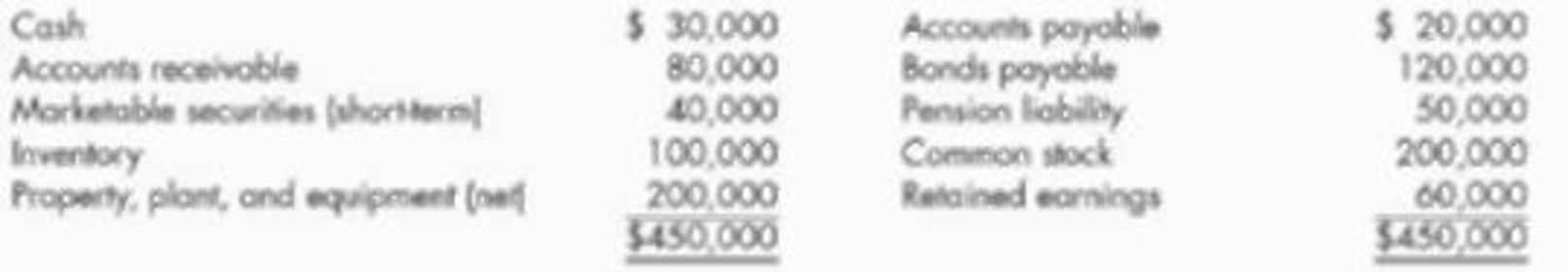

Hamilton Company’s balance sheet on January 1, 2019, was as follows:

Korbel Company is considering purchasing Hamilton (a privately held company) and discovers the following about Hamilton:

- a. No allowance for doubtful accounts has been established. A $10,000 allowance is considered appropriate.

- b. Marketable securities are valued at cost. The current market value is $60,000.

- c. The LIFO inventory method is used. The FIFO inventory of $140,000 would be used if the company is acquired.

- d. Land, included in property, plant, and equipment, which is recorded at its cost of $50,000, is worth $120,000. The remaining property, plant, and equipment is worth 10% more than its

depreciated cost. - e. The company has an unrecorded trademark that is worth $70,000.

- f. The company’s bonds are currently trading for $130,000.

- g. The pension liability is understated by $40,000.

Required:

- 1. Compute the amount of

goodwill if Korbel agrees to pay $500,000 cash for Hamilton. - 2. Next Level What are the reasons that the book value of Hamilton’s net identifiable assets differ from their market value?

- 3. Prepare the

journal entry to record the acquisition on the books of Korbel assuming Hamilton is liquidated. - 4. If Korbel agrees to pay only $400,000 cash, how much goodwill exists?

- 5. If Korbel pays only $400,000 cash, prepare the journal entry to record the acquisition on its books, assuming Hamilton is liquidated.

1.

Calculate the amount of goodwill of Company H.

Explanation of Solution

Goodwill: Goodwill is the good reputation developed by a company over years. This is recorded as an intangible asset, and is quantified when other company acquires. Goodwill should be recorded only when one company is acquired by another company. Goodwill value would be impaired, if the book value of goodwill is less than fair market value.

Calculate the amount of goodwill of Company H:

| Particulars | Amount ($) |

| Amount willing to pay | $500,000 |

| Less: Identifiable net assets | $415,000 |

| Goodwill | $85,000 |

Table (1)

Compute the identifiable net assets:

| Assets | Amount ($) |

| Cash | $30,000 |

| Accounts receivable (net) (1) | 70,000 |

| Marketable securities (short-term) | 60,000 |

| Inventory | 140,000 |

| Land | 120,000 |

| Plant Property &Equipment (2) | 165,000 |

| Trademark | 70,000 |

| Total assets (a) | $655,000 |

| Liabilities | |

| Accounts payable | 20,000 |

| Bonds payable | 130,000 |

| Pension liability | 90,000 |

| Total liabilities (b) | $240,000 |

| Identifiable net assets | 415,000 |

Table (2)

Working note (1):

Compute the accounts receivable (net):

Working note (2):

Compute the plant, property and equipment (net):

2.

State the reason for the difference in the book value of Company H’s identifiable net assets from the market value.

Explanation of Solution

Identifiable intangibles: The identifiable intangibles are the intangible assets that can be easily separated from the company, and it would be sold, transferred, licensed, rented or exchanged. Examples: trademarks, patents, copyrights, franchises, customer lists and relationships, non-compete agreements, and licenses.

The book value of H Company’s identifiable net assets differs from its market value for the following reason:

- Some of the assets of Company H are listed on the balance sheet at amounts other than their market value. For instance: The marketable securities are listed at cost and not at a fair value, likewise the inventory is valued using LIFO, instead of FIFO. The land is reported at cost but not at its market value, if it would have reported at its market value, then the cost would be much higher. Equipment is reported at depreciated cost while its market value is much higher.

- Company H has a valuable internally developed trademark that is not recorded.

- An unidentifiable intangible asset (goodwill) exists. However, it is not reported on H Company’s books.

3.

Prepare journal entry for the given transaction.

Explanation of Solution

Prepare journal entry in the books of Company K assume that Company H has been liquidated.

| Date | Account Title and Explanation | Post Ref |

Debit ($) | Credit ($) |

| Cash | 30,000 | |||

| Accounts Receivable | 70,000 | |||

| Marketable Securities | 60,000 | |||

| Inventory | 140,000 | |||

| Land | 120,000 | |||

| Property, Plant, and Equipment | 165,000 | |||

| Trademark | 70,000 | |||

| Goodwill | 85,000 | |||

| Accounts Payable | 20,000 | |||

| Bonds Payable | 130,000 | |||

| Pension Liability | 90,000 | |||

| Cash | 500,000 | |||

| (To record the acquisition of company H) |

Table (3)

4.

Compute the amount of goodwill that exist, when Company K agrees pay only $400,000 cash.

Explanation of Solution

Compute the amount of goodwill that exist, when Company K agrees pay only $400,000 cash

| Particulars | Amount ($) |

| Amount willing to pay | $400,000 |

| Less: Identifiable net assets | 415,000 |

| Goodwill | (15,000) |

Table (4)

5.

Prepare journal entry for the given transaction.

Explanation of Solution

Prepare journal entry in the books of Company K assume that Company H had paid only $400,000.

| Date | Account Title and Explanation | Post Ref |

Debit ($) | Credit ($) |

| Cash | 30,000 | |||

| Accounts Receivable | 70,000 | |||

| Marketable Securities | 60,000 | |||

| Inventory | 140,000 | |||

| Land | 120,000 | |||

| Property, Plant, and Equipment | 165,000 | |||

| Trademark | 70,000 | |||

| Accounts Payable | 20,000 | |||

| Bonds Payable | 130,000 | |||

| Pension Liability | 90,000 | |||

| Cash | 400,000 | |||

| Gain on purchase of Company H | 15,000 | |||

| (To record the gain on acquisition of company H) |

Table (5)

Want to see more full solutions like this?

Chapter 12 Solutions

Intermediate Accounting: Reporting And Analysis

- In 2020, Frost Company, which began operations in 2018, decided to change from LIFO to FIFO because management believed that FIFO belter represented the flow of their inventory. Management prepared the following analysis showing the effect of this change: Frost reported net income of 2,500,000, 2,400,000, and 2,100,000 in 2018, 2019, and 2020, respectively. The tax rate is 21%. Required: 1. Prepare the journal entry necessary to record the change. 2. What amount of net income would Frost report in 2018, 2019, and 2020? 3. If Frosts employees received a bonus of 10% of income before deducting the bonus and income taxes in 2018 and 2019, what would be the effect on net income for 2018, 2019, and 2020?arrow_forwardCamille, Inc., sold $130,000 in inventory to Eckerle Company during 2020 for $250,000. Eckerle resold $89,000 of this merchandise in 2020 with the remainder to be disposed of during 2021. Assuming that Camille owns 20 percent of Eckerle and applies the equity method, what journal entry is recorded at the end of 2020 to defer the intra-entity gross profit? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.)arrow_forwardMaximus Company sold its inventory for P300,000 to Maxwell on January 2,2021 and received a one year Note bearing an interest rate or 12% for the full amount. On December 31,2021, Maxim determined based on Maxwell’s recent financial crisis, there’s a delay and change in the pattern of collection. The delay and change in the pattern show’s that P150,000 will be due on December 31, 2022 and 100,000 will be due on December 31,2023. What amount of impairment loss should Maxwell Company recognized on December 31,2021? none P86,000 P122,352 P136,701arrow_forward

- Griggs Company bought 30% of Jackson Corporation in 2020. During 2020, Jackson reported net income in the amount of P400,000 and declared and paid dividends in the amount of P50,000. Griggs mistakenly accounted for the investment using the cost method instead of the equity method. What effect would this error have on the investment account and net income, respectively, for 2020? Choices: Overstated by P105,000; understated by P105,000. Understated by P105,000; understated by P105,000. Understated by P120,000; overstated by P105,000. Overstated by P120,000; overstated by P120.000.arrow_forwardBirch Company is considering purchasing EKC Company. EKC's balance sheet at December 31, 2019, is as follows: Cash $51,000 Current liabilities $56,000 Accounts receivable 76,000 Bonds payable 194,000 Inventory 130,000 Common stock 290,000 Property, plant, and equipment (net) 630,000 Retained earnings 347,000 $887,000 $887,000 At December 31, 2019, Birch discovered the following about EKC: No allowance for uncollectible accounts has been established. An allowance of $5,200 is considered appropriate. The LIFO inventory method has been used. The FIFO inventory method would be used if EKC were purchased by Birch. The FIFO inventory valuation of the December 31, 2019, ending inventory would be $181,000. The fair value of the property, plant, and equipment (net) is $780,000. The company has an unrecorded patent that is worth $100,000. The book values of the current liabilities and bonds payable are the same as their market values. Required: 1. Compute the value…arrow_forwardOn January 1, 2020, the Soondubu Stew Corporation purchased equity securities to be held for trading purposes for P2,000,000. The company also paid commissions, taxes and other transaction costs amounting to P50,000. The securities had fair values at December 31, 2020 and 2021, respectively: P1,750,000 and P2,100,000. No securities were sold during 2020. What amount of unrealized gain (loss) should be reported in the 2020 profit or loss section of the statement of comprehensive income?Required to answer. Single choice. -P100,000 -P350,000 -(P250,000) -(P200,000)arrow_forward

- During 2020 Carne Corporation transferred inventory to Nolan Corporation and agreed to repurchase the merchandise early in 2021. Nolan then used the inventory as collateral to borrow from Norwalk Bank, remitting the proceeds to Carne. In 2021 when Carne repurchased the inventory, Nolan used the proceeds to repay its bank loan.On whose books should the cost of the inventory appear at the December 31, 2020 balance sheet date? Nolan Corporation Carne Corporation Nolan Corporation, with Carne making appropriate note disclosure of the transaction Norwalk Bankarrow_forwardOn January 1, 2020, the Gim Corporation purchased equity securities for P2,000,000. The company also paid commissions, taxes and other transaction costs amounting to P50,000. Because the securities were not acquired for immediate trading, Gim exercised the option to take the change in fair value through other comprehensive income. The securities had fair values at December 31, 2020 and 2021, respectively: P1,750,000 and P2,100,000. No securities were sold during 2020. What amount of unrealized gain (loss) should be reported in the 2020 statement of financial position? a. P250,000 cumulative unrealized loss b. P100,000 cumulative unrealized gain c. P200,000 cumulative unrealized loss d. P50,000 cumulative unrealized gainarrow_forwardOn January 1, 2020, the Gim Corporation purchased equity securities for P2,000,000. The company also paid commissions, taxes and other transaction costs amounting to P50,000. Because the securities were not acquired for immediate trading, Gim exercised the option to take the change in fair value through other comprehensive income. The securities had fair values at December 31, 2020 and 2021, respectively: P1,750,000 and P2,100,000. No securities were sold during 2020. What amount of unrealized gain (loss) should be reported in the 2020 statement of financial position?Required to answer. Single choice.arrow_forward

- On January 1, 2020, the Stew Corporation purchased equity securities to be held for trading purposes for $2,000,000. The company also paid commissions, taxes and other transaction costs amounting to $50,000. The securities had fair values at December 31, 2020 and 2021, respectively: $1,750,000 and $2,100,000. No securities were sold during 2020. What amount of unrealized gain (loss) should be reported in the 2020 profit or loss section of the statement of comprehensive income?arrow_forwardOn January 1, 2020, the Pacita Corporation purchased equity securities for P2,000,000. The company also paid commission, taxes and other transaction costs amounting to P50,000. Because the securities were acquired not for immediate trading, Pacita exercised its option to measure the change in fair value through other comprehensive income. The securities had the following market values at December 31, 2020 and 2021, respectively: P1,750,000 and P2,100,000. No securities were sold during 2020 and 2021. What amount of unrealized gain or loss should be reported in December 31, 2021 statement of financial position as a component of shareholders’ equity?arrow_forwardVirginia Corp. owned all of the voting common stock of Stateside Co. Both companies use the perpetual inventory method, and Virginia decided to use the partial equity method to account for this investment. During 2020, Virginia made cash sales of $400,000 to Stateside. The gross profit rate was 30% of the selling price. By the end of 2020, Stateside had sold 75% of the goods to outside parties for $420,000 cash. Prepare journal entries for Virginia and Stateside to record the sales/purchases during 2020.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning