Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter3: Journalizing Transactions

Section3.2: Transactions Affecting Prepaid Insurance And Supplies

Problem 1WT

Related questions

Question

#5 is the question

Transcribed Image Text:A. Week 2 Assignment

d VitalSource Bookshelf: The Capita X

b My Questions | bartleby

A. Quiz: Test 1: Chapters 1 & 2

A online.vitalsource.com/#/books/9781135656232/cfi/6/22!/4/516/16/2/4/16/2@0:65.7

Copy URL

Principal payment

16,000

3. Capital Budgeting:..

Go to 3. Capital Budgeting: The

Traditional Solutions

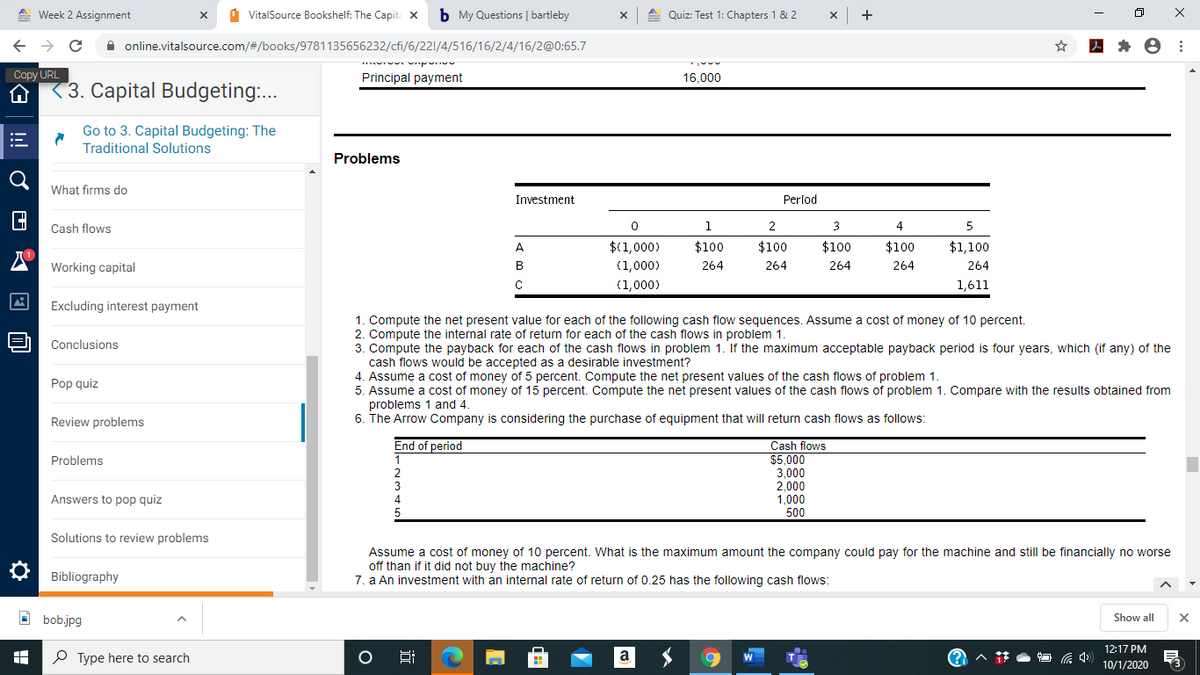

Problems

What firms do

Investment

Perlod

Cash flows

1

2

3.

4

5

A

$(1,000)

$100

$100

$100

$100

$1,100

Working capital

В

(1,000)

264

264

264

264

264

C

(1,000)

1,611

Excluding interest payment

1. Compute the net present value for each of the following cash flow sequences. Assume a cost of money of 10 percent.

2. Compute the internal rate of return for each of the cash flows in problem 1.

3. Compute the payback for each of the cash flows in problem 1. If the maximum acceptable payback period is four years, which (if any) of the

cash flows would be accepted as a desirable investment?

4. Assume a cost of money of 5 percent. Compute the net present values of the cash flows of problem 1.

5. Assume a cost of money of 15 percent. Compute the net present values of the cash flows of problem 1. Compare with the results obtained from

problems 1 and 4.

6. The Arrow Company is considering the purchase of equipment that will return cash flows as follows:

Conclusions

Pop quiz

Review problems

End of period

Cash flows

$5,000

3,000

2,000

1,000

500

Problems

3

4

Answers to pop quiz

Solutions to review problems

Assume a cost of money of 10 percent. What is the maximum amount the company could pay for the machine and still be financially no worse

off than if it did not buy the machine?

7. a An investment with an internal rate of return of 0.25 has the following cash flows:

O Bibliography

O bob.jpg

Show all

12:17 PM

P Type here to search

Hi

10/1/2020

近

!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you