1, 2 and

Q: Young and Old Corporation (YOC) uses two aging categorles to estimate uncollectible accounts. Accoun...

A: Bad debt expense = Estimated Uncollectible accounts +/- Debit/Credit balance of Allowance for doubtf...

Q: Your client, Piano Keys Inc., owns and operates a piano repair shop in Albany, New York. Piano Keys ...

A: Here incurred the natural calamities of collapsing the building which incurred the losses into the b...

Q: Pat Company owns 100% of the outstanding shares of common stock of Sue Company. On 1/1/20 Pat Compan...

A: GIVEN Company sold a building to Sue Company for $8,000,000. At the time of the sale the buildi...

Q: filling the blanks a. amount of(0,250,500 OR 1400) (for or from) AGI and (0,250,500,650,1400) is a...

A: Solution:-a The following are the income tax consequence of the $1,400 if Christine choose the itemi...

Q: The FOB term is used with an identified physical location to determine а. None of the options O b. T...

A: FOB stands for Free on Board. This is a shipment term used to show that whether buyer or seller born...

Q: National Bank has the following balance sheet (in millions) and has no off-balance-sheet activities....

A: Bank classified the total asset into Tier 1 and Tier 2. Total risk capital is the sum of Tier 1 and ...

Q: 6. Explain the benefits which an external financial statement audit provides for an auditee.

A: External financial statement audit is the audit of financial statements conducted by an audit profes...

Q: Which of the following is not directly engaged in the production operations but only to assist or he...

A: Solution: "Indirect Expense" is not directly engaged in the production operations but only to assist...

Q: Bonds, may sell at par, at premium or at a discount. When do they sell

A: Premium represents the value more than the par value whereas, discount represents the value lower th...

Q: Mr. Tuck and Ms. Under organized a new business as an LLC in which they own equal interests. The new...

A: The question is related to taxation. Since there is a loss of $7200 and the tax rate applicable to M...

Q: Susie Smith opened Susie's Commerical Clearning on April 1, 2021. In Apr, the following transaction...

A: Explanation - There are three statements of the organization which show different accounting financi...

Q: Which of the following statements about the margin of safety is (are) correct? a. producing units fo...

A: Margin of safety is difference between actual sales and break even sales. Sales of more units increa...

Q: Which of the following entry rightly record for transferring goods from WIP to finished stock? a. A....

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal....

Q: On August 1, 2021, Comical Company issued rights to stockholders to subscribe to additional share of...

A: Right issue Right issue which was proposed by the entity to its shareholders to acquire new shares w...

Q: Is the cost of sales under weighted average always greater than the cost of sales in FIFO?

A: as FIFO method of inventory valuation goods purchased first will be used first or sold first. The Fi...

Q: On August 1, 2021, Comical Company issued rights to stockholders to subscribe to additional share of...

A: Right issue is the company jurisdiction to issue shares to existing shareholder before make issue th...

Q: Which of the following is an ideal cost unit for the International Marble Company to extract marbles...

A: Cost per hour is used for labor work / machine work Cost per miles & Cost per Km is used for tra...

Q: Julie Whiteweiler made $930 this week. Only social security (fully taxable) and federal income taxes...

A: Contribution to 401k is exempted from FIT. Therefore, earnings subject to FIT will be gross pay - 40...

Q: At a break-even point of 1,000 units sold, total variable expenses were $4,000 and total fixed expen...

A: Since you have asked multiple question, we will solve the first question for you. If you want any sp...

Q: Choosing an Appropriate Depreciation Method When it comes to his new silk-screening machine, Liam i...

A: Depreciation: The term "depreciation" refers to the loss in the monetary value of a fixed asset caus...

Q: what are some general management accounting issues?

A: Accounting is the language of business. It the art of recording the business transactions and presen...

Q: Company started construction of a combination office and warehouse building for its own use at an es...

A: Avoidable interest is the amount of interest that could have been avoided had the project not taken ...

Q: Exercise 15-37 (Algo) Segment Reporting (LO 15-5) Perth Corporation has two operating divisions, a c...

A: Solution Given Casino Hotel Revenue $34,000,000 $27,000,000 Cost 17,000,000 ...

Q: Village Shipping Inc. Income Statement Horizontal Analysis For the years ending December 31, 2014 an...

A: In ratio analysis we calculate the ratios of each year and a comparison is made between the result a...

Q: Under an operating lease, the lessor recognizes a ____________ when the cumulative rental income is ...

A: Under an operating lease, the lessor recognizes a Rent Receivable when the cumulative rental income ...

Q: an office bullding to use in ner business at a cost or $520,000. She properny allocates $20 to the l...

A: Depreciation if the building is purchased on June 30, 1992? Mid-month convention i...

Q: Balances in T-accounts New balances in T-accounts New balances in T-accounts BEFORE adjusting entrie...

A: Statement of retained earning is an essential part of the financial statement and prepare at the end...

Q: What is the term used to describe financial data comparisons conducted inside a company?

A: Introduction: Financial data typically comprises three financial statements: the balance sheet, the ...

Q: What is the effective-interest amortization mechanism for a bond discount or premium?

A: Method of interest amortization that is effective: Interest expenditure is calculated as follows: bo...

Q: 9. Describe the purpose of a proposed auditor communicating with the existing or predecessor auditor...

A: Answer: It is mentioned in the provisions of law that whenever any auditor has been appointed, prope...

Q: Wiley Inc. produces two products, A and B. Presently, the company utilizes a single plantwide factor...

A: Single plantwide predetermined overhead rate = Overhead cost / Total DLHs

Q: The summarized balance sheets of ROSE N' Company and GARDEN Company as of December 31, 2021, are as ...

A: Investments are recorded by companies using three different methods which are as follows: 1. Amortiz...

Q: Plase help me how did 62,500 or 625 shares get? The authorized capital stock o

A: The provisions relating to minimum subscription are available in Section 39 of the Companies Act. Th...

Q: QUESTION 15 Martin Company purchases a machine at the beginning ofthe year at a cost of $155,000 The...

A: Depreciation is charged on the cost of assets. It can be calculated on the basis of different method...

Q: Petro Incorporated and Sport Company reported summarized balance sheets as shown below, on December ...

A: Book value of net identifiable assets of sport (525000+1075000-125000-375000) 1100000 Add: NCI (20...

Q: Review the following sales transactions for Dish Mart and record any required journal entries. Note...

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal....

Q: At December 31, MediSharp Precision Instruments owes $55,000 on Accounts Payable, Salaries Payable o...

A: The balance sheet shows the balances of assets and liabilities as on the balance sheet date. Balance...

Q: On January 1, 2024, Males contributes land in a partnership with Phillips. Males purchased the land ...

A: If a partner takes assets in the form of capital, then the assets will be debited and the partner'...

Q: When comparing absorption costing to variable costing, all of the below are disadvantages of traditi...

A: Solution: When comparing absorption costing to variable costing, all of the below are disadvantages ...

Q: Villanueva Company has two producing and two service departments labeled P1, P2, S1 and S2, respecti...

A: Particular S1 S2 P1 P2 Department Cost 100,000 40,000 300,000 200,000 S1 -106,667 26,667 53,333 ...

Q: Which of the following cost unit is an ideal cost unit for Mwasalat Transport company engaged in bus...

A: Transport company running it buses will measures its cost in terms of kilo meters or passenger kilo ...

Q: Oregon Co.‘s employees are eligible for retirement with benefits at the end of the year in which bot...

A: GIVEN Oregon Co.‘s employees are eligible for retirement with benefits at the end of the year in w...

Q: On January 1, 2019, West company acquired a tract of land for P1,000 000. West company paid P100,00...

A: Amount of promissory note = Cost of tract of land - amount paid = P1,000,000 - 100,000 = P900,000

Q: Direction: discussed the process of auditing the following transactions/accounts: b. Midstream and...

A: Auditing Process Auditing process in the natural extraction which can be measured the initial recogn...

Q: Mr. Lion, who is in the 37 percent tax bracket, is the sole shareholder of Toto Inc, which menufactu...

A: As you have posted multiple independent questions, we are answering first three questions. Please re...

Q: The partnership of Frick, Wilson, and Clarke has elected to cease all operations and liquidate its b...

A:

Q: Sharp Enterprises operates its factory on a two-shift basis and pays a later shift differential of 1...

A: As per our protocol we provide solution to one question but as you have asked multiple questions und...

Q: The following information was drawn from the accounting records of Jones Company. (Round the percent...

A: Return on investment = Net income / Average total assets

Q: Total Materials Variance Krumple Inc. produces aluminum cans. Production of 15-ounce cans has a sta...

A: Total variance = (Actual quantity*Actual price) - (Standard quantity*Standard price)

Q: • INSTRUCTIONS: 1. The Assignment Must be typed and sent as a word document on Moodle NO EMAILS WILL...

A: Closing Entries - Closing entries are required to close the temporary accounts after making financi...

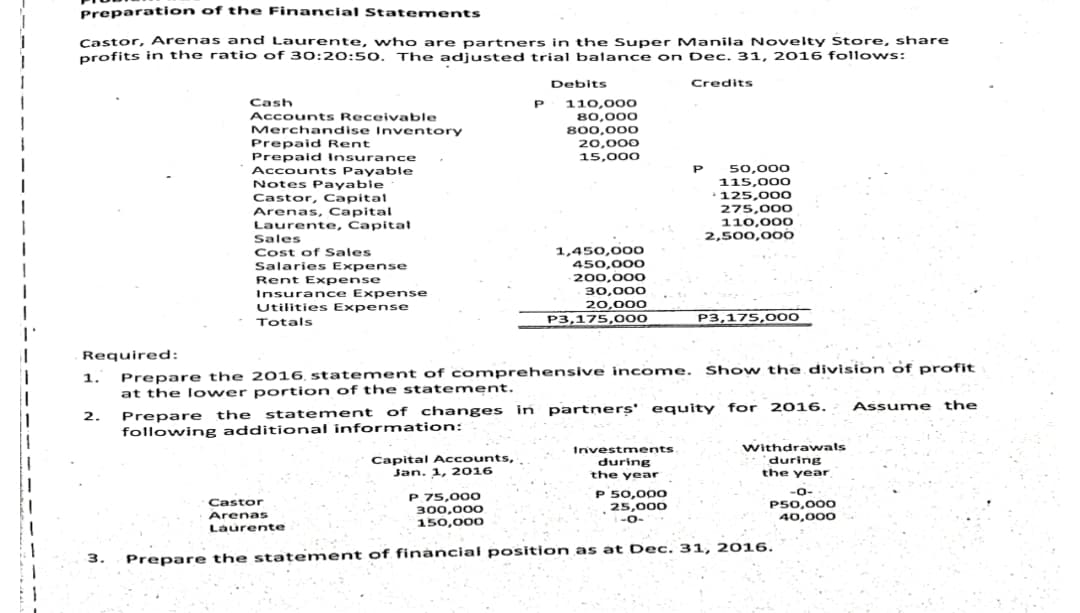

What is the answer in numbers 1, 2 and 3?

Step by step

Solved in 3 steps

- Multiple-Step and Single-Step In coin Statements The following items were derived from Gold Companys December 31 adjusted trial balance: Additional data: 1. Screen thousand share of common stock have been outstanding the entire year. 2. The income tax rate is 30% on all items of income. Required: 1. Prepare a multiple-st income statement. 2. Prepare a single step income statement. 3. Next Level Discuss how Gold Companys income statement in Requirement I might be different if it used IFRSKristopher Company began operations in 2014. At 12/31/22, Kristopher had a debit balance of $25,000 in its Allowance for Adjustment to Market. At January 1, 2022, Kristopher owned the following securities, accounted for using the fair value method. Cost MJO Common (25,000 shares) $550,000 JKH Preferred (1,900 shares) 199,500 EKH Common (7,500 shares) 82,500 During 2022 the following events occurred: 4/3/22 Sold 3,000 shares of MJO for $75,000. 9/6/22 Acquired 1,500 shares of WVO Common for $25 per share. At 12/31/22, the fair values for Kristopher’s securities were: MJO Common, $24 per share JKH Preferred, $103 per share EKH Common, $13 per share WVO Common, $27 per share Required: Prepare any journal entries required in 2022 to record the securities activity, including any required adjusting entries at 12/31/22. Show any calculations.…ACCOUNTING Carry out the following practical case: The company “Inversiones San Remo SAC”, with RUC: 20234125239, began activities in 2005, is dedicated to the manufacture of curtains, operates in its own premises located in La Victoria, has 33 employees (monthly average), and According to the General Shareholders' Meeting, in 2018 they calculated the dividend distribution of 40%. They request to assemble the Financial Statements with the following information: Prepare the Statement of Financial Position 2017 and 2018. Notes to the Financial Statements: Selling expenses correspond to depreciation expenses for 2018. Administrative expenses corresponding to payroll expenses (salaries) for the 2018 financial year. Financial income corresponds to earnings from the profitability of cash surpluses that the company had in the 2018 period. Financial expenses for the 2018 period correspond to interest paid on working capital loans. Make all the discounts by law that you consider for…

- The following trial balance has been extracted from the books of Paul Co. as at 31 December2018$ $Equity share capital ( $1) 6,000Retained earnings at 1 January 2018 6,835Revenue 76,980Salary & wages 7,400Inventory at 1 January 2018 4,930Purchases 40,760Distribution cost 6,130Administrative expenses 6,790Loan interest 1,200Investment income 1,250Tax 1,200Receivables and payables 10,290 3,360Bank 4,125Motor vehicles-cost 6,000Buildings- cost 13,000Motor vehicles-accumulated depreciation 1 January 2018 2,000Buildings- accumulated depreciation 1 January 2018 3,400Debenture ( 2021) 2,000101,825 101,825 Additional information:1. Inventory at the end of the year was valued at $5,0002. Paul made no additions or disposal of tangible non-current assets in the year. Itsdepreciation policy is as follows:Motor vehicle – 20% reducing balanceBuildings- 25 years’ straight lineThe depreciation expense for the year is charged to cost of sales3. Salary and wages are to apportioned equally across…The following trial balance has been extracted from the books of Abraham as at 31st March 2023 UGX 000 UGX 000 Administrative expense 250 Distribution cost 295 Share capital (all ordinary shares of UGX 1 each 270 Share premium 80 Revaluation reserve 20 Dividend 27 Cash at bank and hand 3 Receivables 233 Interest paid 25 Dividend received 15 Interest received 1 Land and buildings at cost (land 380, building 100) 480 Land and building acc. Dep 30 Plant and machinery 400 Plant and machinery acc. Dep 170 Retained earnings account (at April 2022 235 Purchases 1260 Sales 2165 Inventory at 1 April 2022 140 Trade payables 27 Bank loan 100 Total 3113 3113 Additional Information Inventory at 31st March 2023 was valued at a cost UGX 95000. Include in this…Determining the effects of business transactions on selected ratios Financial statement data of Modern Traveler’s Magazine include the following items: Requirements Compute Modern Traveler’s current ratio, debt ratio, and earnings per share. Round all ratios to two decimal places, and use the following format for your answer: Compute the three ratios after evaluating the effect of each transaction that follows. Consider each transaction separately. a. Purchased merchandise inventory of $42,000 on account. b. Borrowed $121,000 on a long-term note payable. c. Issued 5,000 shares of common stock, receiving cash of $103,000. d. Received cash on account, $5,000.

- Please try to answer accurately and accordance with requirements.Thank you!The general ledger of Emerates Traders Ltd includes the following accounts as at 30 June 2018:$000Sales Revenue 8,280Dividend Received 126Interest Received 65Cost of Sales 1,105Selling and Distribution expenses 450Administration expenses 1,550Finance costs 16Valuation loss on trading investments (considered a material item) 250Income tax expense charged to profit and loss 1,500Expenses classified by nature include:Auditors Remuneration:Audit of accounts 20Information technology controls advice 5 25Depreciation expense:Buildings 120Plant and Equipment 225 345Additional InformationThe valuation loss on investments held for trading is not tax deductible.Task 4a. Complete a Statement of Comprehensive Income showing expenses classified byfunction on the face of the Income Statement together with notes to the incomestatement including the material item.- Note that Emerates Traders Ltd discloses material items on the…Determining the effects of business transactions on selected ratios Financial statement data of Style Traveler Magazine include the following items: Requirements Compute Style Traveler’s current ratio, debt ratio, and earnings per share. Round all ratios to two decimal places, and use the following format for your answer: Compute the three ratios after evaluating the effect of each transaction that follows. Consider each transaction separately a. Purchased merchandise inventory of $49,000 on account. b. Borrowed $127,000 on a long-term note payable. c. issued 2,000 shares of common stock, receiving cash of $107,000. d. Received cash on account, $5,000.The following is a partial trial balance for the Green Star Corporation as of December 31, 2018:Account Title Debits CreditsSales revenue 1,300,000Interest revenue 30,000Gain on sale of investments 50,000Cost of goods sold 720,000Selling expenses 160,000General and administrative expenses 75,000Interest expense 40,000Income tax expense 130,000100,000 shares of common stock were outstanding throughout 2018.Required:1. Prepare a single-step income statement for 2018, including EPS disclosures.2. Prepare a multiple-step income statement for 2018, including EPS disclosures.

- On 31 December 20X2, the balances of Argon Enterprises Inc.’s shareholders’ equity accounts were as follows (all are credit balances): Capital stock $ 303,000 Contributed surplus 5,230 Retained earnings 105,400 Currency translation differences 1,400 Mark-to-market adjustments on available for sale investments 26,700 Cash flow hedges 2,000 Actuarial gains and losses 1,400 $ 445,130 Argon’s statement of comprehensive income for the year ending 31 December 20X3 showed the following amounts, from “net profit for the year” through “comprehensive income”: 31 December 20X3 31 December 20X2 Net profit for the year $ 44,900 $ 68,300 Other comprehensive income (loss) net of applicable income tax: Currency translation differences (4,200 ) 2,800 Mark-to-market adjustments on available for sale investments (34,300 ) 8,000 Actuarial gains (losses) 2,100 (6,500 ) Cash…Calculate the amount of gross profit on the basis of the following balances extracted from the books of Edward and Co. for the year ended March 31, 2022.Advertisements (₹)Opening Stock50,000Net sales11,00,000Net purchases6,00,000Direct expenses60,000Administration expenses45,000Selling and distribution expenses65,000Loss due to fire20,000Closing stock70,000REQUIRED Use the information provided below to prepare the Statement of Changes in Equity of Sooraya Enterprises/Partnership for the year ended 28 February 2022. INFORMATION Extract from the ledger of Sooraya Enterprises on 28 February 2022 R Capital: Soo 450 000 Capital: Raya 350 000 Current a/c: Soo (01 March 2021) Current a/c: Raya (01 March 2021) Drawings: Soo Drawings: Raya The following must be taken into account: 30 000 CR 25000 DR 220 000 260 000 1. On 28 February 2022 the Profit and Loss account reflected a net profit of R 880 000. 2. Partners are entitled to interest at 12% p.a. on their capital balances. Note: Soo increased her capital contribution by R180 000 on 01 September 2021. The capital increase has been recorded. 3. The partners are entitled to the following monthly salaries for the first 6 months of the financial year: Soo R15 000 Raya R11 000 From 01 September 2021, the partners will be entitled to annual salaries of R144 000 each. 4. Raya is entitled to a bonus…