A company has a liability of 410,000,000 that is must pay in 26 years. If it can round up the annual interest rate of 3.7 percent how much must it deposit today to fund this liability?

A company has a liability of 410,000,000 that is must pay in 26 years. If it can round up the annual interest rate of 3.7 percent how much must it deposit today to fund this liability?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 3RE: Pinecone Company has plan assets of 500,000 at the beginning of the current year and expects to earn...

Related questions

Question

A company has a liability of 410,000,000 that is must pay in 26 years. If it can round up the annual interest rate of 3.7 percent how much must it deposit today to fund this liability?

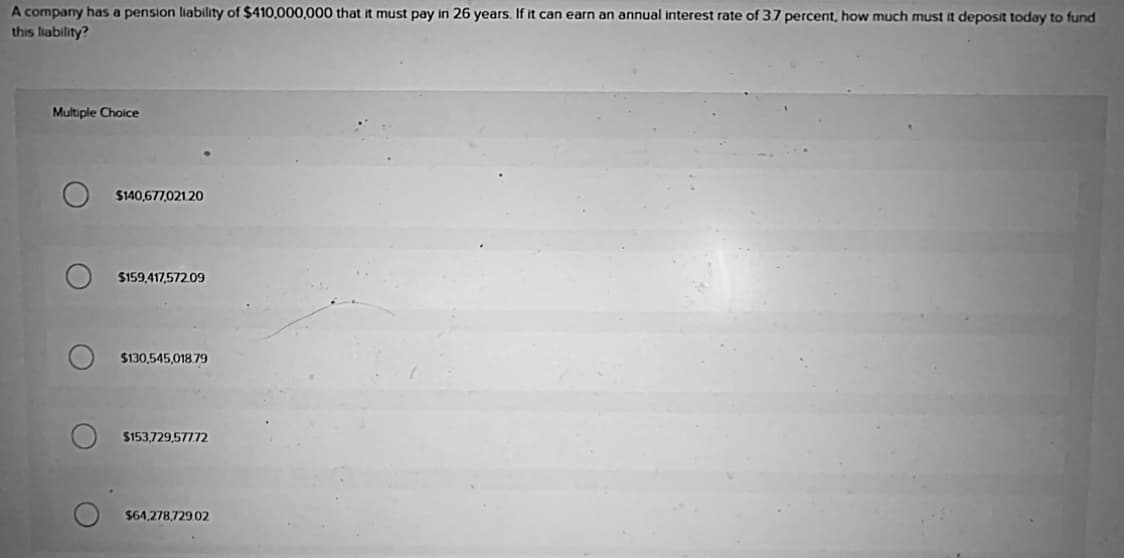

Transcribed Image Text:A company has a pension liability of $410,000,000 that it must pay in 26 years. If it can earn an annual interest rate of 3.7 percent, how much must it deposit today to fund

this liability?

Multiple Choice

$140,677,021.20

$159,417,572.09

$130,545,018.79

$153,729,577.72

$64,278,729.02

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT