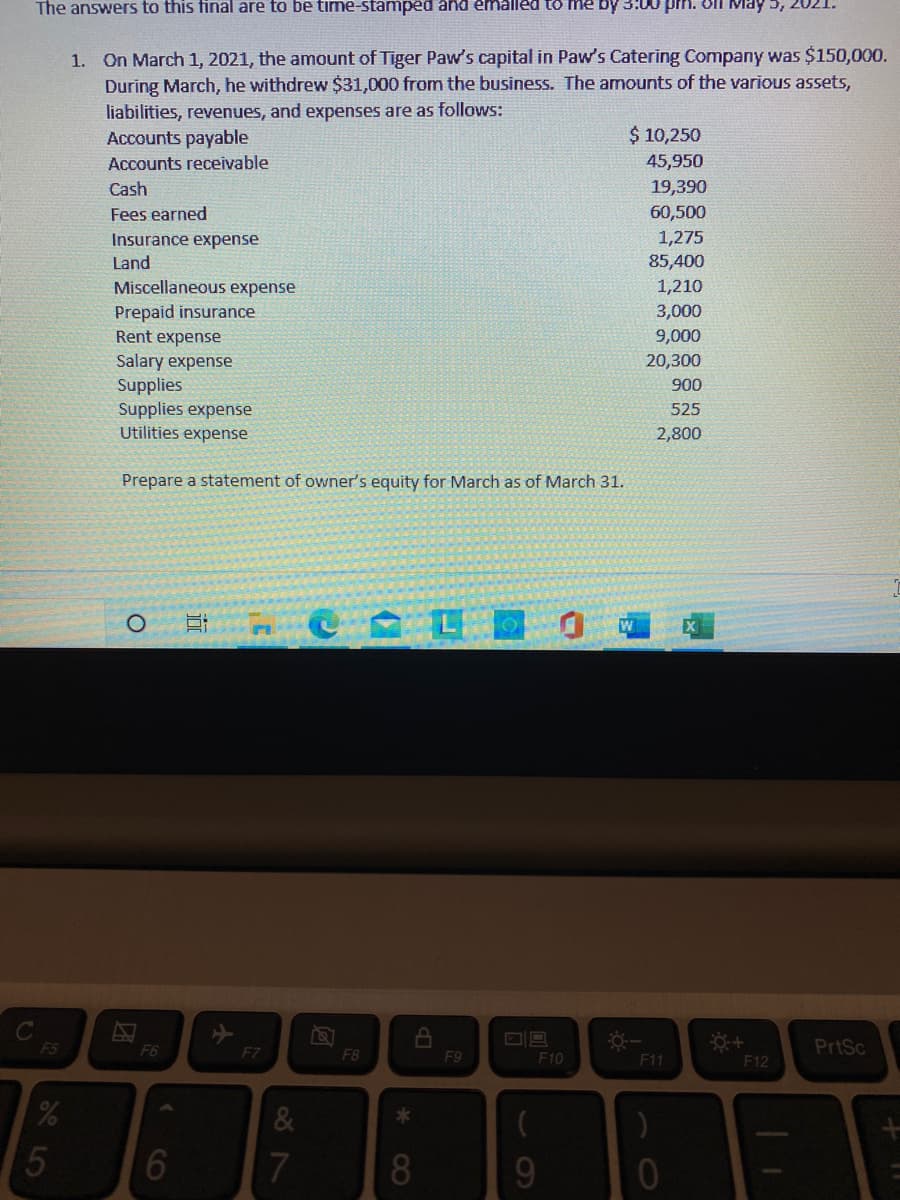

On March 1, 2021, the amount of Tiger Paw's capital in Paw's Catering Comp During March, he withdrew $31,000 from the business. The amounts of the liabilities, revenues, and expenses are as follows: Accounts payable $ 10,250 Accounts receivable 45,950

Q: Julius Caesar, tax consultant, began his practice, on Dec. 1, 2020. The transactions of the firm are…

A: Total current assets include cash, supplies on hand and receivable. Total assets include total…

Q: The following Trial Balance relates to the affairs of AUGUSTINE for the year ended 31st December…

A:

Q: On March 1, 2021, Rey Fernan Refozar, a medical board topnotcher, started his medical practice.…

A: Journal Entries are prepared to record transaction in the books of account. Generally Accepted…

Q: Mr. Igiria started business on January 01, 2018, with cash of Kshs. 50,000, furniture of Kshs.…

A: "Since you have asked multiple sub part question we will solve the first three sub part question for…

Q: For the past several years, M. Adam has operated a part-time business from his home. As of April 1,…

A: Since you have asked multiple questions we will solve the first question for you,If you want any…

Q: Dean Winchester opened Ghost Cleaners on June 1, 2021. He is the sole owner of the corporation.…

A: Investment in Common stock in Ghost Cleaners, Inc. Date Particulars Amount Date Particulars…

Q: For the past several years, M. Adam has operated a part-time business from his home. As of April 1,…

A: Income Statement: Income statement is one of the financial statement which helps the corporations to…

Q: On April 1, 2021, Roland Smith organized a business called Friendly Trucking During April, the…

A: Journal entry is a method to record the financial transaction in books of accounts.

Q: The amounts of the assets and liabilities of Nordic Travel Agency at December 31, 2019, the end of…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: For the past several years, M. Adam has operated a part-time business from his home. As of April 1,…

A: Journal entries are entries recorded in the books of accounts. Journal entries are recorded from the…

Q: ABC Company started its business operations on November 2, 2021. The following were the transactions…

A: Owner Capital means the amount that belong to the owner of the business. Any profit will increase…

Q: Santos started a retail merchandise business on January 1, 2021. During the year ended December 31,…

A: Inventory purchases can be computed by Adding payments to trade creditor and account payable balance…

Q: On April 1, 2019, Betty Booth incorporated a consulting business known as Booth Consulting. Booth…

A: Since you have asked for the preparation of Financial Statements, we have prepared the 1st three…

Q: For the past several years, M. Adam has operated a part-time business from his home. As of April 1,…

A: Since you have asked multiple questions we will solve the first question for you,If you want any…

Q: The account balances of Sentinel Travel Service for the year ended August 31, 2019, are listed…

A:

Q: Prepare a statement of owner’s equity.

A: Computation of statement of equity is shown below :

Q: For the past several years, M. Adam has operated a part-time business from his home. As of April 1,…

A: Income statement cmputes net income of the reported period which is calculated by deducting expenses…

Q: Dean Winchester opened Ghost Cleaners on June 1, 2021. He is the sole owner of the corporation.…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: The following transactions occurred during December 31, 2021, for the Falwell Company. 1. A…

A: Here The accounting period end on 31 December 2021. Therefore we have to record the expense related…

Q: RR Claro, a public relation man, opened his business on May 1, 2020. Below are the transactions…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: Transactions for the month of December 2020 are as follows: 1-Dec Rey Millora opened an account…

A: What is meant by Journal Entries? It is the first step to record the financial transactions in the…

Q: Julius Caesar, tax consultant, began his practice, on Dec. 1, 2020. The transactions of the firm are…

A:

Q: In June 2019, mr.zeeshan organized a corporation to provide crop dusting services .the Company,…

A: Journal entries are passed following the golden rules of accounting. Debit all assets and expenses…

Q: FDN Accounting Services started operations on November 1, 2021. The following were the transactions…

A: 1. The increase in the total liabilities of the business will be equal to the amount of loan…

Q: Prepare a (1) income statement, (2) statement of owners equity, (3) balance sheet of march 31

A: 1. Prepare an income statement.

Q: Crispin Santos started a retail merchandise business on January 1, 2021. During the year ended…

A: A purchase is the practice of obtaining possession of a specific asset, property, item, or right by…

Q: On June 1, 2020, Sam Near created a new travel agency called Tours-For-Less. These activities…

A: 101 Cash (amount in $) Date Particulars Amount Date Particulars Amount 01.06 24.06…

Q: The following transactions occurred during June 2020 for Rashid Est. June 1 Invested BD64,000 cash…

A: Journaling is the process of recording business transactions in accounting records. This activity…

Q: For the past several years, M. Adam has operated a part-time business from his home. As of April 1,…

A:

Q: On December 2020, Miranda Right started Right consulting, a new business, and completed the…

A: If any money is taken from the business for personal use ,it is known as drawings. Debit is given to…

Q: On November 1, 2020, Aleli Gomuna purchased a pest – control company from its previous owner. Aleli…

A: Financial Transaction Worksheet In the financial transaction work sheet it includes the details of…

Q: Dyle Lagomo, Attorney-at-Law, opened his office on September 1, 2019. The following transactions…

A: As per accounting equation of the business, total assets must be equal to total liabilities and…

Q: On January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following…

A:

Q: Requirements: 1 Journalize the December transactions using a general journal and the account titles…

A: You have posted three questions under a single question. A journal entry for the whole month of…

Q: Using the information below, compute for the Ending Capital of the owner for the year ended December…

A: Capital of the Business can be calculated by subtracting total liabilities from total assets in the…

Q: r.Karue started business on January 01, 2018, with cash of Kshs. 50,000, furniture of Kshs. 10,000,…

A: Statement of Affairs as on 01.01.2018 Liability Amount (In Kshs) Asset Amount (In Kshs)…

Q: James Herrera, the owner of spa, has the following account balances as of February 1, 2019 as well…

A: The question seeks to find the revenue generated by James from the information of balances of…

Q: Ms. Ang put up an accounting firm on Nov. 1, 2021. The registered name of the business is "Ang…

A: Every organization is required to record its financial transactions which helps them to determine…

Q: For the past several years, M. Adam has operated a part-time business from his home. As of April 1,…

A: Journal entries are recording of the transaction in the accounting journal in a chronological order.…

Q: For the past several years, M. Adam has operated a part-time business from his home. As of April 1,…

A: Prepration of Ledger in the books of Adam & Family Inc. for the month of…

Q: The following transactions occurred during 2021 for the Beehive Honey Corporation: Feb. 1…

A: Interest expense (Feb 1)=$12,000×10%×1112=$1,100

Q: On January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following…

A: The day to day transactions are recorded in Journal and then the transactions are posted to ledger.…

Q: On March 1, 2020, Michael Kerrigan established a house arrangement business under the name Michael…

A: Journal entry is also known as the primary recording of transactions in chronological order. It…

Q: Prepare the Income Statement for 2019 and Balance Sheet for December 31, 2019

A: Income statements and balance sheets are important financial statements that tell a lot about the…

Q: On April 1, 2021, Betty Trout created a new self-storage company called Betty Storage Company. The…

A: T- Account

Q: ransactions for the month of December 2020 are as follows: 1-Dec Rey Millora opened an account with…

A: General Ledger: All company's transactions are recorded through general ledger to prepare the…

Q: On June 1, 2020, Sam Near created a new travel agency called Tours-For-Less. These activities…

A: Adjusting entries includes the transactions which are left to be adjusted in the financial statement…

Q: Below are transactions for Wolverine Company during 2021.1. On December 1, 2021, Wolverine receives…

A: The adjusting entries are prepared at the end of the year to show the correct amount of expenses and…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?

- Assume that a lawyer bills her clients $15000 on June 30, for services rendered during June. The lawyer collects $8500 of the billings during July and the remainder in August. Under the accrual basis of accounting, when would the lawyer record the revenue for the fees? A. June, $15,000; July, $0; and August, $0 B. June, $0; July, $6,500; and August, $8,500 C. June, $8,500; July, $6,500; and August, $0 D. June, $0; July, $8,500; and August, $6,500In December 2019, Swanstrom Inc. receives a cash payment of $3,500 for services performed in December 2019 and a cash payment of S4,500 for services to be performed in January 2020. Swanstrom also receives the December utility bill for S600 but does not pay this bill until 2020. For 2019, under the accrual basis of accounting, Swanstrom would recognize: a. $8,000 of revenue and $600 of expense. b. $8,000 of revenue and $0 of expense. c. $3,500 of revenue and $600 of expense. d. $3,500 Of revenue and $0 of expense.On October 31, the Vermillion Igloos Hockey Club received 800,000 in cash in advance for season tickets for eight home games. The transaction was recorded as a debit to Cash and a credit to Unearned Admissions. By December 31, the end of the fiscal year, the team had played three home games and received an additional 450,000 cash admissions income at the gate. a. Journalize the adjusting entry as of December 31. b. List the title of the account and the related balance that will appear on the income statement. c. List the title of the account and the related balance that will appear on the balance sheet.

- Adam Smith has a Capital balance of $14,000 at the end of the business fiscal year July 31, 2023. The company’s adjusted account balances include the following temporary accounts with normal balances: Service fee earned................... $35,000 Salaries expense ............... ......$7,000 Telephone expense.....................$450 Insurance expense .....................$250 Adam Smith, withdrawals ..........$3,000 Utilities expense .................... $1,500 Required: From the above information; a) Prepare the closing entries for July 2023. b) After all the closing entries are journalized and posted, what is the balance of the Adam Smith’s Capital?The following transactions occurred during December 31, 2021, for the Falwell Company. A three-year fire insurance policy was purchased on July 1, 2021, for $12,240. The company debited insurance expense for the entire amount. Depreciation on equipment totaled $12,250 for the year. Employee salaries of $16,500 for the month of December will be paid in early January 2022. On November 1, 2021, the company borrowed $190,000 from a bank. The note requires principal and interest at 12% to be paid on April 30, 2022. On December 1, 2021, the company received $6,000 in cash from another company that is renting office space in Falwell’s building. The payment, representing rent for December, January, and February was credited to deferred rent revenue. On December 1, 2021, the company received $6,000 in cash from another company that is renting office space in Falwell’s building. The payment, representing rent for December, January, and February was credited to rent revenue rather than deferred…Brothers Harry and Herman Hausyerday began operations of their machine shop (H & H Tool,Inc.) on January 1, 2020. The annual reporting period ends December 31. The trial balance onJanuary 1, 2021, follows (the amounts are rounded to thousands of dollars to simplify): Transactions and events during 2021 (summarized in thousands of dollars) follow:a. Borrowed $12 cash on March 1 using a short-term note.b. Purchased land on March 2 for future building site; paid cash, $9.c. Issued additional shares of common stock on April 3 for $23.d. Purchased software on July 4, $10 cash.e. Purchased supplies on account on October 5 for future use, $18.f. Paid accounts payable on November 6, $13.g. Signed a $25 service contract on November 7 to start February 1, 2022.h. Recorded revenues of $160 on December 8, including $40 on credit and $120 collectedin cash.i. Recognized salaries and wages expense on December 9, $85 paid in cash.j. Collected accounts receivable on December 10, $24.Data for…

- TA services were formed on May 1, 2020. The following transactions took place during the first month. May 1 Mr. Tarek Ahmed invested $80,000 in the business, as its sole owner.May 2 Hired two employees, who will be paid a salary $1,000 per month.May 3 Paid $20000 in advance for rent of a warehouse.May 4 Purchased furniture & equipment costing $30,000. $10,000 paid in cash and $20,000 payable in next 6 months.May 5 Paid $22,000 for 1-year insurance policy.May 7 Purchase basic office supplies for $500 on account.May 8 $1,500 received in advance for which services to be performed in June.May 10 Revenue earned in cash $20000 and on account $10000.May 12 Payment to creditor for May 7 transactions.May 16 Received from debtors for May 10 transaction.May 22 Withdraw by owner $ 700.May 27 Purchase of pick-up van $ 5000 on account. Instructions:(a) Pass the Journal Entry & Post to ledger.(b) Prepare Trial Balance.On April 1, 2021, Nels Ferrer organized a business called Friendly Trucking. During April, the company entered into the following transactions: April 1 - Nels Ferrer deposited additional P500,000 cash in a bank account in the name of the business 1 - Purchased for P250,000 a transportation equipment to be use in the business. Nels paid 50% as down payment while the balance will be paid on May 15, 2020 1 - Paid rental for the month of April, P5,000 4 - Collected accounts from previous month, P13,200 5 - Earned and collected trucking income from Ryan, P8,000 8 - Earned trucking income from Jesper, P30,000 on account. Jesper will pay on May 8, 2020 10 - Paid salaries of drivers, P10,000 15 - Rented the vehicle to Joshua for P35,000, Joshua paid P20,000 on that date and the balance on April 20 18 - Paid electric bills for the month, P2,000 20 - Collected from Joshua the balance of his April 15 account 25 - Purchased office supplies, P2,300 29 - Earned and…The Jamesway Corporation had the following situations on December 2021. Employee salaries for the month of December totaling $16,000 will be paid on January 7, 2022. On August 31, 2021, Jamesway borrowed $60,000 from a local bank. A note was signed with principal and 8% interest to be paid on August 31, 2022. If none of the adjusting journal entries were recorded, would assets, liabilities, and shareholders’ equity on the 12/31/2021 balance sheet be higher or lower and by how much? This is the question I am stuck on. Does the employees salaries not factor in the December 2021 figures because the employees are paid on January 2022? How do I figure the amounts of liability and equity affected for number two, the note with 8% interest?