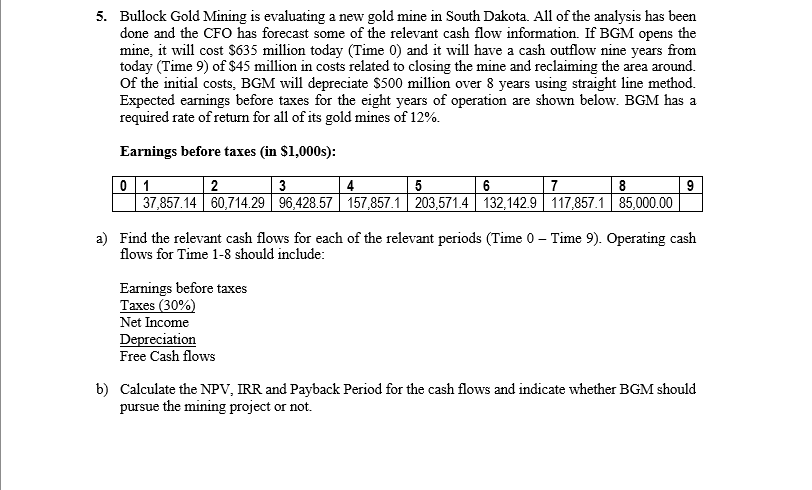

5. Bullock Gold Mining is evaluating a new gold mine in South Dakota. All of the analysis has been done and the CFO has forecast some of the relevant cash flow information. If BGM opens the mine, it will cost S635 million today (Time 0) and it will have a cash outflow nine years from today (Time 9) of $45 million in costs related to closing the mine and reclaiming the area around. Of the initial costs, BGM will depreciate $500 million over 8 years using straight line method. Expected earnings before taxes for the eight years of operation are shown below. BGM has a required rate of return for all of its gold mines of 12%. Earnings before taxes (in $1,000s): 2 5 37,857.14 | 60,714.29 | 96,428.57 | 157,857.1 | 203,571.4 | 132,142.9 | 117,857.1 | 85,000.00 3 6 | 7 8 a) Find the relevant cash flows for each of the relevant periods (Time 0 – Time 9). Operating cash flows for Time 1-8 should include: Earnings before taxes Taxes (30%) Net Income Depreciation Free Cash flows b) Calculate the NPV, IRR and Payback Period for the cash flows and indicate whether BGM should pursue the mining project or not.

5. Bullock Gold Mining is evaluating a new gold mine in South Dakota. All of the analysis has been done and the CFO has forecast some of the relevant cash flow information. If BGM opens the mine, it will cost S635 million today (Time 0) and it will have a cash outflow nine years from today (Time 9) of $45 million in costs related to closing the mine and reclaiming the area around. Of the initial costs, BGM will depreciate $500 million over 8 years using straight line method. Expected earnings before taxes for the eight years of operation are shown below. BGM has a required rate of return for all of its gold mines of 12%. Earnings before taxes (in $1,000s): 2 5 37,857.14 | 60,714.29 | 96,428.57 | 157,857.1 | 203,571.4 | 132,142.9 | 117,857.1 | 85,000.00 3 6 | 7 8 a) Find the relevant cash flows for each of the relevant periods (Time 0 – Time 9). Operating cash flows for Time 1-8 should include: Earnings before taxes Taxes (30%) Net Income Depreciation Free Cash flows b) Calculate the NPV, IRR and Payback Period for the cash flows and indicate whether BGM should pursue the mining project or not.

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:5. Bullock Gold Mining is evaluating a new gold mine in South Dakota. All of the analysis has been

done and the CFO has forecast some of the relevant cash flow information. If BGM opens the

mine, it will cost S635 million today (Time 0) and it will have a cash outflow nine years from

today (Time 9) of $45 million in costs related to closing the mine and reclaiming the area around.

Of the initial costs, BGM will depreciate $500 million over 8 years using straight line method.

Expected earnings before taxes for the eight years of operation are shown below. BGM has a

required rate of return for all of its gold mines of 12%.

Earnings before taxes (in $1,000s):

0 1

37,857.14 60,714.29 96,428.57 157,857.1 203,571.4 132,142.9 117,857.1 85,000.00

2

3

4

6

7

8

a) Find the relevant cash flows for each of the relevant periods (Time 0 – Time 9). Operating cash

flows for Time 1-8 should include:

-

Earnings before taxes

Taxes (30%)

Net Income

Depreciation

Free Cash flows

b) Calculate the NPV, IRR and Payback Period for the cash flows and indicate whether BGM should

pursue the mining project or not.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College