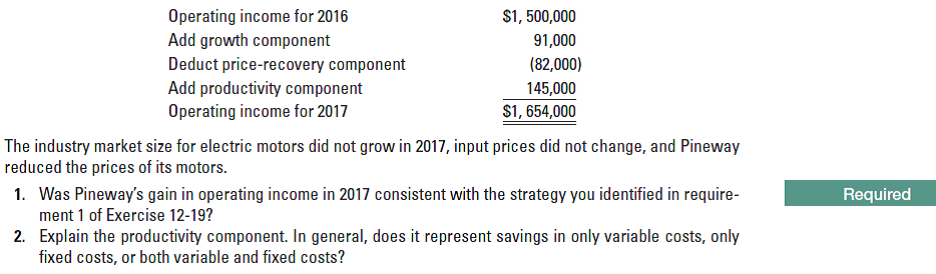

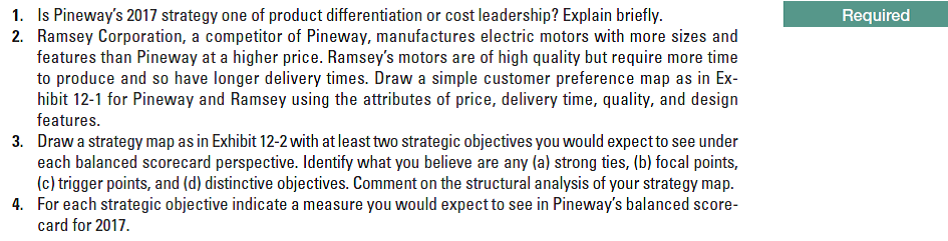

$1, 500,000 Operating income for 2016 Add growth component Deduct price-recovery component Add productivity component Operating income for 2017 91,000 (82,000) 145,000 $1, 654,000 The industry market size for electric motors did not grow in 2017, input prices did not change, and Pineway reduced the prices of its motors. 1. Was Pineway's gain in operating income in 2017 consistent with the strategy you identified in require- ment 1 of Exercise 12-19? 2. Explain the productivity component. In general, does it represent savings in only variable costs, only fixed costs, or both variable and fixed costs? Required 1. Is Pineway's 2017 strategy one of product differentiation or cost leadership? Explain briefly. 2. Ramsey Corporation, a competitor of Pineway, manufactures electric motors with more sizes and features than Pineway at a higher price. Ramsey's motors are of high quality but require more time to produce and so have longer delivery times. Draw a simple customer preference map as in Ex- hibit 12-1 for Pineway and Ramsey using the attributes of price, delivery time, quality, and design features. Required Draw a strategy map as in Exhibit 12-2 with at least two strategic objectives you would expect to see under each balanced scorecard perspective. Identify what you believe are any (a) strong ties, (b) focal points, (c) trigger points, and (d) distinctive objectives. Comment on the structural analysis of your strategy map. For each strategic objective indicate a measure you would expect to see in Pineway's balanced score- card for 2017. 3. 4.

Cost-Volume-Profit Analysis

Cost Volume Profit (CVP) analysis is a cost accounting method that analyses the effect of fluctuating cost and volume on the operating profit. Also known as break-even analysis, CVP determines the break-even point for varying volumes of sales and cost structures. This information helps the managers make economic decisions on a short-term basis. CVP analysis is based on many assumptions. Sales price, variable costs, and fixed costs per unit are assumed to be constant. The analysis also assumes that all units produced are sold and costs get impacted due to changes in activities. All costs incurred by the company like administrative, manufacturing, and selling costs are identified as either fixed or variable.

Marginal Costing

Marginal cost is defined as the change in the total cost which takes place when one additional unit of a product is manufactured. The marginal cost is influenced only by the variations which generally occur in the variable costs because the fixed costs remain the same irrespective of the output produced. The concept of marginal cost is used for product pricing when the customers want the lowest possible price for a certain number of orders. There is no accounting entry for marginal cost and it is only used by the management for taking effective decisions.

Analysis of growth, price-recovery, and productivity components (continuation of 12-19). An analysis of Pineway’s operating-income changes between 2016 and 2017 shows the following:

Reference:

Balanced scorecard. Pineway Electric manufactures electric motors. It competes and plans to grow by selling high-quality motors at a low price and by delivering them to customers in a reasonable time after receiving customers’ orders. There are many other manufacturers who produce similar motors. Pineway believes that continuously improving its manufacturing processes and having satisfied employees are critical to implementing its strategy in 2017.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps