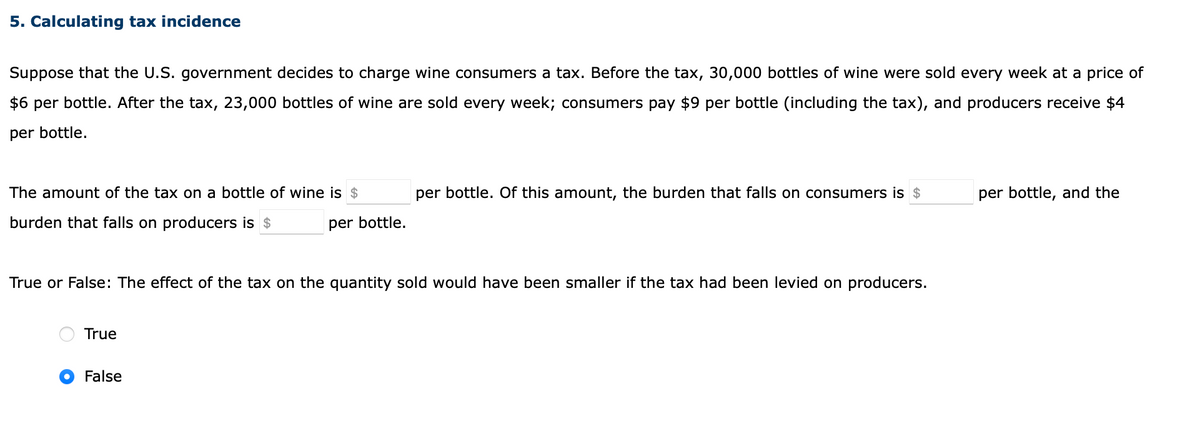

5. Calculating tax incidence Suppose that the U.S. government decides to charge wine consumers a tax. Before the tax, 30,000 bottles of wine were sold every week at a price of $6 per bottle. After the tax, 23,000 bottles of wine are sold every week; consumers pay $9 per bottle (including the tax), and producers receive $4 per bottle. The amount of the tax on a bottle of wine is $ per bottle. Of this amount, the burden that falls on consumers is $ per bottle, and the burden that falls on producers is $ per bottle. True or False: The effect of the tax on the quantity sold would have been smaller if the tax had been levied on producers. True False

5. Calculating tax incidence Suppose that the U.S. government decides to charge wine consumers a tax. Before the tax, 30,000 bottles of wine were sold every week at a price of $6 per bottle. After the tax, 23,000 bottles of wine are sold every week; consumers pay $9 per bottle (including the tax), and producers receive $4 per bottle. The amount of the tax on a bottle of wine is $ per bottle. Of this amount, the burden that falls on consumers is $ per bottle, and the burden that falls on producers is $ per bottle. True or False: The effect of the tax on the quantity sold would have been smaller if the tax had been levied on producers. True False

Principles of Microeconomics

7th Edition

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter6: Supply, Demand And Government Policies

Section: Chapter Questions

Problem 5QR

Related questions

Question

would you please help me with this homework? thank you.

Transcribed Image Text:5. Calculating tax incidence

Suppose that the U.S. government decides to charge wine consumers a tax. Before the tax, 30,000 bottles of wine were sold every week at a price of

$6 per bottle. After the tax, 23,000 bottles of wine are sold every week; consumers pay $9 per bottle (including the tax), and producers receive $4

per bottle.

The amount of the tax on a bottle of wine is $

per bottle. Of this amount, the burden that falls on consumers is $

per bottle, and the

burden that falls on producers is $

per bottle.

True or False: The effect of the tax on the quantity sold would have been smaller if the tax had been levied on producers.

True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning