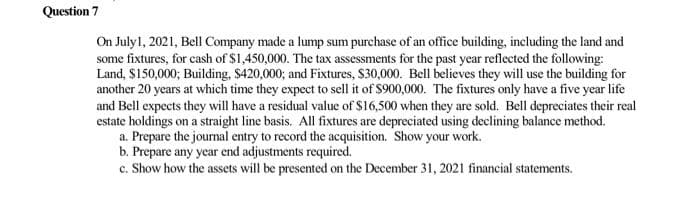

Question 7 On July1, 2021, Bell Company made a lump sum purchase of an office building, including the land and some fixtures, for cash of $1,450,000. The tax assessments for the past year reflected the following: Land, $150,000; Building, $420,000; and Fixtures, S30,000. Bell believes they will use the building for another 20 years at which time they expect to sell it of $900,000. The fixtures only have a five year life and Bell expects they will have a residual value of $16,500 when they are sold. Bell depreciates their real estate holdings on a straight line basis. All fixtures are depreciated using declining balance method. a. Prepare the journal entry to record the acquisition. Show your work. b. Prepare any year end adjustments required. c. Show how the assets will be presented on the December 31, 2021 financial statements.

Question 7 On July1, 2021, Bell Company made a lump sum purchase of an office building, including the land and some fixtures, for cash of $1,450,000. The tax assessments for the past year reflected the following: Land, $150,000; Building, $420,000; and Fixtures, S30,000. Bell believes they will use the building for another 20 years at which time they expect to sell it of $900,000. The fixtures only have a five year life and Bell expects they will have a residual value of $16,500 when they are sold. Bell depreciates their real estate holdings on a straight line basis. All fixtures are depreciated using declining balance method. a. Prepare the journal entry to record the acquisition. Show your work. b. Prepare any year end adjustments required. c. Show how the assets will be presented on the December 31, 2021 financial statements.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 20E: (Appendix 11.1) Depreciation for Financial Statements and Income Tax Purposes Dinkle Company...

Related questions

Question

Transcribed Image Text:Question 7

On July1, 2021, Bell Company made a lump sum purchase of an office building, including the land and

some fixtures, for cash of $1,450,000. The tax assessments for the past year reflected the following:

Land, $150,000; Building, $420,000; and Fixtures, S30,000. Bell believes they will use the building for

another 20 years at which time they expect to sell it of S900,000. The fixtures only have a five year life

and Bell expects they will have a residual value of $16,500 when they are sold. Bell depreciates their real

estate holdings on a straight line basis. All fixtures are depreciated using declining balance method.

a. Prepare the journal entry to record the acquisition. Show your work.

b. Prepare any year end adjustments required.

c. Show how the assets will be presented on the December 31, 2021 financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT