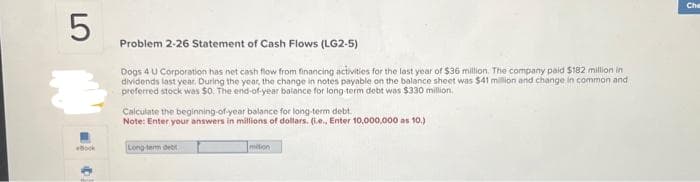

5 *Book Problem 2-26 Statement of Cash Flows (LG2-5) Dogs 4 U Corporation has net cash flow from financing activities for the last year of $36 million. The company paid $182 million in dividends last year. During the year, the change in notes payable on the balance sheet was $41 million and change in common and preferred stock was $0. The end-of-year balance for long-term debt was $330 million. Calculate the beginning-of-year balance for long-term debt Note: Enter your answers in millions of dollars. (ie, Enter 10,000,000 as 10.) Long-term deb

5 *Book Problem 2-26 Statement of Cash Flows (LG2-5) Dogs 4 U Corporation has net cash flow from financing activities for the last year of $36 million. The company paid $182 million in dividends last year. During the year, the change in notes payable on the balance sheet was $41 million and change in common and preferred stock was $0. The end-of-year balance for long-term debt was $330 million. Calculate the beginning-of-year balance for long-term debt Note: Enter your answers in millions of dollars. (ie, Enter 10,000,000 as 10.) Long-term deb

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:5

Book

Problem 2-26 Statement of Cash Flows (LG2-5)

Dogs 4 U Corporation has net cash flow from financing activities for the last year of $36 million. The company paid $182 million in

dividends last year. During the year, the change in notes payable on the balance sheet was $41 million and change in common and

preferred stock was $0. The end-of-year balance for long-term debt was $330 million,

Calculate the beginning-of-year balance for long-term debt.

Note: Enter your answers in millions of dollars. (i.e., Enter 10,000,000 as 10.)

Long-term deb

mation

Che

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning