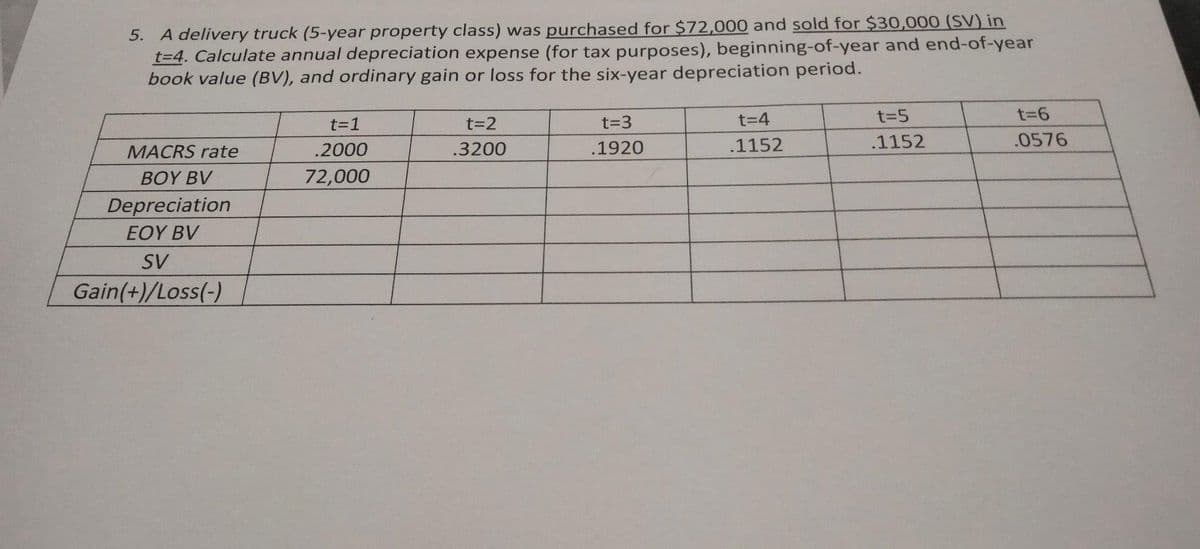

5. A delivery truck (5-year property class) was purchased for $72,000 and sold for $30,000 (SV) in t=4. Calculate annual depreciation expense (for tax purposes), beginning-of-year and end-of-year book value (BV), and ordinary gain or loss for the six-year depreciation period. t=1 t=2 t=3 t=4 t=5 t36 .1152 .1152 .0576 MACRS rate .2000 .3200 .1920 ΒΟΥ BV Depreciation 72,000 ΕΟΥBV SV Gain(+)/Loss(-)

5. A delivery truck (5-year property class) was purchased for $72,000 and sold for $30,000 (SV) in t=4. Calculate annual depreciation expense (for tax purposes), beginning-of-year and end-of-year book value (BV), and ordinary gain or loss for the six-year depreciation period. t=1 t=2 t=3 t=4 t=5 t36 .1152 .1152 .0576 MACRS rate .2000 .3200 .1920 ΒΟΥ BV Depreciation 72,000 ΕΟΥBV SV Gain(+)/Loss(-)

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 8PA: Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the...

Related questions

Question

Transcribed Image Text:5. A delivery truck (5-year property class) was purchased for $72,000 and sold for $30,000 (SV) in

t=4. Calculate annual depreciation expense (for tax purposes), beginning-of-year and end-of-year

book value (BV), and ordinary gain or loss for the six-year depreciation period.

t=D1

t%3D3

t=4

t35

.2000

.3200

.1920

.1152

.1152

.0576

MACRS rate

ΒΟΥ BV

72,000

Depreciation

ΕΟΥBV

SV

Gain(+)/Loss(-)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,