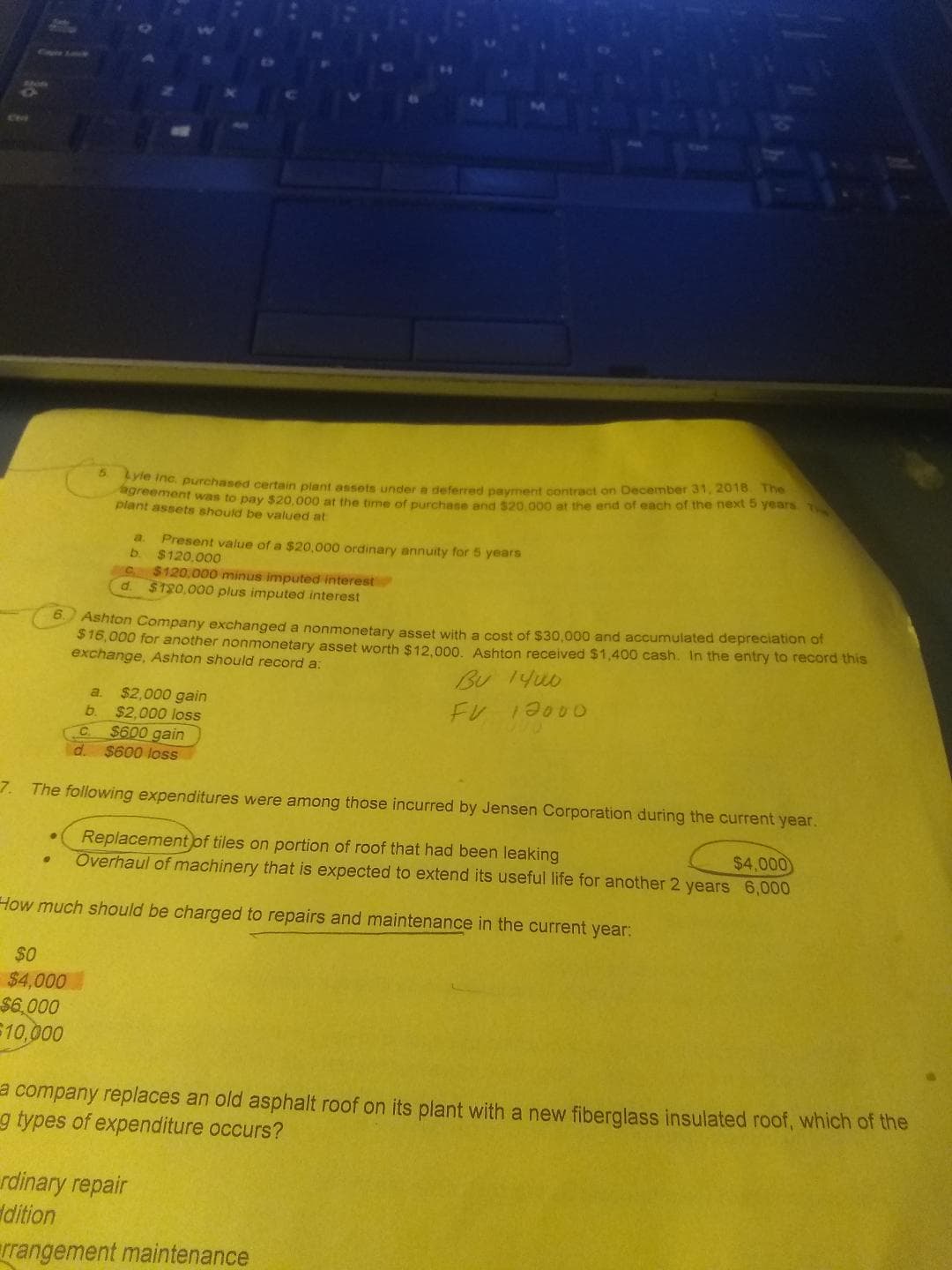

5 Lyle inc. purchased certain plant assets under a deferred payment contract on December 31, 2018 The agreement was to pay $20,000 at the time of purchase and $20,000 at the end of each of the next 5 years T plant assets should be valued at a. Present value of a $20,000 ordinary annuity for 5 years b $120,000 $120,000 minus imputed interest $120,000 plus imputed interest C. Ashton Company exchanged a nonmonetary asset with a cost of $30,000 and accumulated depreciation of $16,000 for another nonmonetary asset worth $12,000. Ashton received $1,400 cash. In the entry to record this exchange, Ashton should record a: 6 Bu 1yuo $2,000 gain $2,000 loss a. FU 19000 $600 gain C. $600 loss 7. The following expenditures were among those incurred by Jensen Corporation during the current year. Replacement of tiles on portion of roof that had been leaking Overhaul of machinery that is expected to extend its useful life for another 2 years 6,000 $4,000 How much should be charged to repairs and maintenance in the current year: $0 $4,000 $6,000 10,000 a company replaces an old asphalt roof on its plant with a new fiberglass insulated roof, which of the g types of expenditure occurs? rdinary repair ldition rrangement maintenance

5 Lyle inc. purchased certain plant assets under a deferred payment contract on December 31, 2018 The agreement was to pay $20,000 at the time of purchase and $20,000 at the end of each of the next 5 years T plant assets should be valued at a. Present value of a $20,000 ordinary annuity for 5 years b $120,000 $120,000 minus imputed interest $120,000 plus imputed interest C. Ashton Company exchanged a nonmonetary asset with a cost of $30,000 and accumulated depreciation of $16,000 for another nonmonetary asset worth $12,000. Ashton received $1,400 cash. In the entry to record this exchange, Ashton should record a: 6 Bu 1yuo $2,000 gain $2,000 loss a. FU 19000 $600 gain C. $600 loss 7. The following expenditures were among those incurred by Jensen Corporation during the current year. Replacement of tiles on portion of roof that had been leaking Overhaul of machinery that is expected to extend its useful life for another 2 years 6,000 $4,000 How much should be charged to repairs and maintenance in the current year: $0 $4,000 $6,000 10,000 a company replaces an old asphalt roof on its plant with a new fiberglass insulated roof, which of the g types of expenditure occurs? rdinary repair ldition rrangement maintenance

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 38P

Related questions

Question

please answer question 6

Transcribed Image Text:5 Lyle inc. purchased certain plant assets under a deferred payment contract on December 31, 2018 The

agreement was to pay $20,000 at the time of purchase and $20,000 at the end of each of the next 5 years T

plant assets should be valued at

a.

Present value of a $20,000 ordinary annuity for 5 years

b $120,000

$120,000 minus imputed interest

$120,000 plus imputed interest

C.

Ashton Company exchanged a nonmonetary asset with a cost of $30,000 and accumulated depreciation of

$16,000 for another nonmonetary asset worth $12,000. Ashton received $1,400 cash. In the entry to record this

exchange, Ashton should record a:

6

Bu 1yuo

$2,000 gain

$2,000 loss

a.

FU 19000

$600 gain

C.

$600 loss

7. The following expenditures were among those incurred by Jensen Corporation during the current year.

Replacement of tiles on portion of roof that had been leaking

Overhaul of machinery that is expected to extend its useful life for another 2 years 6,000

$4,000

How much should be charged to repairs and maintenance in the current year:

$0

$4,000

$6,000

10,000

a company replaces an old asphalt roof on its plant with a new fiberglass insulated roof, which of the

g types of expenditure occurs?

rdinary repair

ldition

rrangement maintenance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning