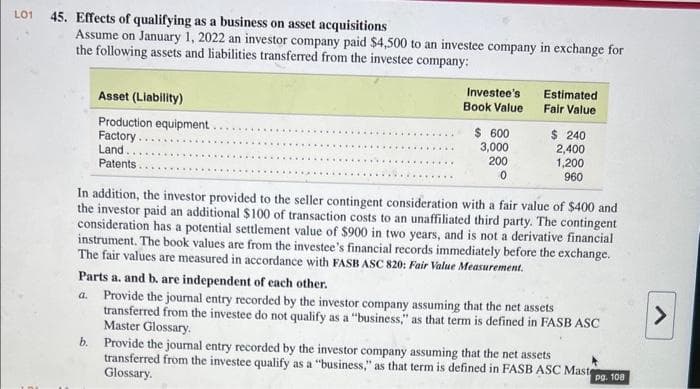

45. Effects of qualifying as a business on asset acquisitions Assume on January 1, 2022 an investor company paid $4,500 to an investee company in exchange for the following assets and liabilities transferred from the investee company: Asset (Liability) Production equipment. Factory. Land. Patents. Investee's Book Value b. $ 600 3,000 200 0 Estimated Fair Value $ 240 2,400 1,200 960 In addition, the investor provided to the seller contingent consideration with a fair value of $400 and the investor paid an additional $100 of transaction costs to an unaffiliated third party. The contingent consideration has a potential settlement value of $900 in two years, and is not a derivative financial instrument. The book values are from the investee's financial records immediately before the exchange. The fair values are measured in accordance with FASB ASC 820: Fair Value Measurement. Parts a. and b. are independent of each other. a. Provide the journal entry recorded by the investor company assuming that the net assets transferred from the investee do not qualify as a "business," as that term is defined in FASB ASC Master Glossary. Provide the journal entry recorded by the investor company assuming that the net assets transferred from the investee qualify as a "business," as that term is defined in FASB ASC Maste Glossary. Pg. 108

45. Effects of qualifying as a business on asset acquisitions Assume on January 1, 2022 an investor company paid $4,500 to an investee company in exchange for the following assets and liabilities transferred from the investee company: Asset (Liability) Production equipment. Factory. Land. Patents. Investee's Book Value b. $ 600 3,000 200 0 Estimated Fair Value $ 240 2,400 1,200 960 In addition, the investor provided to the seller contingent consideration with a fair value of $400 and the investor paid an additional $100 of transaction costs to an unaffiliated third party. The contingent consideration has a potential settlement value of $900 in two years, and is not a derivative financial instrument. The book values are from the investee's financial records immediately before the exchange. The fair values are measured in accordance with FASB ASC 820: Fair Value Measurement. Parts a. and b. are independent of each other. a. Provide the journal entry recorded by the investor company assuming that the net assets transferred from the investee do not qualify as a "business," as that term is defined in FASB ASC Master Glossary. Provide the journal entry recorded by the investor company assuming that the net assets transferred from the investee qualify as a "business," as that term is defined in FASB ASC Maste Glossary. Pg. 108

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 7P: Hamilton Companys balance sheet on January 1, 2019, was as follows: Korbel Company is considering...

Related questions

Question

Don't give answer in image format

Transcribed Image Text:LO1 45. Effects of qualifying as a business on asset acquisitions

Assume on January 1, 2022 an investor company paid $4,500 to an investee company in exchange for

the following assets and liabilities transferred from the investee company:

Asset (Liability)

Production equipment.

Factory

Land..

Patents.

Investee's

Book Value

b.

$ 600

3,000

200

0

Estimated

Fair Value

$ 240

2,400

1,200

960

In addition, the investor provided to the seller contingent consideration with a fair value of $400 and

the investor paid an additional $100 of transaction costs to an unaffiliated third party. The contingent

consideration has a potential settlement value of $900 in two years, and is not a derivative financial

instrument. The book values are from the investee's financial records immediately before the exchange.

The fair values are measured in accordance with FASB ASC 820: Fair Value Measurement.

Parts a. and b. are independent of each other.

a.

Provide the journal entry recorded by the investor company assuming that the net assets

transferred from the investee do not qualify as a "business," as that term is defined in FASB ASC

Master Glossary.

Provide the journal entry recorded by the investor company assuming that the net assets

transferred from the investee qualify as a "business," as that term is defined in FASB ASC Maste

Glossary.

Pg. 108

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning