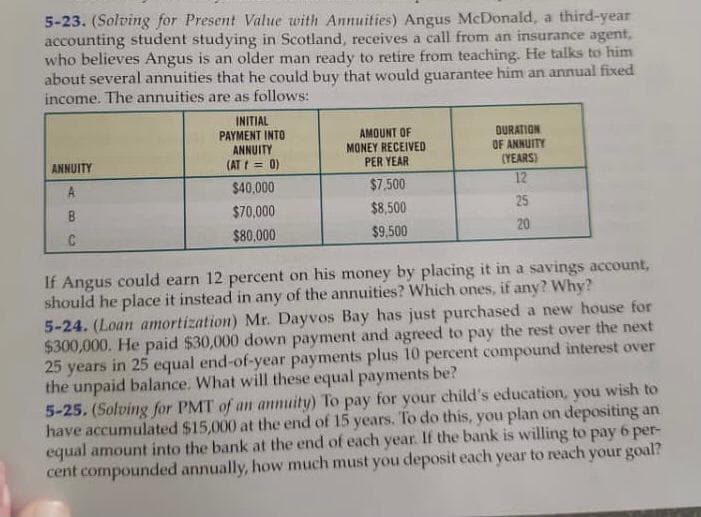

5-23. (Solving for Present Value with Annuities) Angus McDonald, a third-year accounting student studying in Scotland, receives a call from an insurance agent, who believes Angus is an older man ready to retire from teaching. He talks to him about several annuities that he could buy that would guarantee him an annual fixed income. The annuities are as follows: INITIAL PAYMENT INTO ANNUITY (AT = 0) AMOUNT OF MONEY RECEIVED PER YEAR DURATION OF ANNUITY (YEARS) ANNUITY $40,000 $7.500 12 $70,000 $8,500 25 C $80,000 $9,500 20 If Angus could earn 12 percent on his money by placing it in a savings account, should he place it instead in any of the annuities? Which ones, if any? Why? 5-24. (Loan amortization) Mr. Dayvos Bay has just purchased a new house for $300,000. He paid $30,000 down payment and agreed to pay the rest over the next 25 in 25 equal end-of-year payments plus 10 percent compound interest over years the unpaid balance. What will these equal payments be? 5-25. (Solving for PMT of an annuity) To pay for your child's education, you wish to have accumulated $15,000 at the end of 15 years. To do this, you plan on depositing an equal amount into the bank at the end of each year. If the bank is willing to pay 6 per- cent compounded annually, how much must you deposit each year to reach your goal?

5-23. (Solving for Present Value with Annuities) Angus McDonald, a third-year accounting student studying in Scotland, receives a call from an insurance agent, who believes Angus is an older man ready to retire from teaching. He talks to him about several annuities that he could buy that would guarantee him an annual fixed income. The annuities are as follows: INITIAL PAYMENT INTO ANNUITY (AT = 0) AMOUNT OF MONEY RECEIVED PER YEAR DURATION OF ANNUITY (YEARS) ANNUITY $40,000 $7.500 12 $70,000 $8,500 25 C $80,000 $9,500 20 If Angus could earn 12 percent on his money by placing it in a savings account, should he place it instead in any of the annuities? Which ones, if any? Why? 5-24. (Loan amortization) Mr. Dayvos Bay has just purchased a new house for $300,000. He paid $30,000 down payment and agreed to pay the rest over the next 25 in 25 equal end-of-year payments plus 10 percent compound interest over years the unpaid balance. What will these equal payments be? 5-25. (Solving for PMT of an annuity) To pay for your child's education, you wish to have accumulated $15,000 at the end of 15 years. To do this, you plan on depositing an equal amount into the bank at the end of each year. If the bank is willing to pay 6 per- cent compounded annually, how much must you deposit each year to reach your goal?

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 8FPE

Related questions

Question

Transcribed Image Text:5-23. (Solving for Present Value with Annuities) Angus McDonald, a third-year

accounting student studying in Scotland, receives a call from an insurance agent,

who believes Angus is an older man ready to retire from teaching. He talks to him

about several annuities that he could buy that would guarantee him an annual fixed

income. The annuities are as follows:

INITIAL

PAYMENT INTO

ANNUITY

(AT I = 0)

DURATION

OF ANNUITY

(YEARS)

12

AMOUNT OF

MONEY RECEIVED

PER YEAR

ANNUITY

$40,000

$7.500

B

$70,000

$8,500

25

C

$80,000

$9,500

20

If Angus could earn 12 percent on his money by placing it in a savings account,

should he place it instead in any of the annuities? Which ones, if any? Why?

5-24. (Loan amortization) Mr. Dayvos Bay has just purchased a new house for

$300,000, He paid $30,000 down payment and agreed to pay the rest over the next

25 years in 25 equal end-of-year payments plus 10 percent compound interest over

the unpaid balance. What will these equal payments be?

5-25. (Solving for PMT of an annuity) To pay for your child's education, you wish to

have accumulated $15,000 at the end of 15 years. To do this, you plan on depositing an

equal amount into the bank at the end of each year. If the bank is willing to pay 6 per-

cent compounded annually, how much must you deposit each year to reach your goal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning