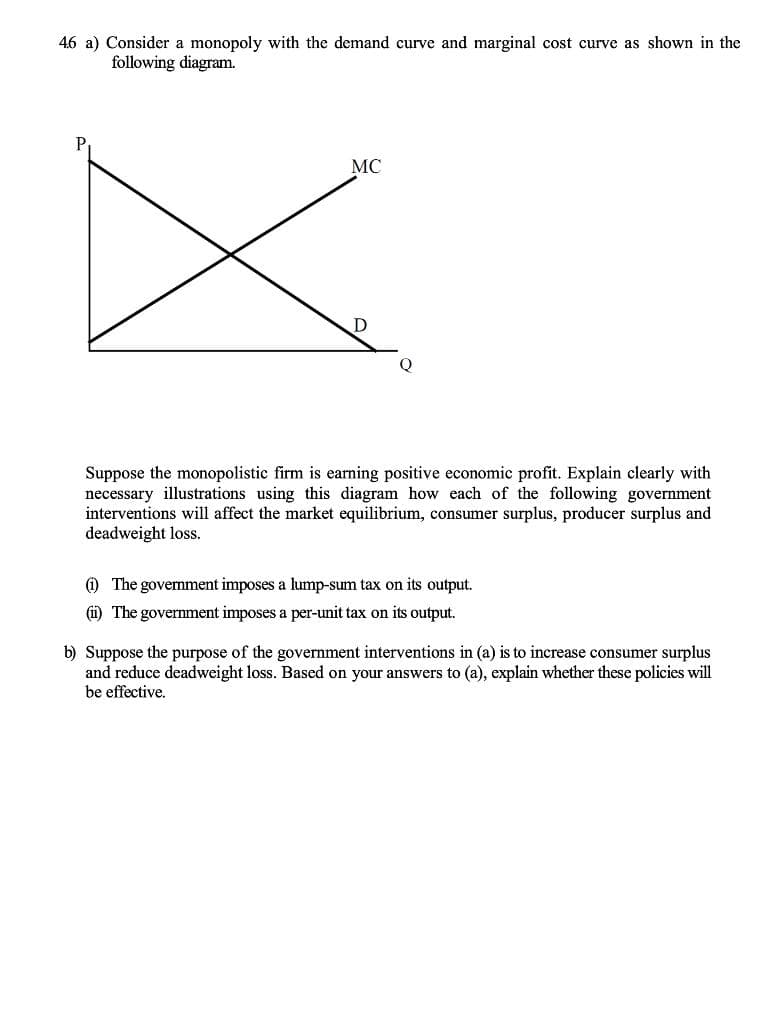

4.6 a) Consider a monopoly with the demand curve and marginal cost curve as shown in the following diagram. P MC D Suppose the monopolistic firm is earning positive economic profit. Explain clearly with necessary illustrations using this diagram how each of the following government interventions will affect the market equilibrium, consumer surplus, producer surplus and deadweight loss. O The govermment imposes a lump-sum tax on its output. (i) The government imposes a per-unit tax on its output. b) Suppose the purpose of the government interventions in (a) is to increase consumer surplus and reduce deadweight loss. Based on your answers to (a), explain whether these policies will be effective.

4.6 a) Consider a monopoly with the demand curve and marginal cost curve as shown in the following diagram. P MC D Suppose the monopolistic firm is earning positive economic profit. Explain clearly with necessary illustrations using this diagram how each of the following government interventions will affect the market equilibrium, consumer surplus, producer surplus and deadweight loss. O The govermment imposes a lump-sum tax on its output. (i) The government imposes a per-unit tax on its output. b) Suppose the purpose of the government interventions in (a) is to increase consumer surplus and reduce deadweight loss. Based on your answers to (a), explain whether these policies will be effective.

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter9: Monopoly

Section: Chapter Questions

Problem 32P: Draw the demand curve, marginal revenue, and marginal cost curves from Figure 9.6, and identify the...

Related questions

Question

Transcribed Image Text:46 a) Consider a monopoly with the demand curve and marginal cost curve as shown in the

following diagram.

MC

Q

Suppose the monopolistic firm is earning positive economic profit. Explain clearly with

necessary illustrations using this diagram how each of the following government

interventions will affect the market equilibrium, consumer surplus, producer surplus and

deadweight loss.

) The government imposes a lump-sum tax on its output.

(i) The government imposes a per-unit tax on its output.

b) Suppose the purpose of the government interventions in (a) is to increase consumer surplus

and reduce deadweight loss. Based on your answers to (a), explain whether these policies will

be effective.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning