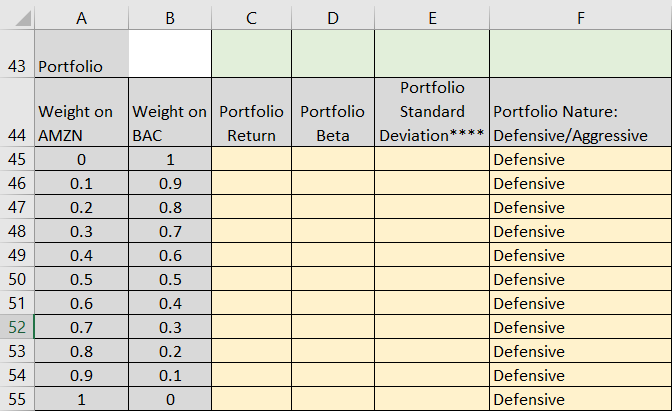

43 Portfolio Weight on Weight on Portfolio Portfolio 44 AMZN BAC Return 45 46 47 48 -49 50 51 52 53 54 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 Portfolio Standard Portfolio Nature: Beta Deviation* ** Defensive/Aggressive Defensive Defensive Defensive Defensive Defensive Defensive Defensive Defensive Defensive Defensive

Sheet 5

Use Sheet 5 to complete the following

|

Date |

AMZN Return |

BAC Return |

Market Return |

Risk-Free Return |

AMZN Excess Return* |

BAC Excess Return* |

Market Excess Return* |

|

|

3/1/2017 |

0.05 |

-0.04 |

0.04 |

0.0050 |

0.04 |

-0.05 |

0.03 |

|

|

4/1/2017 |

0.04 |

-0.01 |

0.00 |

0.0050 |

0.04 |

-0.02 |

-0.01 |

|

|

5/1/2017 |

0.08 |

-0.04 |

0.01 |

0.0050 |

0.07 |

-0.04 |

0.00 |

|

|

6/1/2017 |

-0.03 |

0.08 |

0.01 |

0.0050 |

-0.03 |

0.08 |

0.01 |

|

|

7/1/2017 |

0.02 |

-0.01 |

0.00 |

0.0050 |

0.02 |

-0.01 |

0.00 |

|

|

8/1/2017 |

-0.01 |

-0.01 |

0.02 |

0.0050 |

-0.01 |

-0.01 |

0.01 |

|

|

9/1/2017 |

-0.02 |

0.06 |

0.00 |

0.0050 |

-0.02 |

0.06 |

0.00 |

|

|

10/1/2017 |

0.15 |

0.08 |

0.02 |

0.0050 |

0.14 |

0.08 |

0.01 |

|

|

11/1/2017 |

0.06 |

0.03 |

0.02 |

0.0050 |

0.06 |

0.02 |

0.02 |

|

|

12/1/2017 |

-0.01 |

0.05 |

0.03 |

0.0050 |

-0.01 |

0.04 |

0.02 |

|

|

1/1/2018 |

0.24 |

0.08 |

0.01 |

0.0050 |

0.24 |

0.08 |

0.00 |

|

|

2/1/2018 |

0.04 |

0.00 |

0.06 |

0.0050 |

0.04 |

0.00 |

0.05 |

|

|

3/1/2018 |

-0.04 |

-0.07 |

-0.04 |

0.0050 |

-0.05 |

-0.07 |

-0.04 |

|

|

4/1/2018 |

0.08 |

0.00 |

-0.03 |

0.0050 |

0.08 |

-0.01 |

-0.03 |

|

|

5/1/2018 |

0.04 |

-0.03 |

0.00 |

0.0050 |

0.04 |

-0.03 |

0.00 |

|

|

6/1/2018 |

0.04 |

-0.03 |

0.02 |

0.0050 |

0.04 |

-0.03 |

0.02 |

|

|

7/1/2018 |

0.05 |

0.10 |

0.00 |

0.0050 |

0.04 |

0.09 |

0.00 |

|

|

8/1/2018 |

0.13 |

0.00 |

0.04 |

0.0050 |

0.13 |

0.00 |

0.03 |

|

|

9/1/2018 |

0.00 |

-0.05 |

0.03 |

0.0050 |

-0.01 |

-0.05 |

0.03 |

|

|

10/1/2018 |

-0.20 |

-0.07 |

0.00 |

0.0050 |

-0.21 |

-0.07 |

0.00 |

|

|

11/1/2018 |

0.06 |

0.03 |

-0.07 |

0.0050 |

0.05 |

0.03 |

-0.07 |

|

|

12/1/2018 |

-0.11 |

-0.13 |

0.02 |

0.0050 |

-0.12 |

-0.14 |

0.01 |

|

|

1/1/2019 |

0.14 |

0.16 |

-0.09 |

0.0050 |

0.14 |

0.15 |

-0.10 |

|

|

2/1/2019 |

-0.05 |

0.02 |

0.08 |

0.0050 |

-0.05 |

0.02 |

0.07 |

|

|

3/1/2019 |

0.09 |

-0.05 |

0.03 |

0.0050 |

0.08 |

-0.06 |

0.02 |

|

|

4/1/2019 |

0.08 |

0.11 |

0.02 |

0.0050 |

0.08 |

0.10 |

0.01 |

|

|

5/1/2019 |

-0.08 |

-0.13 |

0.04 |

0.0050 |

-0.08 |

-0.14 |

0.03 |

|

|

6/1/2019 |

0.07 |

0.09 |

-0.07 |

0.0050 |

0.06 |

0.09 |

-0.07 |

|

|

7/1/2019 |

-0.01 |

0.06 |

0.07 |

0.0050 |

-0.02 |

0.05 |

0.06 |

|

|

8/1/2019 |

-0.05 |

-0.10 |

0.01 |

0.0050 |

-0.05 |

-0.11 |

0.01 |

|

|

9/1/2019 |

-0.02 |

0.06 |

-0.02 |

0.0050 |

-0.03 |

0.06 |

-0.02 |

|

|

10/1/2019 |

0.02 |

0.07 |

0.02 |

0.0050 |

0.02 |

0.07 |

0.01 |

|

|

11/1/2019 |

0.01 |

0.07 |

0.02 |

0.0050 |

0.01 |

0.06 |

0.02 |

|

|

12/1/2019 |

0.03 |

0.06 |

0.03 |

0.0050 |

0.02 |

0.05 |

0.03 |

|

|

1/1/2020 |

0.09 |

-0.07 |

0.03 |

0.0050 |

0.08 |

-0.07 |

0.02 |

|

|

SECTION 3 |

Average Excess Return |

0.0231 |

0.0056 |

0.0056 |

||||

|

Std. Deviation of Return |

0.0801 |

0.0700 |

0.0354 |

|||||

|

Beta |

-0.4315 |

-0.5539 |

|

|||||

|

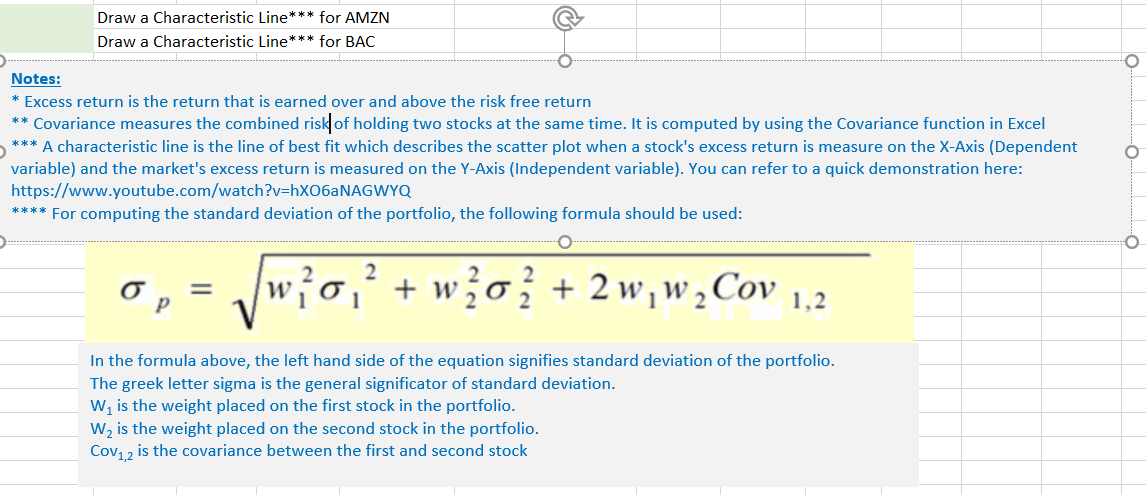

Covariance** |

-0.00053 |

-0.000675 |

|

Step by step

Solved in 4 steps with 4 images