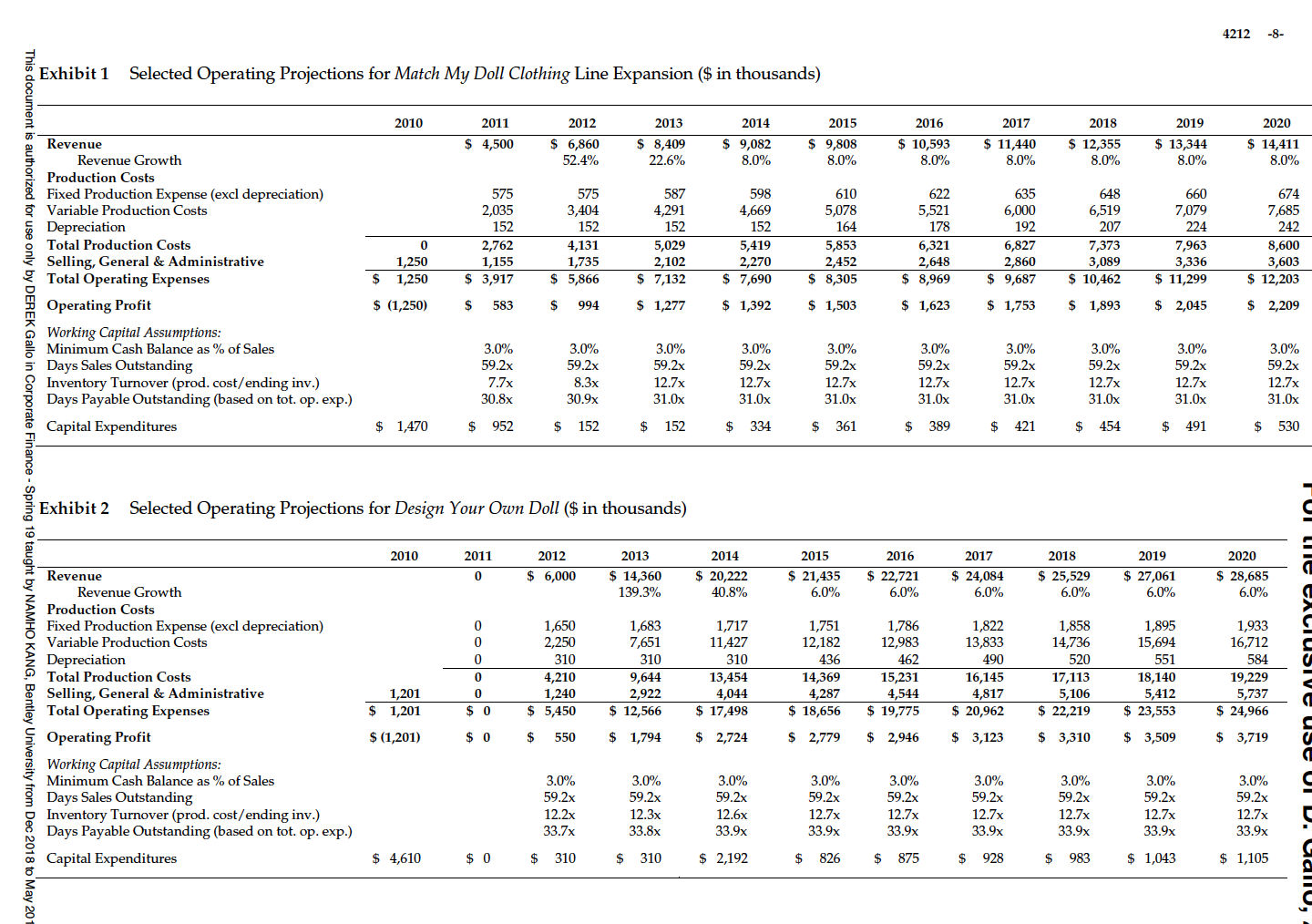

4212 -8- Exhibit 1 Selected Operating Projections for Match My Doll Clothing Line Expansion ($ in thousands) 2011 2012 2013 2014 2015 2016 2019 2020 $ 9,082 $ 10,59311,440 $ 12,355 13,344 80% Revenue $ 14,411 ue Grow 52.4% 80% Production Costs Fixed Production Expense (excl depreciation) Variable Production Costs 660 7,079 674 7,685 5,078 5,521 152 5,029 2,102 7,132 Depreciation o Total Production Costs 5,419 Selling, General & Administrative Total Operating Expenses 2,762 1,155 $ 3,917 4,131 1,735 2,648 $ 8,969 2,452 $ 9,687 10,462 $11,299 Operating Profit $ (1,250) Q Working Capital Assumptions Minimum Cash Balance as % of Sales 5 Days Sales Outstanding I Inventory Turnover (prod. cost/ending inv.) 8 Days Payable Outstanding (based on tot. op. exp.) 59.2x 59.2x 59.2x 59.2x 59.2x 12.7x 31.0x 59.2x 59.2x 59.2x 59.2x 30.9x 31.0x 31.0x api 2 Exhibit 2 Selected Operating Projections for Design Your Own Doll (S in thousands) 2011 2013 2014 2015 2016 2018 2020 $ 6,000 14,360 139.3% 20,222 40.8% S 21,435 22,721 60% Revenue 24,084 25,529 27,061 S 28,685 Revenue 6.0% 60% 60% Growth Production Costs Fixed Production Expense (excl depreciation) Variable Production Costs 1,683 7,651 1,650 1,786 1,858 1,895 15,694 11,427 12,182 13,833 16,712 C 520 17,113 ż Depreciation Total Production Costs 18,140 5,412 $18,65619,775 20,962 22,219 23,553 16,145 o Selling, General & Administrative 5,737 S 24,966 Total Operating Expenses $ 5,45012,566 $ 17,498 Operating Profit Working Capital Assumptions: Minimum Cash Balance as % of Sales Days Sales Outstanding $(1,201) $0 550 1,794$ 2,7242,779 2,946 3,123 3,310 3,509 3,719C 3.0% 3.0% 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x OInventory Turnover (prod. cost/ending inv.) 12.7x 33.9x Days Payable Outstanding (based on tot. op. exp.) 33.9x 33.9x 33.9x 33.9x 33.9x 33.9x 4,610 $ 2,192 $ 1,043

4212 -8- Exhibit 1 Selected Operating Projections for Match My Doll Clothing Line Expansion ($ in thousands) 2011 2012 2013 2014 2015 2016 2019 2020 $ 9,082 $ 10,59311,440 $ 12,355 13,344 80% Revenue $ 14,411 ue Grow 52.4% 80% Production Costs Fixed Production Expense (excl depreciation) Variable Production Costs 660 7,079 674 7,685 5,078 5,521 152 5,029 2,102 7,132 Depreciation o Total Production Costs 5,419 Selling, General & Administrative Total Operating Expenses 2,762 1,155 $ 3,917 4,131 1,735 2,648 $ 8,969 2,452 $ 9,687 10,462 $11,299 Operating Profit $ (1,250) Q Working Capital Assumptions Minimum Cash Balance as % of Sales 5 Days Sales Outstanding I Inventory Turnover (prod. cost/ending inv.) 8 Days Payable Outstanding (based on tot. op. exp.) 59.2x 59.2x 59.2x 59.2x 59.2x 12.7x 31.0x 59.2x 59.2x 59.2x 59.2x 30.9x 31.0x 31.0x api 2 Exhibit 2 Selected Operating Projections for Design Your Own Doll (S in thousands) 2011 2013 2014 2015 2016 2018 2020 $ 6,000 14,360 139.3% 20,222 40.8% S 21,435 22,721 60% Revenue 24,084 25,529 27,061 S 28,685 Revenue 6.0% 60% 60% Growth Production Costs Fixed Production Expense (excl depreciation) Variable Production Costs 1,683 7,651 1,650 1,786 1,858 1,895 15,694 11,427 12,182 13,833 16,712 C 520 17,113 ż Depreciation Total Production Costs 18,140 5,412 $18,65619,775 20,962 22,219 23,553 16,145 o Selling, General & Administrative 5,737 S 24,966 Total Operating Expenses $ 5,45012,566 $ 17,498 Operating Profit Working Capital Assumptions: Minimum Cash Balance as % of Sales Days Sales Outstanding $(1,201) $0 550 1,794$ 2,7242,779 2,946 3,123 3,310 3,509 3,719C 3.0% 3.0% 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x OInventory Turnover (prod. cost/ending inv.) 12.7x 33.9x Days Payable Outstanding (based on tot. op. exp.) 33.9x 33.9x 33.9x 33.9x 33.9x 33.9x 4,610 $ 2,192 $ 1,043

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter11: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11.2.5P

Related questions

Question

Compute

Transcribed Image Text:4212 -8-

Exhibit 1

Selected Operating Projections for Match My Doll Clothing Line Expansion ($ in thousands)

2011

2012

2013

2014

2015

2016

2019

2020

$ 9,082

$ 10,59311,440 $ 12,355 13,344

80%

Revenue

$ 14,411

ue Grow

52.4%

80%

Production Costs

Fixed Production Expense (excl depreciation)

Variable Production Costs

660

7,079

674

7,685

5,078

5,521

152

5,029

2,102

7,132

Depreciation

o Total Production Costs

5,419

Selling, General & Administrative

Total Operating Expenses

2,762

1,155

$ 3,917

4,131

1,735

2,648

$ 8,969

2,452

$ 9,687 10,462 $11,299

Operating Profit

$ (1,250)

Q Working Capital Assumptions

Minimum Cash Balance as % of Sales

5 Days Sales Outstanding

I Inventory Turnover (prod. cost/ending inv.)

8 Days Payable Outstanding (based on tot. op. exp.)

59.2x

59.2x

59.2x

59.2x

59.2x

12.7x

31.0x

59.2x

59.2x

59.2x

59.2x

30.9x

31.0x

31.0x

api

2 Exhibit 2

Selected Operating Projections for Design Your Own Doll (S in thousands)

2011

2013

2014

2015

2016

2018

2020

$ 6,000 14,360

139.3%

20,222

40.8%

S 21,435 22,721

60%

Revenue

24,084 25,529

27,061

S 28,685

Revenue

6.0%

60%

60%

Growth

Production Costs

Fixed Production Expense (excl depreciation)

Variable Production Costs

1,683

7,651

1,650

1,786

1,858

1,895

15,694

11,427

12,182

13,833

16,712 C

520

17,113

ż Depreciation

Total Production Costs

18,140

5,412

$18,65619,775 20,962 22,219 23,553

16,145

o Selling, General & Administrative

5,737

S 24,966

Total Operating Expenses

$ 5,45012,566 $ 17,498

Operating Profit

Working Capital Assumptions:

Minimum Cash Balance as % of Sales

Days Sales Outstanding

$(1,201)

$0

550 1,794$ 2,7242,779 2,946

3,123 3,310 3,509

3,719C

3.0%

3.0%

59.2x

59.2x

59.2x

59.2x

59.2x

59.2x

OInventory Turnover (prod. cost/ending inv.)

12.7x

33.9x

Days Payable Outstanding (based on tot. op. exp.)

33.9x

33.9x

33.9x

33.9x

33.9x

33.9x

4,610

$ 2,192

$ 1,043

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning