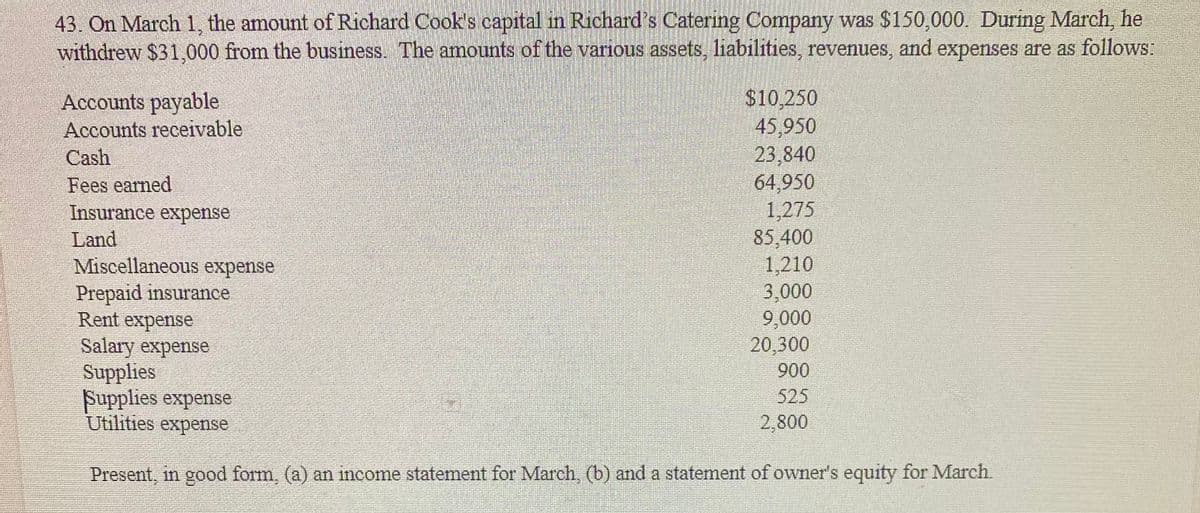

43. On March 1, the amount of Richard Cook's capital in Richard's Catering Company was $150,000. During March, he withdrew $31,000 from the business. The amounts of the various assets, liabilities, revenues, and expenses are as follows: $10,250 45,950 23,840 64,950 1,275 85,400 1,210 3,000 9,000 20,300 Accounts payable Accounts receivable Cash Fees earned Insurance expense Land Miscellaneous expense Prepaid insurance Rent expense Salary expense Supplies Supplies expense Utilities expense 900 525 2,800 Present, in good form, (a) an income statement for March, (b) and a statement of owner's equity for March.

43. On March 1, the amount of Richard Cook's capital in Richard's Catering Company was $150,000. During March, he withdrew $31,000 from the business. The amounts of the various assets, liabilities, revenues, and expenses are as follows: $10,250 45,950 23,840 64,950 1,275 85,400 1,210 3,000 9,000 20,300 Accounts payable Accounts receivable Cash Fees earned Insurance expense Land Miscellaneous expense Prepaid insurance Rent expense Salary expense Supplies Supplies expense Utilities expense 900 525 2,800 Present, in good form, (a) an income statement for March, (b) and a statement of owner's equity for March.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 20PC: Analyzing Transactions. Using the analytical framework, indicate the effect of the following related...

Related questions

Question

Directions shown in picture attached

Transcribed Image Text:43. On March 1, the amount of Richard Cook's capital in Richard's Catering Company was $150,000. During March, he

withdrew $31,000 from the business. The amounts of the various assets, liabilities, revenues, and expenses are as follows:

$10,250

45,950

23,840

64,950

1,275

85,400

1,210

3,000

9,000

20,300

900

525

2,800

Accounts payable

Accounts receivable

Cash

Fees earned

Insurance expense

Land

Miscellaneous expense

Prepaid insurance

Rent expense

Salary expense

Supplies

Supplies expense

Utilities expense

Present, in good form, (a) an income statement for March, (b) and a statement of owner's equity for March.

Expert Solution

Step 1

Financial statement is prepared from the trial balance which include :-

- Profit and loss and other comprehensive income statement where all revenue and expenses will be shown and net profit or loss is calculated.

- Statement of financial position where all the assets , liabilities and equities has been shown.

Trial balance means a statement which include all the debit or credit balances of accounts from ledgers and should match as so to pass the test of equality of debit and credit.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning