5. Capital flight The graphs below depict the loanable funds market and the relationship between real interest rates and the level of net capital outflow (NCO) calculated in terms of the Mexican peso. (Percent) The Market for Loanable Funds in Mexico Supply (?) Percent) Mexican Net Capital Outflow 7 (?)

5. Capital flight The graphs below depict the loanable funds market and the relationship between real interest rates and the level of net capital outflow (NCO) calculated in terms of the Mexican peso. (Percent) The Market for Loanable Funds in Mexico Supply (?) Percent) Mexican Net Capital Outflow 7 (?)

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter14: A Macroeconomic Theory Of The Open Economy

Section: Chapter Questions

Problem 7PA

Related questions

Question

100%

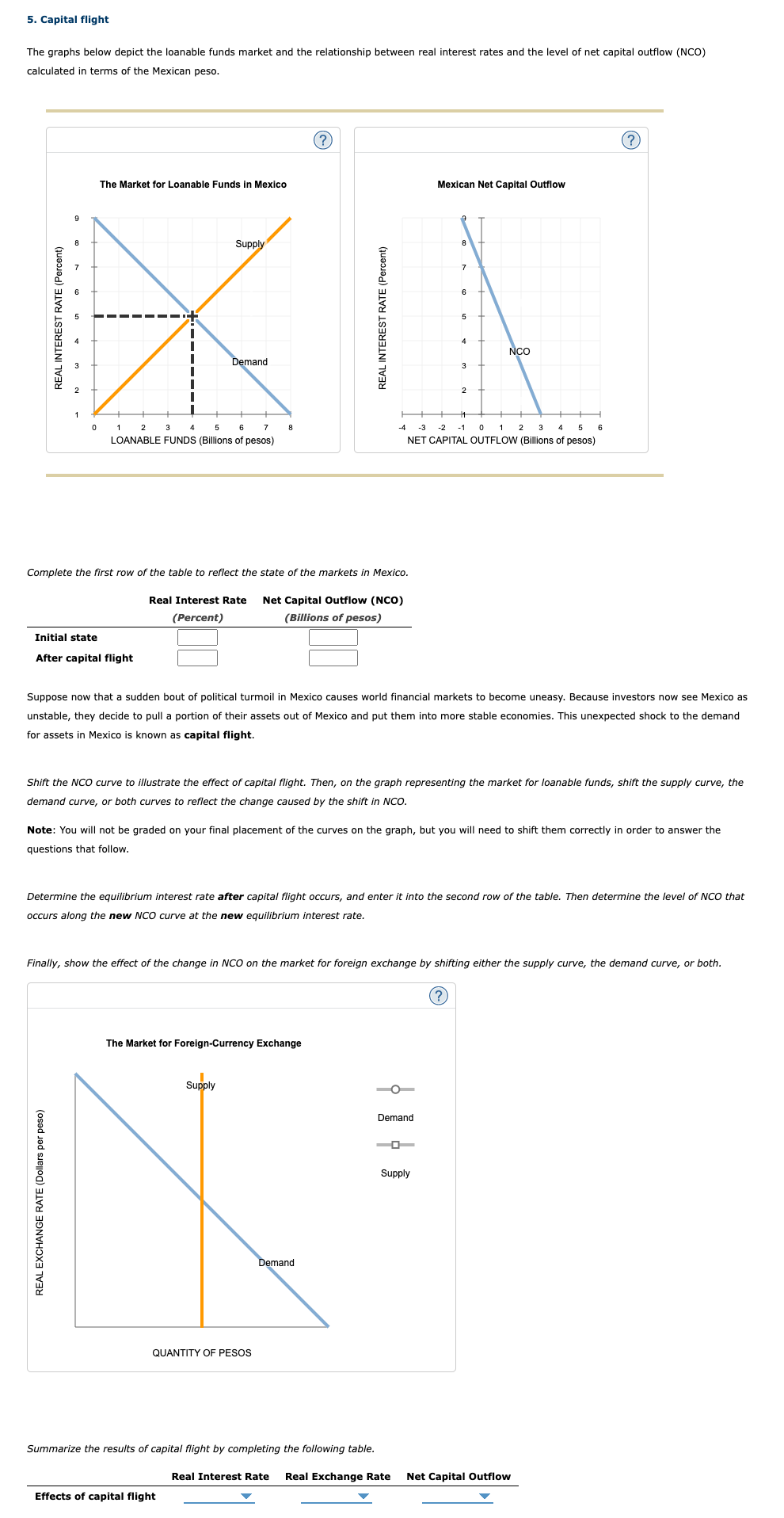

Transcribed Image Text:5. Capital flight

The graphs below depict the loanable funds market and the relationship between real interest rates and the level of net capital outflow (NCO)

calculated in terms of the Mexican peso.

REAL INTEREST RATE (Percent)

The Market for Loanable Funds in Mexico

1

4

6

7

LOANABLE FUNDS (Billions of pesos)

Initial state

After capital flight

3

REAL EXCHANGE RATE (Dollars per peso)

Supply

Demand

Complete the first row of the table to reflect the state of the markets in Mexico.

Real Interest Rate Net Capital Outflow (NCO)

(Percent)

(Billions of pesos)

8

REAL INTEREST RATE (Percent)

Supply

Effects of capital flight

The Market for Foreign-Currency Exchange

QUANTITY OF PESOS

Suppose now that a sudden bout of political turmoil in Mexico causes world financial markets to become uneasy. Because investors now see Mexico as

unstable, they decide to pull a portion of their assets out of Mexico and put them into more stable economies. This unexpected shock to the demand

for assets in Mexico is known as capital flight.

Shift the NCO curve to illustrate the effect of capital flight. Then, on the graph representing the market for loanable funds, shift the supply curve, the

demand curve, or both curves to reflect the change caused by the shift in NCO.

Note: You will not be graded on your final placement of the curves on the graph, but you will need to shift them correctly in order to answer the

questions that follow.

Demand

Mexican Net Capital Outflow

Determine the equilibrium interest rate after capital flight occurs, and enter it into the second row of the table. Then determine the level of NCO that

occurs along the new NCO curve at the new equilibrium interest rate.

Finally, show the effect of the change in NCO on the market for foreign exchange by shifting either the supply curve, the demand curve, or both.

7

Demand

O

5

-3 -2 -1 0 1 2 3

5

NET CAPITAL OUTFLOW (Billions of pesos)

Summarize the results of capital flight by completing the following table.

Real Interest Rate Real Exchange Rate

3

Supply

2

NCO

(?)

Net Capital Outflow

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning