indicates that the stated coupon rate for this bond is 5% and that the coupon payments are to be made semi-annually. How much are each of the semi-annual coupon payments? Assuming the appropriate YTM on the ABC company bond is 8.8%, then at what price should this bond trade?1. A coupon bond pays annual interest, has a par value of P1,000, matures in 4 years, has a coupon rate of 10%, and has a yield to maturity of 12%. The current yield on this bond is 9.39% 10.65% 10.00% 12.00% 2. If Treasury bills yield 4.0%, and the market risk premium is 9.0%, then a portfolio with a beta of 1.5 would be expected to yield 19.5% 9.0% 15.0% 17.5% 3. What is the current price of a share of stock when last year’s dividend was P3.00, the growth rate is 6 percent, and the investor's required rate of return is 12 percent? P53.00 P25.00 P26.50 P50.00