5. 1st statement – The Legislative Department levies the taxes. 2nd statement - The Executive Department, through the Department of Finance's line agency, the Bureau of Internal Revenue makes the assessment and collection of internal revenue taxes. a. Only the 1st statement is true b. Only the 2nd statement is true c. Both statements are true d. Both statements are false

5. 1st statement – The Legislative Department levies the taxes. 2nd statement - The Executive Department, through the Department of Finance's line agency, the Bureau of Internal Revenue makes the assessment and collection of internal revenue taxes. a. Only the 1st statement is true b. Only the 2nd statement is true c. Both statements are true d. Both statements are false

Principles of Microeconomics (MindTap Course List)

8th Edition

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter12: The Design Of The Tax System

Section: Chapter Questions

Problem 2PA

Related questions

Question

100%

Hello can you help answer the 3 questions below? It is multiple choice questions. Thank you in advance! It will be a big help for me :)

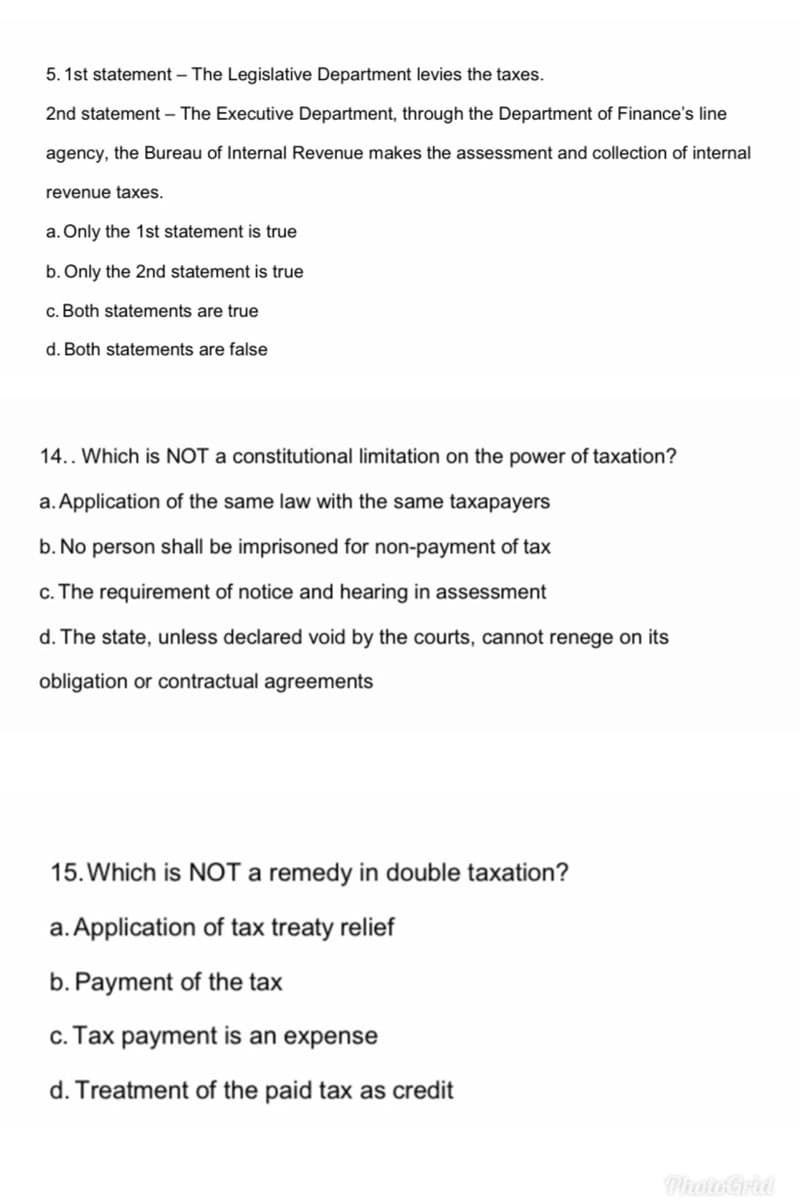

Transcribed Image Text:5. 1st statement – The Legislative Department levies the taxes.

2nd statement – The Executive Department, through the Department of Finance's line

agency, the Bureau of Internal Revenue makes the assessment and collection of internal

revenue taxes.

a. Only the 1st statement is true

b. Only the 2nd statement is true

c. Both statements are true

d. Both statements are false

14.. Which is NOT a constitutional limitation on the power of taxation?

a. Application of the same law with the same taxapayers

b. No person shall be imprisoned for non-payment of tax

c. The requirement of notice and hearing in assessment

d. The state, unless declared void by the courts, cannot renege on its

obligation or contractual agreements

15. Which is NOT a remedy in double taxation?

a. Application of tax treaty relief

b. Payment of the tax

c. Tax payment is an expense

d. Treatment of the paid tax as credit

Photo Grid

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning