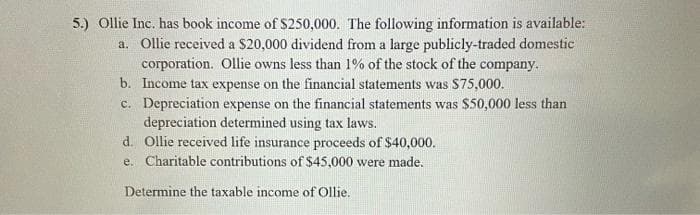

5.) Ollie Inc. has book income of $250,000. The following information is available: a. Ollie received a $20,000 dividend from a large publicly-traded domestic corporation. Ollie owns less than 1% of the stock of the company. b. Income tax expense on the financial statements was S75,000. c. Depreciation expense on the financial statements was S50,000 less than depreciation determined using tax laws. d. Ollie received life insurance proceeds of $40,000. e. Charitable contributions of $45,000 were made. Determine the taxable income of Ollie.

5.) Ollie Inc. has book income of $250,000. The following information is available: a. Ollie received a $20,000 dividend from a large publicly-traded domestic corporation. Ollie owns less than 1% of the stock of the company. b. Income tax expense on the financial statements was S75,000. c. Depreciation expense on the financial statements was S50,000 less than depreciation determined using tax laws. d. Ollie received life insurance proceeds of $40,000. e. Charitable contributions of $45,000 were made. Determine the taxable income of Ollie.

Chapter4: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 43P

Related questions

Question

7

Transcribed Image Text:5.) Ollie Inc. has book income of $250,000. The following information is available:

a. Ollie received a $20,000 dividend from a large publicly-traded domestic

corporation. Ollie owns less than 1% of the stock of the company.

b. Income tax expense on the financial statements was $75,000.

c. Depreciation expense on the financial statements was $50,000 less than

depreciation determined using tax laws.

d. Ollie received life insurance proceeds of $40,000.

e. Charitable contributions of $45,000 were made.

Determine the taxable income of Ollie.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you